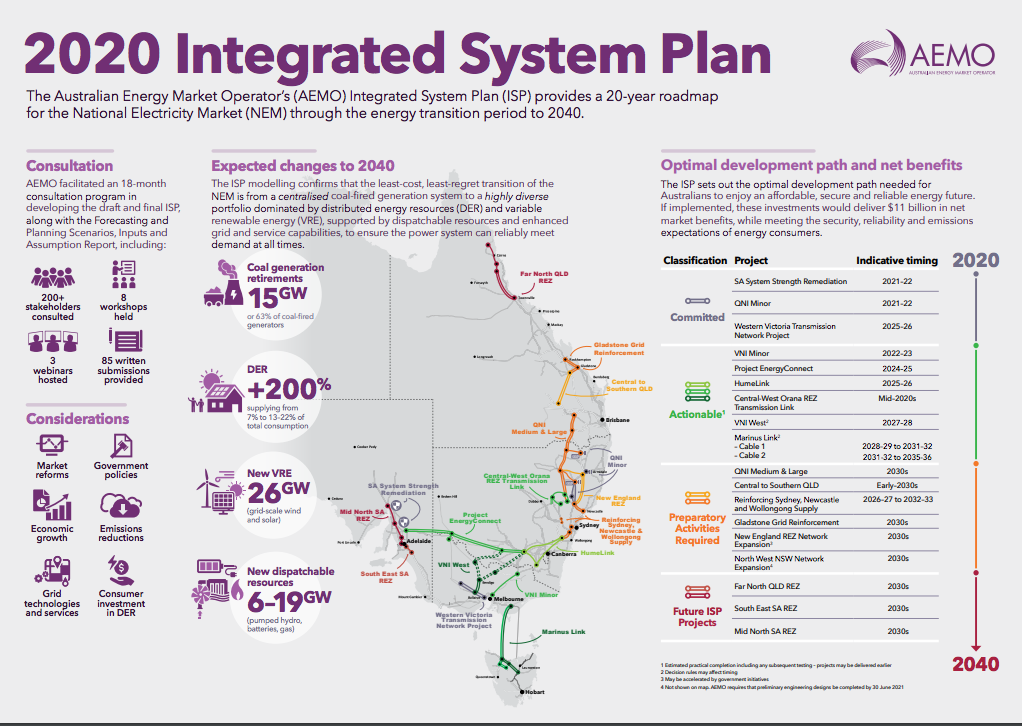

The Australian Energy Market Operator (AEMO) has released its 20-year blueprint detailing how an optimal national electricity market should look like to deliver the best outcomes for consumers and $11 billion in net market benefits. The final version of the 2020 Integrated System Plan (ISP) released on Thursday provides an actionable roadmap for eastern Australia’s power system as it switches from coal to renewables and storage in what is described as “the biggest and fastest transformational change in the world”.

Over an 18-month period, AEMO consulted on and developed the ISP which confirmed that Australia is moving towards an electricity system dominated by distributed energy resources (DER) and utility-scale solar and wind, supported by dispatchable resources, primarily pumped hydro and batteries that will gradually replace gas as a more cost-effective option across all five scenarios considered. The AEMO modeling explicitly states that the investment case for new gas-powered generation will critically depend on future gas prices that need to remain low in order to compete with batteries when providing dispatchable supply during 2- and 4-hour periods.

DER integration

With 15 GW or 63% of coal-fired generation set to retire by 2040, more than 26 GW of new solar and wind grid-scale projects are needed to replace the ageing fleet of polluters in all but the Slow Change scenario, the ISP finds. While overall grid consumption is being held constant by DER, AEMO forecasts that Australia should invest in a further 26-50 GW of new large-scale solar and wind projects beyond existing, committed and anticipated projects – most optimally in renewable energy zones (REZs). In the Slow Change scenario, only 8 GW would be needed by 2040.

Simultaneously, DER capacity is expected to double or even triple, providing 13 to 22% of total underlying annual energy consumption. Residential, industrial and commercial consumers are expected to continue to invest heavily in distributed PV, with increasing interest in battery storage and load management. However, AEMO warns that without urgent and well-targeted reforms that would allow DER to maximize their contribution to the power system reliability and allow consumers to benefit from their investment, “limits may have to be imposed on DER instead, which would be a sub-optimal outcome for Australia.”

