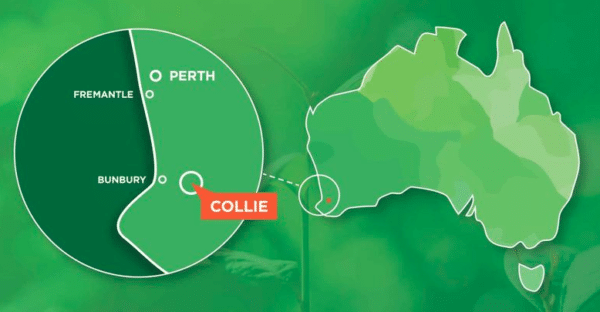

A town that lists one large letterbox and replica coal mine among its top attractions probably isn’t the setting that springs to mind when you think of the global race to produce a crucial component of the lithium-ion batteries. But Collie, a town with a population of 7000 in the south west of Western Australia, is precisely that.

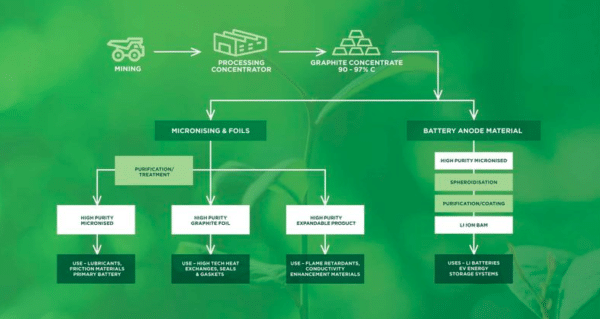

Soon, Collie may well be home to one of the world’s first battery anode material producers outside of China. The key component of battery anode material, which has the joyous acronym BAM, is graphite. Often overlooked, the mineral is at the heart of the battery anode material which is ultimately responsible for holding and distributing charge in lithium-ion batteries.

Niche as it may sound, BAM is claiming its position in the energy sector’s limelight more by the day. “The opportunity is right now in terms of timing, in terms of demand for the product, and in terms of buyers of the product openly stating in the media and in person that they need to have more than one geographic source of supply,” International Graphite’s CEO Neil Rinaldi told pv magazine Australia.

Which is where his company, International Graphite, comes in. The WA start-up is one of just a handful of companies seeking to diversify BAM production away from Chinese shores in time for the seemingly imminent global battery boom.

Rinaldi admits when he heard the start-up had decided on inland Collie, his first reaction was “Really?! And then the penny dropped, and the penny dropping event was cheap power.”

“We need to be competitive on a world-wide basis and being potentially behind the [meter] in terms of energy supply contracts is an opportunity that presents itself in Collie for us to achieve. That brings our power costs down dramatically.”

In other words, the company sees low energy costs as balancing some of the advantage China has given its cheap labour.

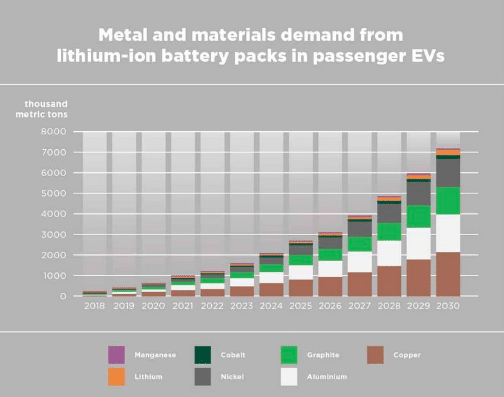

Bloomberg

Wrestling the reigns from China

Currently, China controls 90% of the market for the purified product that goes into BAM, according to Rinaldi. Which is something that he says leaves many in the world of battery production a little uneasy. “It doesn’t take a genius to work out why,” he says. Between trade wars, political risk and the supply chain crisis illustrated at the beginning of the pandemic, Rinaldi says a lot of battery manufacturers are eager to diversify their BAM supply.

“We intend on being one of the first outside of China. We’re sort of in the first wave of producers but I think the industry is going to grow quite dramatically over the coming decades – but you’ve got to start somewhere, right?”

Which brings us back to our unexpected hub: Collie. Why is the power so cheap there? Well, the tiny coal-mining town is in the midst of a pivot, with various levels of government pushing to reposition the region as a clean energy centre, providing incentives, grants and, perhaps most importantly, sustained focus.

The town has even come to be associated with climate guru and respected economist Professor Ross Garnaut. A consortium linked to his company, Sunshot Energy, have invested in Renergi’s Collie-based project which converts landfill waste and other biomass to energy and biochar.

