In 2020, battery energy storage systems in Australia found new markets and new applications, the FCAS market for big batteries and VPPs collapsed under the weight of enthusiasm, state governments supported the development of big batteries; and residential battery sales, also to some extent supported by government incentives, grew by 20% on 2019 figures. The outlook for battery activity in 2021 looks similarly buoyant, though not phenomenal, according to exhaustive research conducted and published by SunWiz in its Australian Battery Market Report 2021.

Solar market analyst, SunWiz has been producing battery market reports since 2015, dicing, relating and forensically examining input from battery retailers, manufacturers, state incentive programs, the Clean Energy Regulator, software platforms used by sales teams, the Australian Energy Market Operator’s (AEMO) new Distributed Energy Resources Register (registration of new grid connected systems was made mandatory in early 2020) and interviews with consumers.

SunWiz calculates that in 2020, 31,269 new residential batteries were installed, which resulted in a 27% increase in overall residential storage capacity because the average battery size increased to around 10.9 kWh; that’s up from 10.3 kWh in 2019, but still down from the heights of 2018, when the average size was 11.4 kWh.

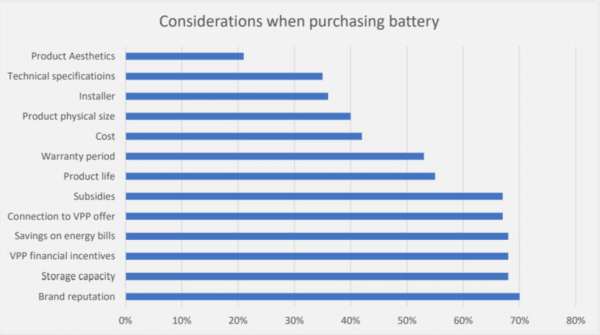

Why we buy batteries

To understand what triggers homeowners to purchase a battery, SunWiz channels a 2020 survey conducted by Simply Energy, the Australian retail arm of Engie, which has captured 12% of the Australian retail energy market.

Unsurprisingly, the survey identified a desire to reduce electricity bills as the main driver for interest in home batteries; “This is consistent with every other survey we’ve read and has been the significant motivator Y-o-Y,” says SunWiz.

Government subsidies and the ability to store energy for later use were the next most important motivations.

Image: SunWiz/ Simply Energy

The number of new homes being built with solar systems that include energy storage has also increased, driven by developer initiatives, such as Stoddart, a supplier of building materials to residential developers, using South Australia’s home battery subsidy to provide new builds with 6.5 kW PV systems and a 11.6 kWh SolaX battery for no extra cost.

Another 2020 example, was battery manufacturer sonnen signing deals with property developers such as Stockland to include batteries on new homes from the get go.

Such deals are often accompanied by sign up to Virtual Power Plants (VPPs), which aim to orchestrate large numbers of household solar-plus-battery systems for the financial benefit of their owners and the stability of the grid.

Energy retailers such as AGL and Discovery Energy, have negotiated attractive financing or discounts on batteries, which create extra value in VPP solar-plus-battery packages to consumers.

Why we don’t buy batteries

Despite state-based subsidies, and VPP bundles that reduce the cost of battery purchase, SunWiz identifies upfront cost of home energy storage systems as the ongoing principle barrier to more enthusiastic uptake.

With the cost of batteries expected to remain stable, SunWiz predicts the market for residential storage in 2021 is also around 31,000, which will bring the Australian installed base to some 143,000 systems by end December.

The Report says, “Historical forecasts of massive uptake were predicated upon a steep price drop in batteries that hasn’t played out thus far… in the residential segment.

“As residential system prices have been quite steady for three years running, accelerated uptake is unlikely to be fuelled in the near future by falling prices.”

Innovative niche markets for medium-scale storage

In between residential and very large-scale batteries, some interesting developments have emerged.

For example, Western Australia opened up the opportunity for community batteries, with its rollout of 116 kW/464 kWh batteries to help householders manage their solar energy supplies into the evenings, and help Western Power to manage the grid during the day.

Although still being trialed, in the sense that a viable model for investment and return on the batteries has yet to be arrived at, the idea that householders could share storage at a modest ‘rental’ cost paid to the provider “may capture market share from HESS”, says SunWiz.

