AGL has been busier than a beaver in the Suez Canal recently, and its most recent announcement may just be the most insightful to the trajectory the energy giant is taking. Following on from its recent announcement

The news followed on the momentum of recent announcements from AGL including the forging ahead of plans to establish a 200 MW grid-scale battery at its Loy Yang power station in Victoria’s Latrobe Valley, the start of construction on its 250 MW one-hour-duration battery at the site of its Torrens Island power station in South Australia, its entering into a joint venture with the UK’s Ovo Energy for the exclusive rights to the company’s energy management platform, and AGL’s recent acquisitions of Epho and Solgen Energy Group – making it the largest commercial solar provider in Australia.

All of these examples are the kind of long-overdue moves with the current of the energy transition that AGL had been resisting for so long, but is this partition another one?

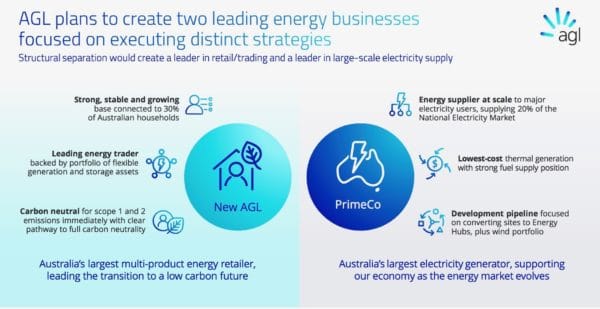

AGL’s plan is to partition itself into two energy businesses with separate strategies. Both have been given placeholder names, the first of these is “New AGL”, which will be Australia’s largest multi-product energy retailer by number of services to customers, providing electricity, gas, internet and mobile service to more than 30% of Australian households. The other is “PrimeCo”, Australia’s largest electricity generator, generating around 20% of the electricity demand in the National Electricity Market (NEM).

This separation entails an entire restructuring of AGL’s business model and capital structure. According to AGL managing director and CEO, Brett Redman, “The accelerating market forces of customer, community and technology are driving the imperative to create this new path and separate AGL into two distinct organisations.”

The idea is to give the retail business and the generator business the individual freedom to pursue their own agendas, “while playing an equally important, but different,” stressed Redman, “role in Australia’s energy transition.” To power its own transition, AGL will be reducing its operating costs by $150 million and selling soon-to-be-obsolete assets such as the Newcastle Gas Storage Facility and Silver Springs gas project.

“An accelerating desire for action on climate change, shifts in government policy and rapidly falling technology costs, have changed our market,” said Redman

Redman added that New AGL would be carbon neutral for scope one and two emissions from the get-go, and have a clear structured pathway to full carbon neutrality. Although, as Redman said in his Investor Day speech, New AGL will “retain AGL’s leading low-cost thermal generation position and strong fuel supply position,” which is to say, AGL’s three coal-fired power stations.

Image: AGL

Moreover, “This strong customer base would be backed by a leading energy trading capability and a 2.1 GW portfolio of flexible generation and storage assets to manage peak demand events.”

As for PrimeCo, the generator sibling, this business will focus on the “safe and reliable running of its generation portfolio. As the low-cost backbone of the NEM it would be well positioned from day one to support the Australian economy as the energy market continues to evolve. PrimeCo’s strong base generation position brings with it a capacity” continued Redman, “to invest in development options including the transformation of existing generation sites into the energy hubs of the future”.

Criticism

According to the Australian Financial Review, “investors believe a full demerger is on the cards for Australia’s oldest energy utility after AGL Energy said it would hive off its huge coal power plants into a separate business. This will allow the core retailing activities to emerge as a zero-carbon electricity supplier.”

Despite the optimism and advertised movements in the right direction from AGL in recent times, it seems as if these moves may have been largely performative, at least, that is what the Australasian Centre for Corporate Responsibility (ACCR) thinks and has criticised AGL’s plans for partition.

ACCR’s director of climate and environment, Dan Gocher, said that the move to split the company in two was AGL abandoning its responsibility on coal closure. “Just seven years after it acquired the last of its coal-fired power stations,” said Gocher, “AGL is walking away from managing their closure, by spinning them off into PrimeCo, which any responsible investor will surely avoid.”

“Following a halving in AGL’s share price over the last year,” continued Gocher, “CEO Brett Redman is attempting to sell the demerger as a win for shareholders, claiming it would give both companies the ‘freedom’ to pursue their own ‘growth agendas’. This is optimistic at best, and delusional at worst.”

Gocher points out that the partition will do nothing for the company’s emissions reduction, “but it may appease some institutional investors who have been demanding AGL do something to reduce its carbon exposure. AGL has chosen the easy way out, leaving the heard decisions around coal closure to whoever is chosen to run PrimeCo.”

Effectively, Gocher argues that AGL has thrown in the towel and selected a scapegoat. “AGL has no plans to encourage electrification and continues to promote the use of fossil gas in order to justify its planned Crib Point gas import terminal. Despite the 2021 AEMO Gas Statement of Opportunities highlighting the flatlining of industrial demand for fossil gas, along with the opportunity to further decrease demand through household electrification, fuel switching and energy efficiency.”

Recent news coming out of AGL has suggested the company, which generates 8% of Australia’s emissions, was beginning to take the lead when it came to the energy transition. Gocher argues instead that “AGL had the opportunity to embrace the energy transition by accelerating its decarbonisation, but it has chosen to spin off its most polluting assets to the detriment of us all.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.