Japanese industrial giant the Sumitomo Corporation, owner of Western Australia’s coal and gas-powered Kwinana Power Plant, the coal-fired Bluewaters Power Plant (Bluewaters), and solar retailer Infinite Energy, has reported a stunning ¥26bn (US$251m) loss on its Western Australian (WA) Bluewaters coal fired power investment.

The 434 MW Bluewaters coal-fired power station is WA’s newest coal power station, completed in 2009 and generates approximately 15% of the state’s energy. Interestingly, it is WA’s only privately-owned coal-fired power station.

According to a report from the Institute for Energy Economics and Financial Analysis (IEEFA), the loss strongly contributes to the company’s worst ever half and full-year performances. According to the report’s author, energy finance analyst Simon Nicholas, the Australian coal power loss raises important questions for investors and the company.

Such questions, which Sumitomo and its investors are no doubt hurriedly typing into the Google search bar, include: How to flog a dead horse? How to get blood from an obsolete stone? And, why won’t banks invest in stranded assets?

This last question may just be the kicker, as the timing of the loss stems at least partially from Sumitomo and joint venture partner Kansai Electric’s failure to refinance loans of almost AUD$400m on the Bluewaters plant due in August 2020, “as a growing wave of major banks decline further coal funding.”

Late last month, ANZ Bank announced plans to follow in the footsteps of fellow Big Four competitors Commonwealth Bank and Westpac by releasing a new climate change policy that set out a plan to disentangle its finances from thermal coal and actively support the transition to a net zero emissions economy by 2050.

According to the report, more than 120 major global banks and insurers have announced policies restricting coal financing and more are being announced every week.

New Japan, old Sumitomo

Of course, it is not only Australian financiers who are becoming less interested in stranded coal assets in the face of the global energy transition. In July 2020, after many years of criticism for its financing of coal power throughout the globe, particularly in developing nations, the Japanese government adjusted its policies. In an interview with the Financial Times, Japan’s environment minister, Shinjiro Koizumi, described the tightened conditions as a “turning point.” “[Until now] Japan’s attitude was that if we can sell, then we should,” Koizumi said. “That is completely changed. In principle, there will be no support.”

The Japanese government didn’t stop there, it has gone on to put together a gut-busting combo of punches to put the all but defeated coal industry out of its misery. Japan announced that approximately 100 inefficient coal plants would be shut down by 2030, and then, in October 2020, the great nation of the rising sun committed to a net zero by 2050 emissions target – effectively a knockout punch, although, like Ali v Foreman, Big George takes a while to fall.

“From being considered a laggard on coal policy, the Japanese government has quickly taken the initiative on policy which has left Sumitomo and its coal projects behind,” wrote Nicholas, who also points out that Sumitomo is alone among the major Japanese trading houses for not having taken significant steps away from thermal coal power in recent years.

In fact, where its fellow house peers have divested in coal, Sumitomo has invested. “When Mitsubishi Corp sold its investment in the Australian Clermont thermal coal mine in 2018,” continues Nicholas, “the stake was acquired by a joint venture of Sumitomo and Glencore.”

Mitubishi, Marubeni, and Mitsui have already divested from thermal coal mines. Sojitz Corporation sold its 10% stake in the NSW’s Moolarben Coal Mine in March 2020, and in February, Itochu Corporation sold its interest in Glencore’s QLD Rolleston thermal coal mine.

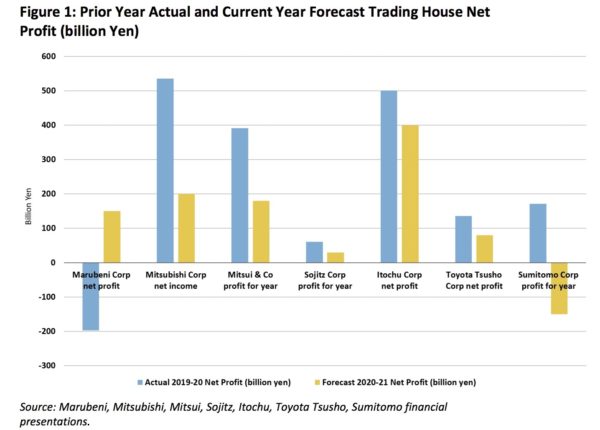

Furthermore, Sumitomo cannot blame the global pandemic for its loss because it is the only Japanese trading house forecasting a loss in FY2020.

International pressure

Of course, there is also significant pressure from international wealth funds such as Blackrock, Norway’s Storebrand and the Norwegian Oil Fund, the world’s largest sovereign wealth fund, which have both restricted investments to coal laggards. Indeed, only last month, BlackRock revolted at AGL’s annual general meeting, calling for AGL to pick up the pace on its coal plant closures. BlackRock is also a major Sumitomo shareholder.

“Despite the Covid-19 pandemic, there has been no let-up in investor pressure on companies that are exposed to coal,” writes Nicholas, “if anything the rate has only increased.”

However, despite mounting pressure, Sumitomo is obstinately continuing with its coal investments in Indonesia, Vietnam and Bangladesh. Nicholas points out that Sumitomo is even planning a second coal power project in Bangladesh despite the nation already struggling with an overcapacity problem that has the energy sector in crisis. “Sumitomo’s coal power projects in Bangladesh and Indonesia will lead to further, inflexible and unaffordable capacity payments which contribute to the need for larger taxpayer-funded bail-outs of state-owned power utilities and higher consumer tariffs,” says Nicholas. “This is a poor outcome for developing nations.”

Coal crisis

Sumitomo’s problems are not limited to financial mutiny however, as the IEEFA report makes note, Bluewaters is struggling to even get its hands on the coal it can’t afford to burn. Bluewater’s former owner, Griffin Coal part of Griffin Group, is the power station’s sole supplier and since it is losing AUD$6m a month, its ability to deliver coal to Bluewaters has been compromised. Nicholas states that Bluewaters has made its intentions to double-down clear, the company intends to take over the Griffin Coal mine to secure supply, “a move that would increase Sumitomo’s equity share of thermal coal production again.”

Considering the rate at which renewable energy prices are falling, particularly solar, the early retirement dates of coal-fired power stations are likely to be brought forward continually, they simply cost more now, and Sumitomo is chasing its loses down a hole it can only reverse out of.

“Western Australia is fast becoming an example of a developed power system entering rapid transition,” writes Nicholas. “Sumitomo’s 2011 investment in coal-fired power in the state has resulted in a loss of US$251m so far – a poor outcome for Sumitomo shareholders. The last nine years since 2011 has seen the economics of renewable energy turn on its head followed by a wave of major financial institutions abandoning coal lending, events that have overwhelmed Sumitomo’s coal investment rationale.”

Signs of hope in the rising sun

Despite Sumitomo Corporation’s obstinacy, there is some good news breaking on the horizon like a rising sun. Sumitomo Mitsui Banking Corporation, a fellow member of the Sumitomo Group, has today been announced as one of the leads, along with Natixis, Société Générale, MUFG Bank, British HSBC and the Commonwealth Bank of Australia, of Norddeutsche Landesbank’s €370m (AUD$598m) financing of what is to be Australia’s largest solar park – QLD’s 460 MWp Western Downs Green Power Hub.

Sumitomo Mitsui Banking Corporation is one of several Japanese banks which has also announced restrictions on coal financing.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.