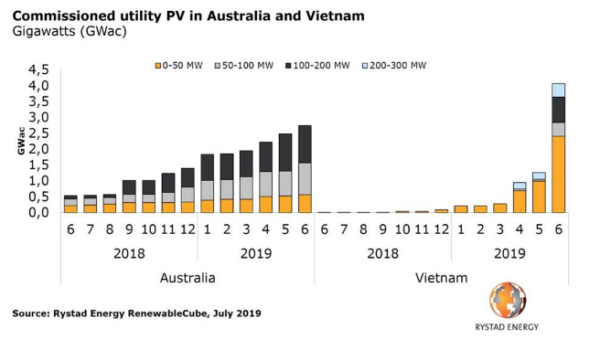

As developers scrambled to meet the end of June deadline and tap the generous feed in tariff scheme, Vietnam saw an unprecedented activity in its utility-scale solar market, with gigawatts of PV capacity connected to the grid. While both markets have been progressively expanding over the past 12 months, the latest tally shows the Southeast Asian country had overtaken Australia for operating utility-scale solar PV capacity, according to Norwegian consultancy Rystad Energy.

Building on its last year’s record volume of large-scale PV capacity additions, Australia continues to expand its portfolio of commissioned projects. According to Rystad’s data, the nation’s operating capacity has risen from under 0.6 GW to 2.7 GW over the past 12 months. However, that performance was put in the shade as the Vietnamese market skyrocketed on the back of June installation figures from less than 10 MW operational as of June 2018 to over 4 GW – a 400-fold increase.

More than 60% of this capacity was commissioned in June alone, Rystad finds. The average time for construction and commissioning in Vietnam was an astonishing 275 days.

“Few would have predicted Vietnamese utility PV to exceed Australia’s by mid-year. The commissioned capacity in Vietnam has exceeded our high case,” says David Dixon, senior analyst on Rystad Energy’s renewables team.

The Vietnamese boom

Indeed, Rystad’s prediction was that 40 projects totaling 2 GW of capacity were due to come online in Vietnam in 2019, itself a big leap from just two large-scale solar projects – the 49 MW Krong Pa and 35 MW Duc Hue solar farms – commissioned last year. However, according to Vietnamese state-owned utility EVN’s latest data, as many as 82 solar power plants with a combined capacity of 4,460 MW were connected to the national grid by the end of June.

Previously, the Vietnamese government said it was expecting some 4 GW of solar generation capacity to be rushed towards commercial operation by June 30. By mid-April, Vietnam had connected only four solar plants with a cumulative capacity of 150 MW to the grid. By the end of May, however, 34 more solar plants with a cumulative capacity of 2.2 GW had been connected. The government said it expected another 54 solar projects entitled to the 20-year FIT of US$0.0935/kWh ($0.13) set in April 2017 to come online last month.

“The main concern in Vietnam is the risk of grid overload once these plants are completed,” Rystad Energy analyst Minh Khoi Le said earlier. “EVN, the country’s only utility company, will need to find more free space in the grid or these plants will not be producing to their designed capacity.”

But, Rystad is not alone in underestimating the Vietnamese boom. In a report published in November, the Asian Development Bank (ADB) predicted solar to increase from a capacity of 368 MW at the end of 2017 to 850 MW – 0.5% of overall electricity generation – next year, 4 GW in 2025 (1.6%) and 12 GW (3.3%) in 2030.

Also, market research company IHS Markit had tipped Vietnam to be one of the most promising PV markets this year and forecast the emerging markets of Argentina, Egypt, South Africa, Spain and Vietnam would account for 7% of the 2019 market – 7 GW of new capacity. Having added just 8 MW of new solar capacity in 2017, Vietnam plugged in 106 MW last year and the nation was poised to take things to another level with IHS Markit analyst Josefin Berg projecting 2 GW will be installed in the utility scale sector alone this year.

Looking ahead

Following the period of breakneck development, the Vietnamese market is surely now in for a slowdown. According to EVN, another 13 solar power plants are scheduled to be connected to the national grid by the end of 2019, with a combined capacity of 630 MW.

“We forecast an additional 0.8 GWac being commissioned in the second half of 2019 in Australia, approaching a total of 3.5 GWac by year-end,” Dixon said. “Yet this is still less than Vietnam’s commissioned capacity at the time of writing.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.