The topic of containing the output of rooftop PV has emerged recently as it became clear the grid was seriously lagging behind in the integration of Australia’s rapidly growing DER fleet. One initiative was revealed in South Australia’s plan to stabilize its grid as it moves towards its 100% renewables goal by 2030. To address major drops in operational demand that could compromise grid stability and cause blackouts, the state government has given the green light to AEMO to switch off its rooftop PV fleet in times of emergency. On top of that, the Australian Energy Market Regulator has called for reforms that would see solar households pay a network fee to be allowed to export energy to the grid.

To optimize market integration of DER, AEMO and Energy Networks Australia (ENA) are working on proposals to integrate DER and distribution constraints into wholesale markets, and for distribution network service providers (DNSPs) to extend their technical capability to monitor, calculate and communicate network constraints for DER. Meanwhile, a rule change made by the Australian Energy Market Commission (AEMC) last month will allow large energy consumers to trade their energy use in the wholesale market. The so-called wholesale demand response mechanism is described as a stepping-stone to Australia achieving a two-sided energy market – where all consumers, both large and small, would be able to actively trade their energy use.

As for the technical integration of DER, distributed PV will need mandatory feed-in management capability. This involves various upgrades, such as uplifting the DER inverter standard AS4777 to improve device responses during power quality disturbances and implementing standards to provide cybersecurity protocols and interoperability at the device level. Real-time visibility would be key to operational decision-making, whereas the behavior of DER still needs to be fully understood under various scenarios in order to prepare the fleet for AI and other machine learning tools to manage the system.

Balancing out

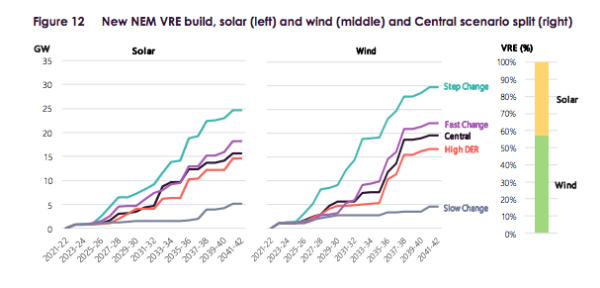

Driven by strong economics and state RETs, Australia’s pipeline of solar and wind projects continues to grow. According to the ISP, there is currently 10 GW installed or in commissioning and another 6 GW expected to be operational in the next two years, as either committed or anticipated projects. An additional 31 GW is forecast to be needed by 2040 in the Central scenario. In the Step Change scenario, up to 50 GW would be required, with Queensland and New South Wales each forecast to add over 16 GW and Victoria over 7 GW by 2040.

The ISP determined an optimal split of new solar and wind projects that would minimize the need for dispatchable storage and generation and therefore keep costs down for consumers. This split is shown in Figure 12 as approximately 43% solar and 57% wind by 2040 for the Central scenario. If DER is also included, the split is more balanced, with grid-scale or distributed solar expected to provide 61% of total new renewable energy capacity.

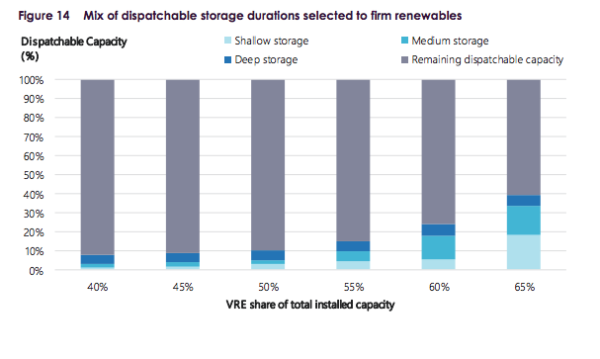

Depending on the scenario, the NEM will need 6-19 GW of new flexible, utility-scale dispatchable resources to firm up renewables. This will come in the form of utility-scale pumped hydro, fast responding gas-fired generation, battery storage, demand response and aggregated DER participating as virtual power plants (VPP). Most initial investment will be in utility-scale pumped hydro, such as Snowy 2.0 that is already committed, or battery storage, whereas new flexible gas generators could play a greater role if gas prices materially reduce, the ISP finds.

The growth in storage is broadly aligned with timing of coal-fired generation retirements, AEMO says. Initially, relatively shallow 1- to 2-hour storage from VPP and large-scale batteries is needed to provide firming capacity and intra-day energy shifting. However, as more coal-fired generation retires, medium 4- hour batteries to 12-hour pumped hydro storage comes into play. Deep pumped hydro, such as Snowy 2.0, is constant throughout in covering utility-scale renewables ‘droughts’ and seasonal smoothing of energy over weeks or months.

