Australia’s solar boom that began in the last quarter of 2016 is now having a notable impact on the National Electricity Market (NEM) even in winter. Thanks to the increasing share of both large-scale and rooftop PV on the grid, renewables provided 30% of Australia’s midday power supply most days last month, according to Green Energy Markets (GEM).

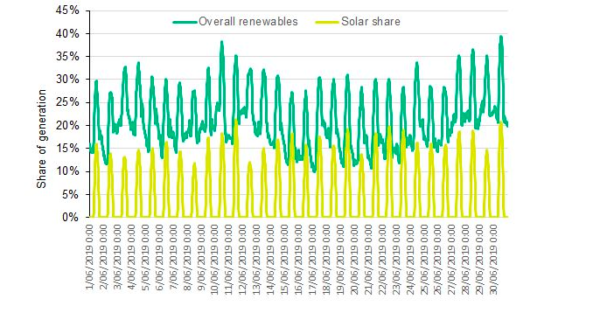

In the latest edition of its Renewable Energy Index, GEM finds solar capacity is now sufficiently large that it drove renewable energy’s share of the electricity market up above 30% in the middle of the day for 20 out of the 30 days in June. It reached a peak of 39.2% over midday on 30 June, helping drive wholesale prices down to zero for a five-minute period across the NEM. The phenomenon has been touted as unprecedented for the market in winter.

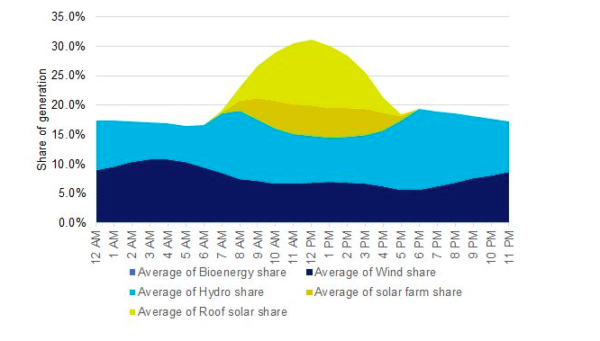

Before rising to a peak above 30% at midday, renewable energy’s share in June averaged 17% overnight. As shown by Figure 2, hydro plays an important role in the morning and evening picking up its output when demand for power increases while solar output is low.

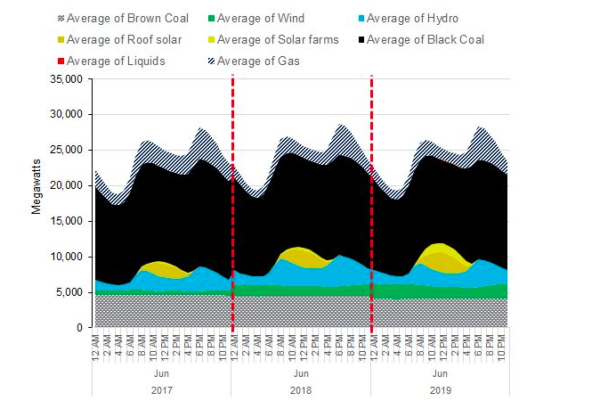

Wind and solar output over June has grown considerably since 2017 following record investment in renewables. Looking at the average hourly profile of renewable energy generation as well as fossil fuels over June this year versus June of 2018 and 2017, GEM finds wind has increased 25% relative to June 2017, while solar has experienced the biggest change with large-scale solar farm output going from negligible to significant. Consequently solar output this June has doubled compared to what it was in 2017, GEM finds.

As for other power sources, brown coal generation tends to remain steady throughout each hour but has declined almost 10% since 2017. Meanwhile hydro generation is down 8% this June and provided a temporary reprieve for gas, which was up 5% on generation levels in 2018, although still down 19% on 2017 levels. Lastly, black coal output is down 3% compared to June last year and 6% relative to 2017.

While renewable energy’s share of overall generation across the main grids of the east and west coast stood at 22.3%, renewables impact on the grid over daytime hours has grown in prominence leading to zero wholesale prices and putting pressure on inflexible coal generators to ramp down. But the impact could go even further undermining the economics of some prospective renewable energy plants exposed to wholesale prices.

“This is what is going to kill this boom in renewables, unfortunately,” GEM director Tristan Edis, who expects zero or negative prices to become a lot more common on the NEM in the next 12 months. He told Financial Review the risk may not have been fully appreciated in a recent upbeat assessment of future investment in renewables by the Clean Energy Regulator.

The warning comes as the Clean Energy Finance Corporation announces an increased focus on grid stability and large-scale storage for FY20 and beyond. The federal government’s green bank finds large-scale wind and solar projects are increasingly standing on their own feet and showing maturity with the ability to tap a strong market for equity and debt.

“Following strong progress in the development of the large-scale solar and wind sectors, our investments will also increasingly target new technologies where there is less appetite from mainstream investors – including pumped storage and large-scale batteries, behind-the-meter generation and grid solutions,” CEFC CEO Ian Learmonth said in a statement.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

“While renewable energy’s share of overall generation across the main grids of the east and west coast stood at 22.3%, renewables impact on the grid over daytime hours has grown in prominence leading to zero wholesale prices and putting pressure on inflexible coal generators to ramp down. But the impact could go even further undermining the economics of some prospective renewable energy plants exposed to wholesale prices.”

There was a time in the U.S. when the power generators were pushing nuclear power plants in the 1960’s. The claim was clean nuclear energy, “Too cheap to meter”. That never happened, and yet solar PV can and has driven down the price of electricity to the zero and even (negative) price per MWh. Large scale energy storage distributed along the grid will be the answer to extending the ‘solar powered day’, when partnered with wind generation could take over the power grid as dispatchable generation with real time grid frequency and voltage regulation. With hydro as a solid back up, will fueled generation or gas fired Peaker plants be required in the future?