The Asia Pacific region stretches all the way from Kazakhstan, Iran and Sri Lanka on the western edges to New Zealand, Fuji and Japan, and includes China, India and, of course, Australia. Australia has historically been the region’s renewable energy frontrunner, but consultancy and analysis company Wood Mackenzie expects renewable investments in the country to decrease substantially over the next five years.

In fact, it expects Australia’s wind and solar investments to drop by 60% in that period, before picking up again in the 2030s to average out around AU$9.3 billion a year.

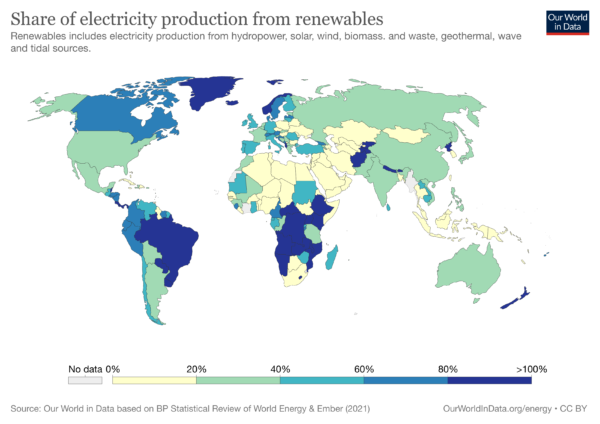

“Australia is a leader in the energy transition in the Asia Pacific. The country has the highest variable renewable energy share in generation now and will accelerate the share from 20% in 2020 to 78% by 2050. The country is closing ageing coal-fired plants and facing reliability and cost challenges at least ten years earlier than other Asian countries,” Woodmac senior analyst, Le Xu, said.

Though Woodmac analysts did not detail the reasons behind the dramatic forecasted drop in Australian investments over the next five years, the predictions presumably stem from the fact the high penetration of renewables, namely solar, in the country has pushed electricity prices down to new daytime lows and caused major congestion issues on the grid, delaying numerous large-scale projects. Australia’s Commonwealth-run renewable energy schemes are also winding down and are scheduled to be phased out by 2030.

