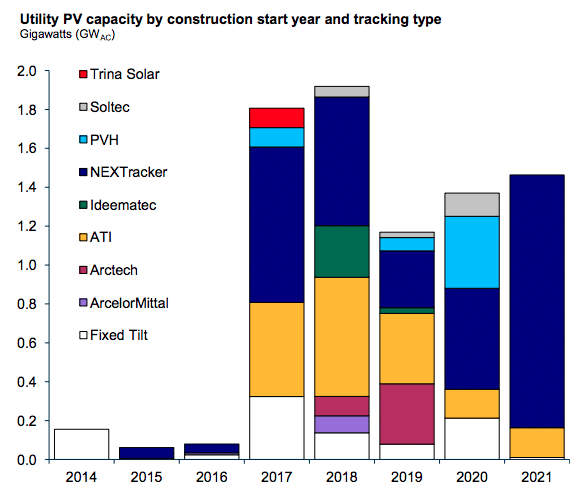

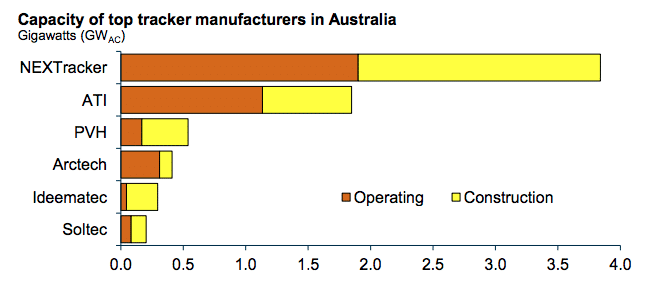

Single axis trackers, devices which turn solar panels to capture more of the sun’s irradiance and therefore help harvest solar power for more of the day, are used in 91% of the utility-scale solar farms which have reached financial close. While there are eight major suppliers of solar trackers in Australia, the market is dominated by just two companies, Nextracker and Array Technologies (ATI).

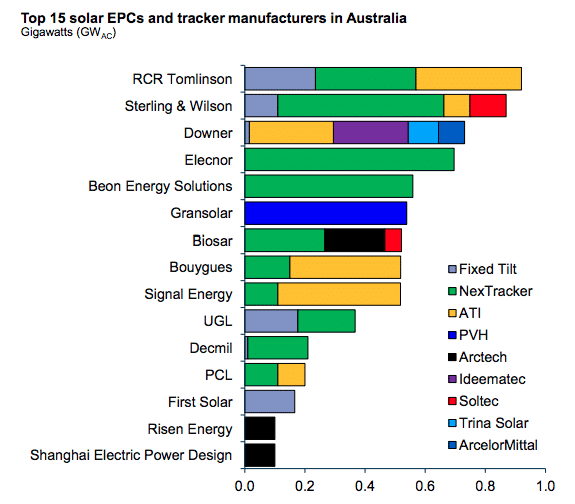

The market’s concentration is largely due to the loyalty of engineering, procurement and construction (EPC) contractors, which typically use just one or two tracking device suppliers, according to analysis from Rystad Energy RenewableCube. “Of the top 15 utility PV EPCs, only two companies (Sterling & Wilson and Biosar) have used more than two tracking manufacturers,” analysts in Rystad’s Australian renewables team, David Dixon, Sushma Jagannath, and Gero Farruggio said in the tracker market review report.

Rystad Energy RenewableCube

“Six EPCs, representing 2.1 GW AC of capacity, have only ever worked with one tracker provider. These include PCL, Beon and Elecnor with Nextracker, Gransolar with PVH, and Risen and Shanghai Electric with Arctech.”

Dominated by two, led by one

Of the two dominating companies, Nextracker and Array Technologies – both headquartered in the United States – Nextracker has proven to be an enduring frontrunner, controlling the Australian market for the past five years.

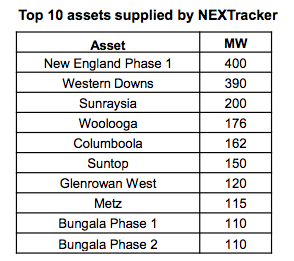

Nextracker has either supplied or committed to supply around 4 GW AC of capacity for 79 assets in every Australian states except Tasmania. The company is the only tracking provider to have surpassed 3 GW AC of utility PV projects in Australia.

Rystad Energy RenewableCube

Australia’s second biggest player, Array Technologies, has supplied around 1.9 GWAC of capacity for 27 assets, Rystad found.

Just one Chinese tracker supplier, Arctech, has won utility PV projects in Australia and only a single German supplier, Ideematec, made it into Rystad’s top eight tracker supplier list.

Off grid systems – the next frontier

As Australia’s National Electricity Market fills up with solar, Rystad predicts the number of utility-scale assets starting construction will drop in the short term. This will compel suppliers to look to the off grid space in Pilbara, North West Australia. “Fortescue, Rio and BHP are likely to be the largest customers. However, the north west coast of Australia will be challenging for any supplier, given that it is a high speed wind region,” the report noted.

Western Australia, especially the state’s lucrative mining sector, is installing off-grid hybrid solar systems at a cracking pace. Many of Australia’s rural communities and industries still run on diesel generators, but Western Australia has been leading the country in its rollout of renewable hybrid systems to replace these carbon-intensive systems.

Rystad Energy RenewableCube

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I need to know more about Australia renewable energy industry and project.