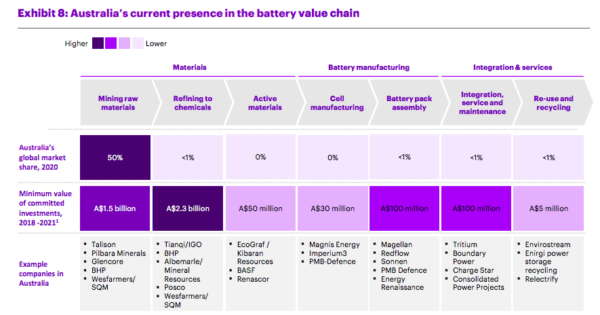

Australia currently supplies around half of the world’s lithium as well as a plethora of the other raw materials and precious metals needed to make batteries. This wealth of buried assets already contributes around $1.3 billion to our GDP, a figure set to grow massively as the world electrifies over the coming decade and demand for batteries booms. But far more wealth could be on the table if Australia can manage to start value adding and diversifying its battery industries onshore, according to the report Future Charge: Building Australia’s Battery Industries, commissioned by Future Battery Industries Cooperative Research Centre.

Western Australian company Australian Vanadium Limited (ASX: AVL) is bringing some of these propositions into reality, with endeavours ranging from classic mining to battery design to diversification into ethical cobalt supplies. The company’s managing director Vincent Algar told pv magazine Australia the company is seeking through its diversification to have “all the bases covered” for both greening the grid and the vehicle fleet.

The imminent battery boom: from lithium-ion to redox flows

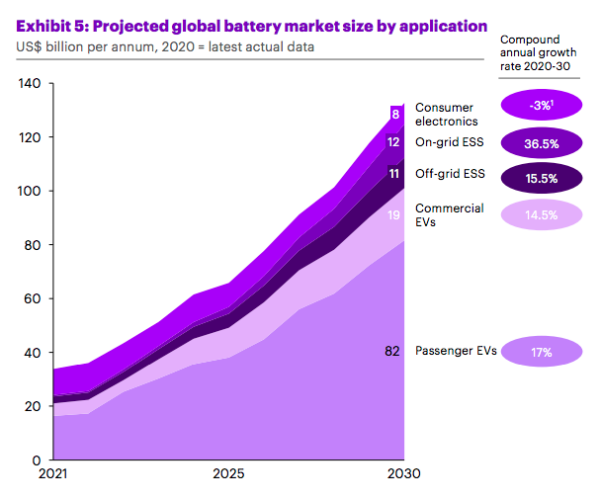

While the Future Battery Industries’ report focuses heavily on lithium-ion, the battery chemistry at the heart of electric vehicles, Australian Vanadium is focussing on the flow battery market. Despite flow batteries technology being well established, it is no where near as prevalent as the lithium-ion makeup used by giants like Tesla.

Interest in flow batteries is steadily growing however, with a recent market study published by Global Industry Analysts projecting the global market for flow batteries to grow from US$290.5 million in 2020 to US$961.9 million by 2026, with an impressive compound annual growth rate of 22.7% over the analysis period.

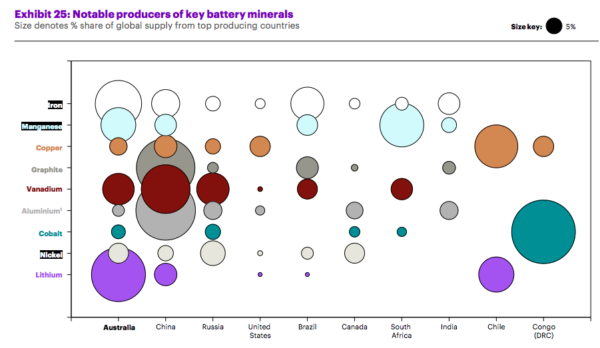

Australia is home to considerable vanadium deposits – which Australian Vanadium Limited (AVL) hopes to use. In fact, Algar says the deposits in Western Australia can “easily dominate the battery supply chain for vanadium inside and outside Australia.”

AVL is currently establishing its vanadium mine in Gabanintha, which is almost smack bang in the middle of Western Australia. The Australian Vanadium Project, as its called, has been awarded Major Project Status by the federal government. Its vision, however, is bigger than simply digging up the raw materials and shipping them overseas.

“AVL is planning to construct a vanadium electrolyte manufacturing facility in WA, adding future downstream value to the vanadium when it’s extracted and providing a revenue stream for the company in the meantime,” Algar told pv magazine Australia.

AVL also recently identified a Cobalt-Nickel-Copper sulphide component in is project. “Our work with Bryah Resources (ASX:BYH), of which AVL holds 5%, has helped quantify the resource and prove recovery via normal sulphide floatation,” Algar added.

“AVL’s vanadium products will be extracted close to Geraldton from the concentrate we will produce on site at Meekatharra. The vanadium products will be used in steel markets and battery markets, specifically as the feedstock for electrolyte in vanadium redox flow batteries,” he added.

Vsun – AVL’s flow battery demand activator

In 2016, Australian Vanadium set up subsidiary VSun to drive market demand for vanadium redox flow batteries (VRFBs). “VRFBs’ target market is long-duration off and on-grid energy storage batteries capturing large scale renewable energy and diesel replacement,” Algar explained. “These are stationary storage batteries suited to the long life and durability.”

In January, VSun announced its plans to develop a vanadium redox flow battery for the Australian residential market, with the company previously working on a number of other off-grid and commercial projects. While the company remains primarily devoted to flow batteries, it is also seizing on opportunities to expand into new corners of the industry.

VSun

“The energy transition is also hinged upon changing over the vehicle fleet to high power batteries such as the current suite of Li-ion chemistries. Included in those chemical makeups (for example NMC – nickel, manganese, cobalt) are lithium, nickel, cobalt and manganese.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.