Asia Pacific overview

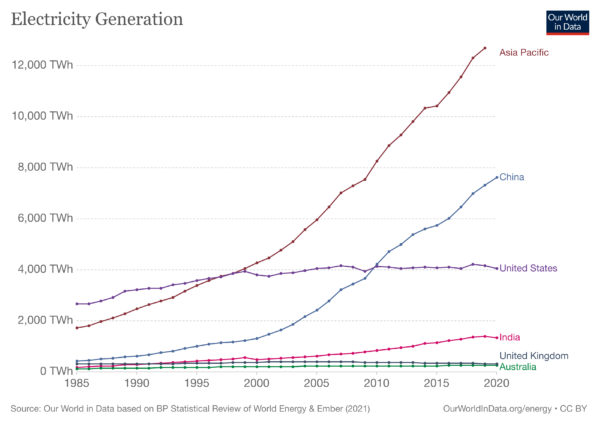

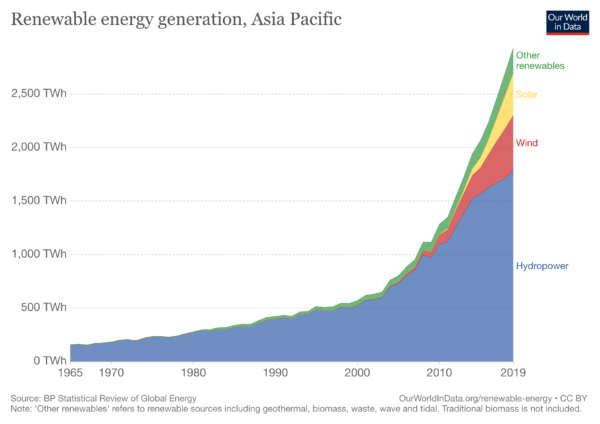

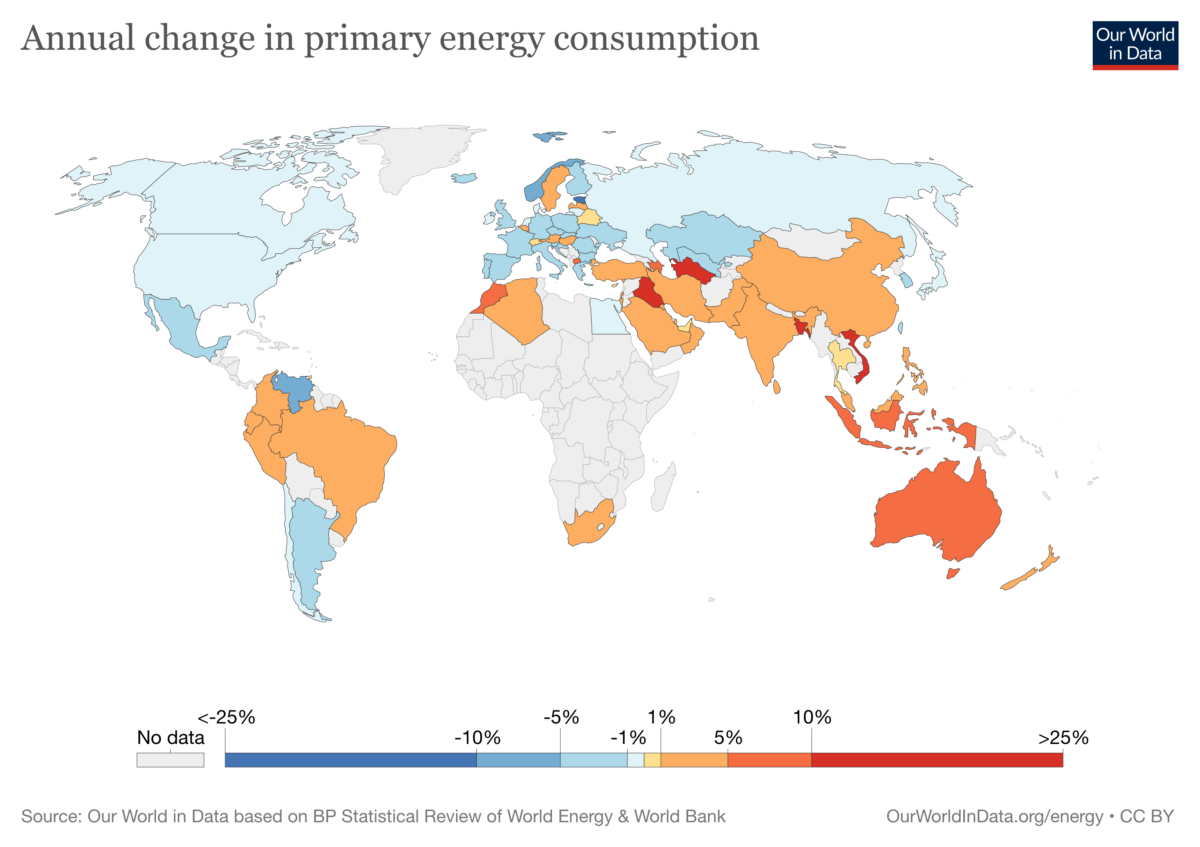

Unlike Australia, which already has a developed economy and renewables market, many of the other countries that populate the Asia Pacific region are still growing their economies. This coupled with population growth has seen the region labelled the future “engine room” of global power demand. The region is expected to account for nearly two-thirds of global power demand growth to 2050, according to previous Woodmac analysis.

“Asia Pacific power generation investments are leading the world and expected to hit US$2.4 trillion [AU$3.2 trillion] in the current decade, with renewables accounting for over half or US$1.3 trillion [AU$1.7 trillion] of power investments. We expect coal to make up 55% of fossil fuel investments until 2030 but shrink to 30% in the 2030s as gas dominates,” Woodmac’s research director Alex Whitworth said at the company’s Asia Pacific Power and Renewables Conference.

Nonetheless, as subsidies for renewable energy are rolled back across Asia, Woodmac forecasts in most of the region’s markets renewably generated power will not be able to compete with with coal power until 2025 or later.

Woodmac expects the top contributors to wind and solar investments in Asia Pacific will be mainland China, Japan, India, South Korea and Taiwan. “China’s 1,200 GW of wind and solar capacity target by 2030 will require more than 534 GW of renewables to be added over the next decade. This will boost annual wind capacity to over 40 GW from 2021 to 2030,” Woodmac’s Principal consultant Xiaoyang Li said.

In the decade to 2030, it foresees annual additional wind and solar capacities will average around 140 GW per year, accounting for two-thirds of average total power capacity additions in the region by 2030.

Southeast Asia

Composed of 11 different countries, southeast Asia includes Brunei, Cambodia, Timor-Leste, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam. Woodmac expects southeast Asia will collectively require around AU$18.6 billion a year of wind and solar investments to 2040, forming just under half of total power investments.

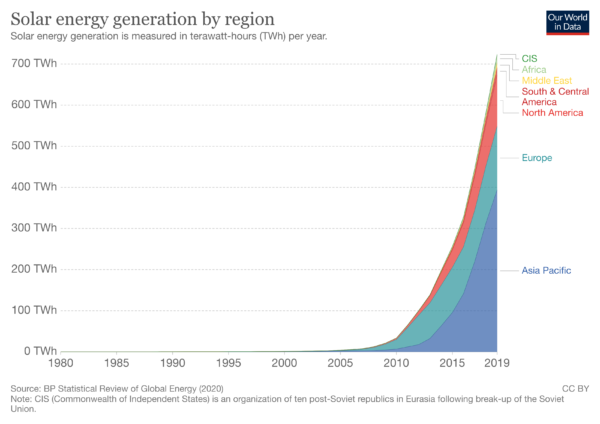

“Southeast Asia is one of the hottest solar market regions in the world, with installed capacity more than doubling every year since 2018. There will be a momentary slow down with subsidies pulled back, but the region will add over 100 GW of solar in the next ten years,” Senior analyst at Woodmac, Rishab Shrestha, said

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.