A new report from the Australian Energy Regulator (AER) shows the National Electricity Market (NEM) is undergoing a “profound transformation” with a record investment in rooftop solar driving the need for a significant package of reforms to ensure the market framework remains fit for purpose.

AER Chair Clare Savage said the latest State of the Energy Market report shows the NEM is transitioning from a centralised system of large coal and gas generation, towards a mixture of smaller scale, widely dispersed wind and solar generators, and battery storage.

The AER’s annual assessment of the market, released on Friday, reveals more than 3.7 GW of large-scale solar and wind generation capacity entered the NEM in 2020 and there was also record investment in rooftop solar, with almost 2.5 GW of new capacity installed across New South Wales, Queensland, South Australia, Victoria and Tasmania.

The new additions delivered record levels of wind and solar generation in 2020, accounting for more than 19% of total electricity generation across the five NEM jurisdictions.

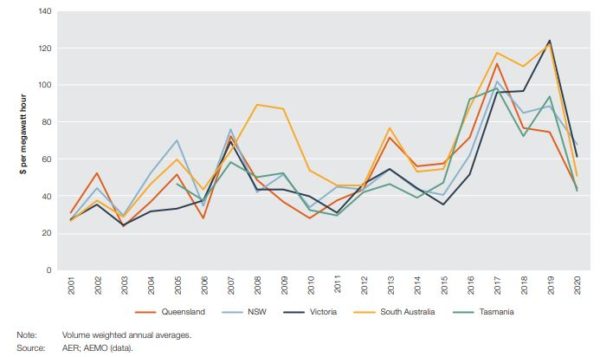

The growth in renewables also contributed to wholesale power price falls in Australia of up to 58% with average prices dropping below $70 MWh for the first time since 2015.

Image: AER

The influx of renewables is expected to continue with the report forecasting that over the next two decades up to 24 GW of new rooftop solar PV capacity will come online, along with up to 50 GW of new large-scale wind and solar capacity.

Energy storage is also expanding, through grid-scale and household batteries, and pumped hydro facilities while technologies including hydrogen and electric vehicles (EVs) are also set to impact on both supply and demand in the grid.

“Energy consumers are adopting their own behind-the-meter energy solutions, embracing distributed energy resources (DERs) that include rooftop solar PV installations, small batteries, electric vehicles and demand response,” Savage said.

The AER said the growth in renewable energy generation is also contributing to financial stress on fossil fuel generators, with the profitability of coal and gas plants challenged by low or negative prices in the middle of the day, when solar generation is at its maximum.

There was a record 3,662 instances of negative spot prices across the NEM in 2020 with minimum demand falling in every NEM jurisdiction, driven by the growth of rooftop solar.

“Almost 24% of all consumers in the NEM now partly meet their electricity needs through rooftop solar and sell excess electricity back into the grid, compared with less than 0.2% of consumers in 2007,” Savage said.

“These systems combined represent around 17% of the NEM’s total generation capacity with rooftop solar PV meeting 6.4% of the NEM’s total electricity requirements in 2020.”

The AER has forecast that the continued penetration of renewables will lead to the retirement of 16 GW of thermal generation, or 61% of the current coal fleet in the NEM within the next two decades.

Image: WA Energy Transformation Taskforce

Savage said the transition to renewables and the associated reduction in output from the fossil-fuel plants has however made the grid more susceptible to erratic frequency shifts and voltage instability.

Shortages of system strength have emerged in South Australia and Tasmania, and parts of Victoria and Queensland. South Australia also faces an inertia shortage, reinforcing the need for investment in on-demand types of generation and batteries to keep the system stable.

“We know that with the growth of renewable generation there needs to be investment in dispatchable resources to stabilise the grid, such as demand response, quick-starting flexible hydro or gas generation and battery storage technology,” Savage said.

Savage said the AER and other regulatory bodies would also have a critical role to play in maintaining system reliability, pointing to the Australian Energy Market Commission’s (AEMC) introduction of new frequency services to manage the rising incidence of frequency deviations.

The AEMC also announced a series of draft reforms in April designed to make transmission networks responsible for providing system strength services.

A further focus of recent reforms has been on planning and coordinating transmission and generation investment with renewable energy zones (REZs) identified as part of the Australian Energy Market Operator’s (AEMO) Integrated System Plan.

AEMO is also considering providing transmission authorities in the NEM with permission to restrict solar PV output as a way of mitigating the threat to the security of the NEM.

The powers, which are already in place in South Australia and were used for the first time in March, can instruct network operators in the state to back off rooftop solar generation, forcing them to draw power from the grid.

Alongside the coordinated reforms, governments are directly intervening in the market through various funding mechanisms for new generation or storage capacity – including the 300 MW / 450 MWh Victoria Big Battery storage facility near Geelong – to meet short-term reliability and security requirements and carbon emissions targets.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.