Primary producers, such as Riverlands Free Range poultry farm (Australia’s largest supplier of free-range chickens) are also realising the benefits of energy storage. Riverlands last year installed 1.4 MW of solar panels, supported by a 2.28 MWh Tesla lithium-ion battery system that was expected to reduce the farm’s energy consumption from the grid by 70%, allowing it to run on renewable energy 65% of the time.

And electric vehicle charging stations are emerging as battery customers. In 2020, Chargefox, twice chose to install an onsite battery as a cheaper alternative to upgrading power supply to EV charging points; its Goulburn electricity storage system consists of a 250 kW/273 kWh LGChem cells and a Vacon inverter, fed by a 50 kW solar system to reduce the amount of energy purchased from the grid. In May last year Chargefox Head of Charging, Evan Beaver also expected the system to earn its keep by participating in the Frequency Control Ancillary Services (FCAS) market …

Image: AAM Investment Group

Whoa, easy on the FCAS expectation

Although energy storage is increasingly providing stabilising services to electricity networks, and allowing the connection of more renewables both at household and large scale, SunWiz says the business model for batteries relying on FCAS revenue has been “thrown into disarray” due to a glut of participants who have seen “incredibly large revenues replaced by incredibly small revenues”.

SunWiz Director, Warwick Johnston, advises that battery operators and developers, and VPP operators need to “adapt their battery capabilities to tap into other sources of the revenue stack”.

He acknowledges that this can be a more difficult pivot for VPP operators that have promised participants an upfront discount or fixed annual revenue.

Build them and the modelling will come?

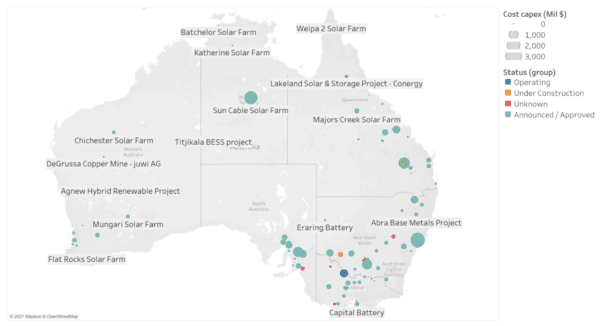

Over 2020, however, co-location of large-scale batteries with generation assets and at strategic network points matured as a successful approach for managing energy flows while increasing the opportunities for connection of renewables to the grid.

AGL last year announced its target to have 850 MW of new large-scale battery storage integrated into its energy generation portfolio by 2024, and topped the until-that-point pinnacle of deployment — Neoen’s 150 MW Hornsdale Power Reserve — with the announcement of a 250 MW battery project on the site of its retiring gas-fired Torrens Island Power Station in South Australia, and has followed through with news of further mega storage facilities this year.

Fluence last year also introduced Australia to the notion of batteries to be deployed as “virtual transmission” — a flexible approach to relieving transmission congestion issues that knocks the process for upgrading traditional transmission infrastructure out of the ballpark.

Image: SunWiz/ Simply Energy

State of the art of big BESS

State Government support of big batteries grew apace over 2020, and took several forms, including:

- Developing Renewable Energy Zones (REZ) which will integrate storage into planned concentrations of renewable generation — for example, the NSW government commitment to unlock tens of gigawatts of solar, wind and storage capacity across five REZs

- Signing contracts for supply of energy that underwrite new projects — the South Australian Government enabled development of the 280 MW Cultana Solar Farm and the 100 MW Playford Utility Battery

- And direct expenditure on state-owned infrastructure, such as the Northern Territory Government’s commitment to outlay $30 million on a 35 MW battery that will support greater integration of solar generation into the Darwin-Katherine grid and save the state-owned utility some $6 million a year by supplying power system services currently provided by gas generators

Developers led by Neoen, gen-tailers (AGL), network owners such as Spark Infrastructure, and service providers such as Transgrid also announced new battery projects last year, and SunWiz notes an increase in battery duration, “with a few announcements of four-hour energy storage indicating the focus shifting towards bulk energy storage”.

The Report says a total of 77 MWh of commercial and grid-scale battery storage projects are “known to have been installed in 2020” — around half of the 2019 volume of 141 MWh — but predicts the grid-scale market will next year surpass the growth of the residential market, with 400 MWh planned for installation.

“Combined with the residential market, this would represent 734 MWh — again demonstrating growth in overall market volume,” concludes the SunWiz analysis.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.