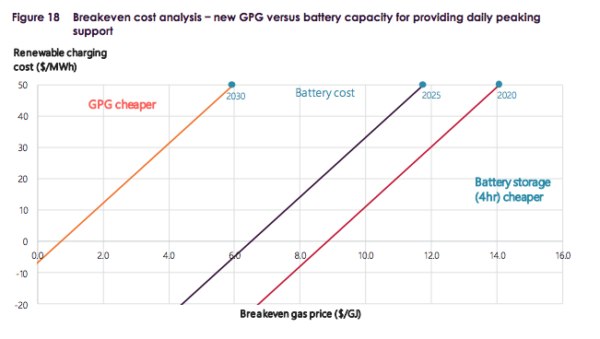

When it comes to costs, gas is likely to lose ground as battery costs continue to reduce, as shown in Figure 18 that depicts the breakeven cost between batteries and gas-powered generation to provide a daily 4-hour dispatchable supply. AEMO reminds that batteries are typically re-charged in the middle of the day, when even today prices already reach $0/MWh or even negative prices at times, which means that at today’s relatively low gas prices, a 4-hour battery installed today (at $1,964 /kW capital cost) would need to be charged for free to be competitive with a new open cycle gas turbine (at $1,416 /kW).

“However, for GPG to remain a competitive investment as battery costs reduce (to $922/kW by 2030), gas prices need to be as low as $4/GJ in the long run, while charging costs need to remain relatively high at $30/MWh. Even in 2019-20, 4-hour batteries would have been able to charge at an average price below $30/MWh in all regions except New South Wales,” the ISP states.

Transmission transition

The 2020 ISP forecasts that by 2035 there could be periods in which nearly 90% of demand is met by renewable generation. To cope with such an energy mix, there is a growing need to actively manage power system services, including voltage control, system strength, frequency control, inertia, ramping and dispatchability. However, this does not necessarily mean that old technologies, such as synchronous condensers, will assume a critical role on the grid since new renewable energy technologies already in use, such as grid-forming inverters that are installed at the Dalrymple ESCRI battery in South Australia and the expanded Hornsdale big battery.

Finally, investment in transmission infrastructure will be crucial to enable renewable energy to join the grid as quickly as necessary. The ISP underlines the importance of strategically placed interconnectors and REZs, coupled with firming resources, to add capacity and balance variable resources across the NEM. The analysis divides targeted augmentations of the NEM transmission grid into four categories of projects ‒ committed, actionable, actionable (with decision rules) and future ISP projects ‒ permitted to be developed by the transmission network service provider through the Renewable Investment Test – Transmission (RIT-T) process.

Previously committed ISP projects that are underway and have already received their regulatory approval include South Australian system strength remediation ( the installation of four high-inertia synchronous condensers), the Western Victoria Transmission Network Project to support generation from the Western Victoria REZ, and QNI Minor, which is the addition of 150 MW of capacity on the NSW-Qld interconnector.

The 2020 actionable ISP projects include:

- VNI Minor: a minor upgrade to the existing Victoria ‒ NSW Interconnector (VNI), which is close to completing its regulatory approval process, with project completion expected in 2022-23;

- Project EnergyConnect: a new 330 kV double-circuit interconnector between South Australia and New South Wales, which is close to completing its regulatory approval process. The project completion is expected by 2024-25;

- HumeLink: a 500 kV transmission upgrade to reinforce the NSW southern shared network and increase transfer capacity between the Snowy Mountains hydroelectric scheme and the region’s demand centres. This project commenced its regulatory approval process earlier this year, with project completion due by 2025-26; and

- Central-West Orana REZ Transmission Link: network augmentations to support the development of the Central-West Orana REZ. The project completion is due in 2024-25.

Two further projects are deemed actionable with additional decision rules:

- VNI West: a new high voltage alternating current (HVAC) interconnector between Victoria and NSW; and

- Marinus Link: two new HVDC cables connecting Victoria and Tasmania, each with 750 MW of transfer capacity and associated alternating current transmission.

Future ISP projects include major upgrades to the NSW-Qld interconnector, and grid augmentations in QLD, NSW and Victoria, which are all included in the optimal development path for the NEM.

“When implemented alongside market and regulatory reforms, the targeted transmission investments identified in the ISP will bring the right resources into the system in a timely fashion. This will create a modern, efficient and resilient energy system that delivers $11 billion in net market benefits weighted across the different ISP scenarios over the next two decades,” AEMO’s Managing Director and CEO, Audrey Zibelman, said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

7 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.