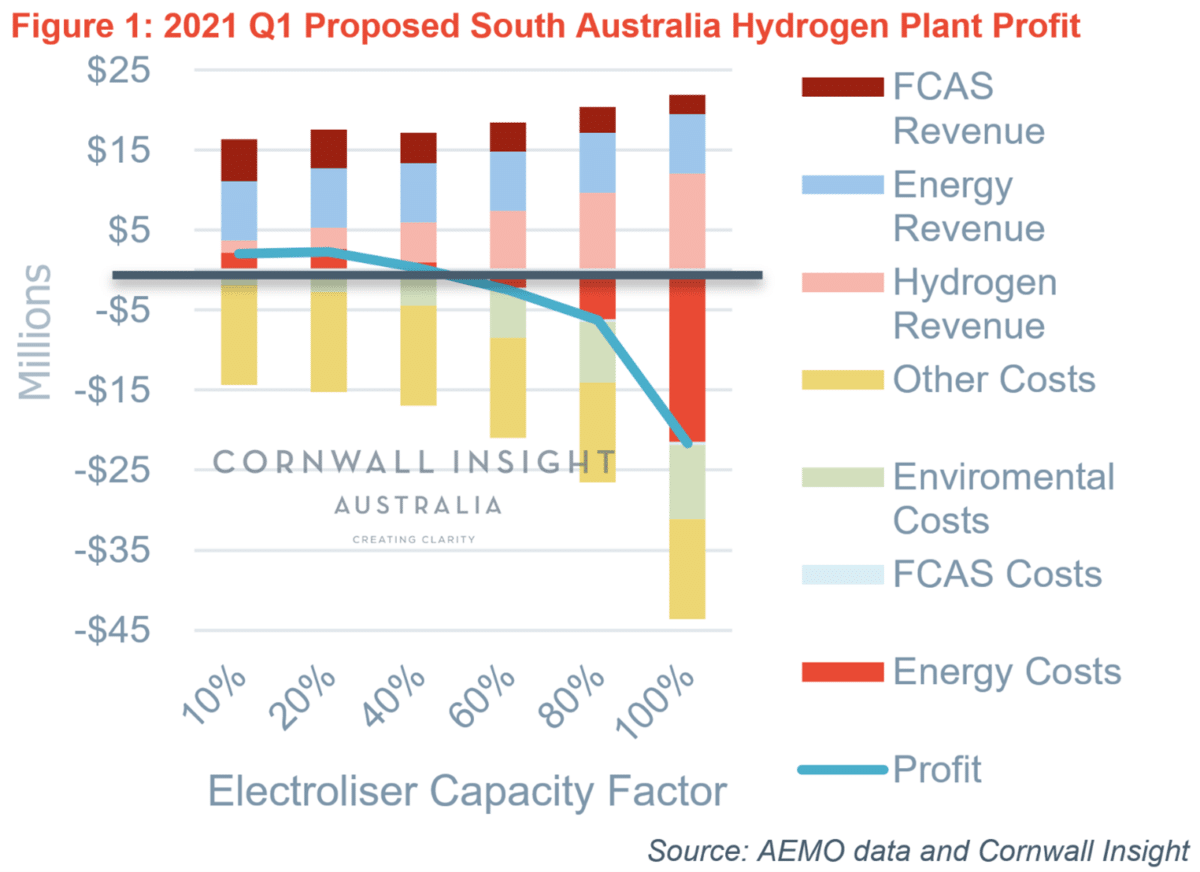

If a hydrogen production plant were already up and running this summer in Australia’s renewable energy powerhouse, South Australia, it would have returned a profit of $2.3 million, according to research by Cornwall Insight Australia.

The analysis comes just days after South Australia’s Liberal government signed a $1 billion-plus energy deal with Morrison’s federal government that has a disconcerting focus on gas extraction as a primary grid stabiliser. The plan hypes gas production and downplays renewable-energy benefits, though a number of important clean-energy-boosting projects also got a funding leg up through the deal.

The state’s Labor opposition, on the other hand, is already focussing on hydrogen, unveiling a $220 million plan in March for a hydrogen production, storage and electricity generation facility, including a 250 MWe of hydrogen electrolyser. The plan also included $31 million for 3,600 tonnes of liquefied hydrogen storage and $342 million for a 200 MW combined-cycle power plant power station. Labor’s plan might just prove lucrative, according to Cornwall.

“Our research shows that if such a plant were in operation at the stated capital costs, it could be profitable,” Senior Storage Consultant at Cornwall Insight Australia, Benjamin Macey, said.

In fact, Cornwall found it could have been profitable to the tune of $47 million in the case of 2020’s summer, given the hydrogen could be sold in line with the government’s goal of $2 per kilogram. This figure, however, is starkly different to the modelled outcome if a hydrogen plant had been operational in the summer Q1 of 2019, in which case Cornwall found it would be suffered a $2.3 million loss.

Cornwall based its analysis a 20% utilisation and included repayments, interest, operating costs and the net cost of energy in its modelling.

“In addition at the 20% utilisation factor, approximately 1,517 tonnes of hydrogen would have been effectively produced. This also could have been stored in the proposed storage facility,” Macey added.

“It should be noted that the financing arrangements using government debt make the project viable and would be difficult to finance on a commercial basis without a clear off-take market and incentive to invest.

“If Australia is to compete globally in hydrogen exports, governments will need to assist the industry and be a first mover. Similarities can be made to the support government has given to battery storage. We estimate there is now over 1 GW of battery projects proposed in South Australia with at least seven virtual power plants in operation.”

Cornwall did not take into account the potential value added from job creation, economic growth and supporting the transition to cleaner fuels in its commercial business case.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.