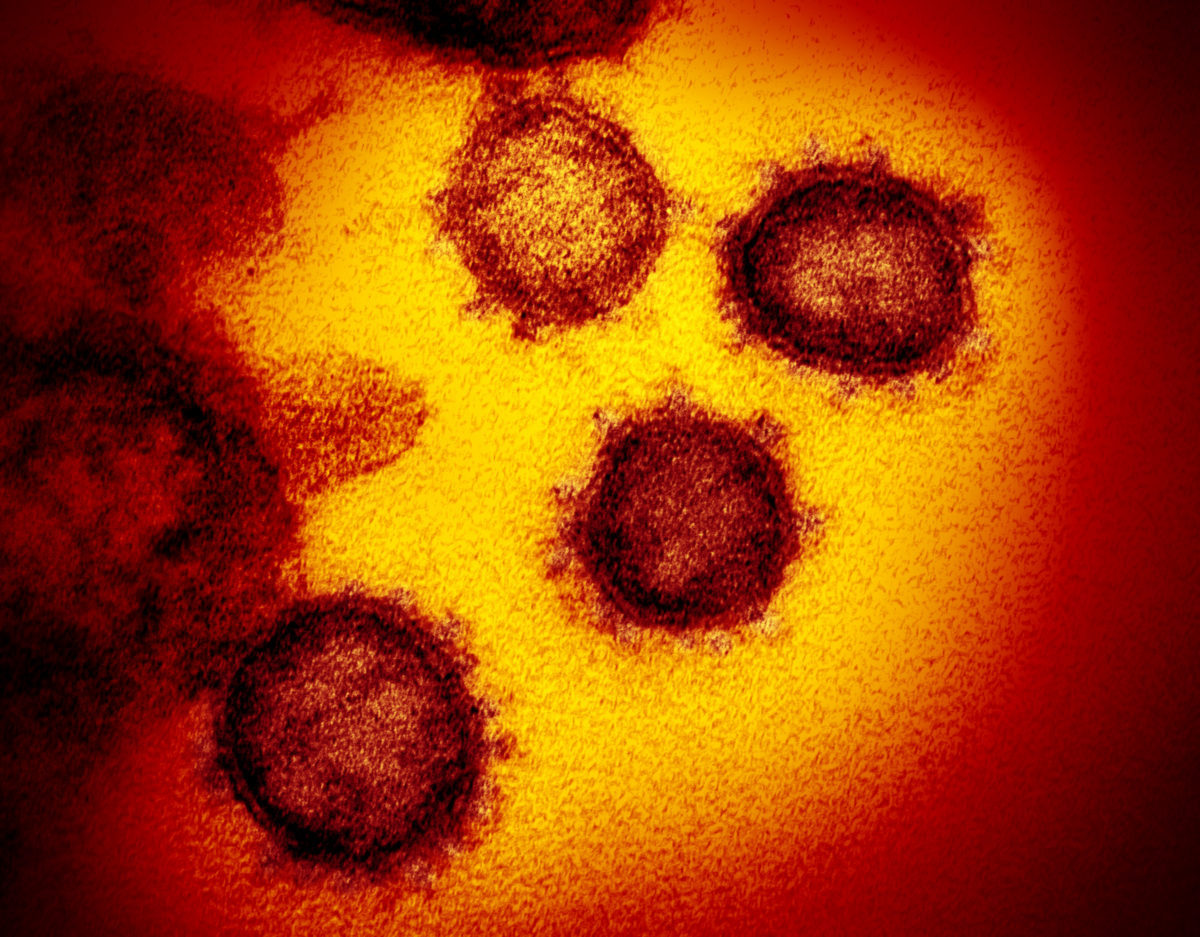

BloombergNEF (BNEF) published its outlook for the solar PV industry last week as markets around the world brace for the economic impact of the Covid-19 pandemic. Despite Chinese factories coming back online, BNEF is not hugely optimistic, indeed, it is not supply they’re worried about, but demand.

Governments around the work are readying stimulus packages to ward off the economic downturn as best they can. The Australian Government’s “Economic Response to the Coronavirus” is a $17.6 billion reinforcement against job and investment losses, included in this package are tax deduction incentives for commercial and industrial (C&I) solar PV.

The Australian Government’s stimulus package is first and foremost a defence of businesses. Well, actually, the overview reads more like a defence of the Government itself, but eventually, it gets to businesses.

“Like other economies around the world, the Australian economy is already feeling the effects of the global Coronavirus outbreak…the economic shock is likely to be significant…The package is front-loaded in order to instil confidence in businesses and households and help firms keep people employed. This will ensure that the economy is in the best possible position to recover as the shock subsides.”

Therefore, key to the Government’s response is “delivering support for business investment.” And what better support than helping businesses reduce the haemorrhaging of energy bills? The stimulus package is thus increasing the instant asset write-off, meaning businesses now have more incentive to install solar systems.

“From today, the Government is increasing the instant asset write-off threshold from $30,000 to $150,000 and expanding access to include businesses with aggregated annual turnover of less than $500 million (up from $50 million) until 30 June 2020.”

Businesses are now able to instantly asset write-off solar systems of $150,000 or less purchased this financial year (30 June 2020). In an interview with Nine News Australia, Prime Minister Scott Morrison said this would give businesses the “confidence” to go ahead and purchase and install equipment “because they will be able to write-off completely, 100%.” Bolstering this support is “backing business investment”, another incentive in place until 30 June 2021 that accelerates depreciation deductions.

“Businesses with a turnover of less than $500 million will be able to deduct 50 per cent of the cost of an eligible asset on installation, with existing depreciation rules applying to the balance of the asset’s cost.”

This latter incentive is only limited by the $500 million turnover mark, meaning large-scale solar farms are also incentivised, given the business isn’t turning over more than $500 million.

The solar industry is particularly at risk considering the source of the pandemic, China, is also the source of most of our solar panels. Recent analysis from Wood Mackenzie said: “If activity is restored by the end of February, the impact is likely to be short term. However, if restrictions remain in place longer, then the impact on supply in China will be significant, choking the country’s output.”

Thankfully, BNEF reports that the production of PV components is starting to resume in China. Whilst there might be shortages in the short-term, China is expected to meet its export demand before it looks to meet its domestic demand.

The current situation in China has shown that the value chain for renewable energy needs to be regionally diversified, says BNEF. More production facilities are also needed in Asia, Europe and the United States – especially for batteries.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The prices of PV modules have already gone up here in Australia. The Australian Government has announced a $17.6 billion stimulus package for the private sector. It remains to be seen how it boost growth in the solar industry.

To diversify the supply chain, Vietnam, Malaysia and Thailand are some good alternatives to China.