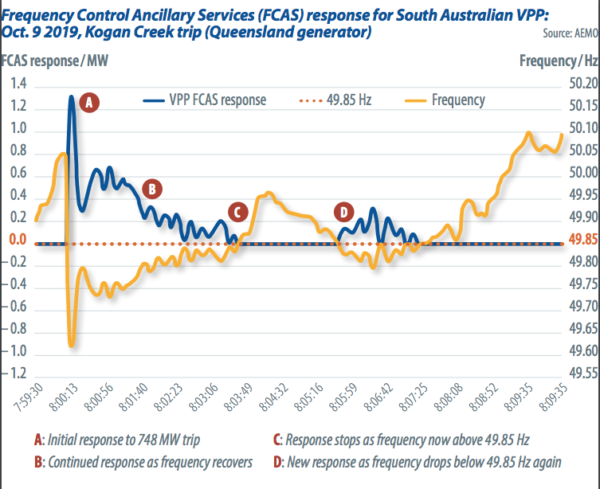

On October 9, 2019, the largest generation unit on Australia’s National Electricity Market (NEM) – located at Kogan Creek, Queensland – tripped unexpectedly. That is, 748 MW of capacity went missing, sending the power system frequency to 49.61 Hz. Hundreds of kilometers away, a Tesla virtual power plant (VPP) in South Australia detected the frequency excursion and responded immediately by injecting power into the system. On that day, a swarm of South Australian solar batteries kept the lights on in Queensland – effectively demonstrating how VPPs can buttress the power system.

VPPs are mushrooming across the NEM in a wide range of shapes and sizes, with the common goal of helping to bridge the shortcomings of the traditional grid in managing the peaks and troughs. The Tesla-Energy Locals-SA government VPP project is perhaps the most prominent and could grow from 1,100 homes to 50,000 to become the equivalent of a 250 MW/650 MWh network of decentralized power generating units.

“Australia’s VPP market is booming. We estimate that there are at least 35 VPPs active in Australia. By the end of 2020, we expect that there will be at least 50, making it one of the most active markets in the world,” says BloombergNEF analyst Will Edmonds.

Indeed, Australia hosts some of the most advanced VPP projects in the world, particularly involving rooftop PV systems and battery storage, for both grid-connected and offgrid applications. Most of them are relatively small at around 5-10 MW each, but the Australian Energy Market Operator (AEMO) anticipates that there may be up to 700 MW of VPP capacity by 2022.

The (r)evolution begins

For now, most Australian VPPs are in the early stages of development. While still in a trial phase, the South Australia Tesla VPP has demonstrated the ability to provide critical network services, such as frequency regulation, after it became the first project to join the AEMO VPP Demonstrations program in September 2019. Launched last July, the program aims to make VPPs visible to the market operator and use the data collected to inform changes to regulations and operational processes that would pave the way for the smooth integration of VPPs before they reach commercial scale.

The Australian market operator expects to exceed its target of five participants over the coming months. Its goal is to continue to collect data on the effectiveness of VPPs in adding value to the power system, such as by charging up during negative pricing and discharging at peak-demand times in the summer.

“AEMO will continue to monitor and analyze participants’ responses to events on the power system,” says Matthew Armitage, principal analyst for the AEMO DER Program. “The addition of other participants will enrich the current data set and allow for more analysis to be carried out to inform operational and regulatory changes to integrate VPP.”

Importantly, AEMO’s proposed approach recognizes a number of barriers that are currently limiting the value that can be recognized from DER participation in existing markets. Namely, the current regulatory framework imposes limitations on aggregated assets by allowing only load-side participation (rather than load-side and generation-side participation) and not allowing the “value stack” – delivering energy and FCAS from behind the meter.

Historically, FCAS markets have been reserved for gas generators that have often used strained grid conditions and failures to push prices to the maximum level, while adding millions to consumer electricity costs. As of recently, big batteries have ramped up competition in these markets while making substantial revenues by maintaining the electricity system at a stable operating state. Based on learnings from the VPP demonstration, interim arrangements were adopted in December to allow VPPs into the most lucrative part of the market for fast contingency FCAS – paving the way for an additional revenue stream for DER owners.

“The VPP Demonstrations project is testing a new specification for DER to deliver FCAS, a key component of which is to allow one-second resolution data to be used to verify FCAS delivery, rather than the current requirement for 50 millisecond data,” says Armitage. “If this is proven successful, it will enable VPPs to deliver FCAS without having to install high-speed measurement equipment.”

Hard sell

Despite a number of attractive offers in the market that fully or partially cover the upfront costs of battery storage, recruiting customers into a VPP is not easy. One of the reasons for this is the sluggish uptake of behind-the-meter batteries, as opposed to eye-watering rooftop PV installation rates. BloombergNEF expects that more than 13 GWh of residential storage will be installed in Australia by 2030, while AEMO estimates that embedded battery storage capacity, including VPPs, will total between 17 GW and 30 GW by 2040. But for now, high upfront costs mean that just 270 MWh of behind-the-meter storage was added in 2019.

While payments for participating in a VPP can reduce the pain of buying a battery, they apparently need to become more prominent in order to sway customers’ purchasing decisions. “We are at the beginning of the evolution of these offers, and we need to earn the trust of all customers, including those with DERs, by sharing the benefits of using their systems with them,” says AGL’s head of orchestration, Travis Hughes.

After the successful trial of its VPP technology in Adelaide, Australia’s biggest power producer, AGL, flagged a new residential battery program – a backbone of a VPP that will spread across Victoria, South Australia, New South Wales, and Queensland. “Our Bring Your Own Battery enrollment offer provides customers with clear limits on how we will use their batteries and visibility of when that occurs. This will keep evolving,” Hughes says.

AGL’s more advanced project, the Adelaide VPP, went online in 2017. Its expansion was announced last year with the launch of an AUD 1,000 ($655) cashback offer on home battery systems. In February, the project became the second participant in the AEMO VPP Demonstrations program to operate in South Australia. According to Hughes, the key to any regulatory changes that AEMO is looking to amend will be to ensure that the value created by VPPs is shared with customers, such as rewarding them when solar and batteries curb energy demand in peak periods. “There are different models for sharing value with VPP customers,” he says. “They depend on the purpose or structure of the VPPs, such as whether they are providing network support or participating in a wholesale market.”

As a more advanced project, AGL has networked more than 1,200 customer batteries while successfully dealing with some technical challenges encountered on the way to market participation. Hughes describes these as being linked to the wider transformation of a centralized energy network to a “multidirectional energy system.” He notes that high network voltage levels are often “blamed on solar systems, but … our data show are high, regardless of whether or not [solar] customers are exporting to the grid.”

Despite headwinds, bidirectional flows at connection points are set to usher in a new era for distribution networks on the back of cutting-edge VPP cloud-to-cloud communications and control technologies. However, since most potential revenue streams that VPPs in Australia could tap into have minimum size requirements, to reach these capacity floors, VPPs must increase their customer base. For instance, to bid in a state’s FCAS market, VPPs require at least 1 MW of capacity.

“Australian VPPs face a Catch 22. To realize value they need to scale, but to scale they need to realize value,” Edmonds says.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.