Rinaldi says he’s been in discussions with Garnaut about sourcing renewable energy in the region, and it seems both men have applications for grants for their Collie-based projects in the woodwork. “It’s very collaborative,” Rinaldi says of West Australian and Collie clean energy industry.

Image: International Graphite

Investors prove hungry in seed capital round

Far from just relying on grants, International Graphite in February closed its seed capital round.

Investors pledged $1.5 million, supplying 50% more than the company’s target. “The appetite was higher – we actually cut it off. We want to manage our capital structure to ensure we deliver as much value to existing and new shareholders without over diluting them.”

While the company has received support from new investors, Rinaldi says the capital raising round was primarily supported by people who are familiar with the business – the majority of which have come into the start-up’s orbit through its sister company, BatteryLimits.

Piggybacking: how the start-up got started

Having been in the graphite space for more than a decade, BatteryLimits have conducted studies for many of major graphite companies with a particular focus on Australia and Africa, says Rinaldi.

“So from all of the experience they had in graphite, the opportunity became quite obvious for them to develop plans for a downstream graphite processing business. And here we are – International Graphite.”

Founded in 2018 by several of the same people behind BatteryLimits, International Graphite has spent the last three years on product research and development as well as studies. “It’s an industry that’s not the easiest to get into, it’s relatively opaque so it does take a period of time to get the knowledge base sorted and to understand exactly what you want to be and who you’re going to service as a customer.”

International Graphite

Graphite – the oft-forgetting component of the beloved Li-ion battery

Graphite comes in two forms: synthetic and natural (which is mined). While there are rumblings of graphite mines soon be producing in Australia, Rinaldi says none have products available that fit the company’s needs as of yet. Which means, for now, International Graphite is sourcing their purified, natural graphite from abroad. (Rinaldi says the company is considering investing in a graphite mine to become a fully vertically integrated business, but that decision remains a way off.)

Graphite in hand, the company sets about making its battery anode material, which Rinaldi says is more akin to a technology product and a mineral stew. That is, there are a lot of moving parts. “It becomes quite a high value product.”

Having put in the hard yards figuring out precisely how to get the product to its high value stage, the company is ready to this year make the plunge from thinkers into doers.

“Our focus now is on producing [the battery anode material] and then manufacturing that to be a world-class green product,” Rinaldi says.

Other plays in the game

International Graphite are not the only company looking to become a BAM producer outside of China – though it’s hardly a flooded market. Off the top of his head, Rinaldi points to groups in Norway, Sweden, Germany expecting bring their products online soon. International Graphite also has a competitor closer to home: Renascor, which is based in South Australia.

“[Those companies are] competitors in a way but not in others,” Rinaldi says. “There’s room of us, there’s room for others. I think the industry only benefits from having more participants.

“The demand is so high that it’s going to drive more production, I think.”

With massive moves afoot in the auto industry, like Land Rover Jaguar’s February announcement that it plans to electrify Jaguar’s entire fleet by 2025, Rinaldi says the battery (and also BAM) buzz is really beginning to boil over.

“You’re starting to see action, you’re starting to see governments, you’re starting to see end-users, you’re starting to see manufacturers of battery products developing the technology and actually building the technology and selling the technology.”

Great expectations (and aspirations)

The company expects to have samples of its product to provide to its network of potential buyers in Europe and North America by the end of the year. Far from the end of the road, this actually marks beginning of a validation process – which can sometimes take years.

“So we have a bit of a balancing act,” Rinaldi admits. Before the company orders the equipment necessary to start producing BAM in large quantities, its hoping to get the ball rolling on end-user agreements – minimising the time between massive outputs and when the revenue stream starts to trickle. “The sooner we can start that, the better. Which is why we’re starting it now.”

In the meantime, International Graphite plans to commence production of foils – another downstream graphite products, that are most notably used in mobile phones.

The start-up is also looking to lock in some partnerships over the coming months. “We’re hopeful to form an alliance and possibly a joint venture agreement with potential technology partners that have a foothold in Europe, that’s one thing that’s attractive to us and we’re talking to people about that now.”

Also on the cards is an ASX listing, which Rinaldi hopes will happen in the next four months. “I understand that traditional investors are looking for an investment that they can price on a daily basis via an ASX listing.

“It’s going to be quite an exciting time.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Why aren’t we looking at converting CO2 to C instead of Carbon Collection and Storage?