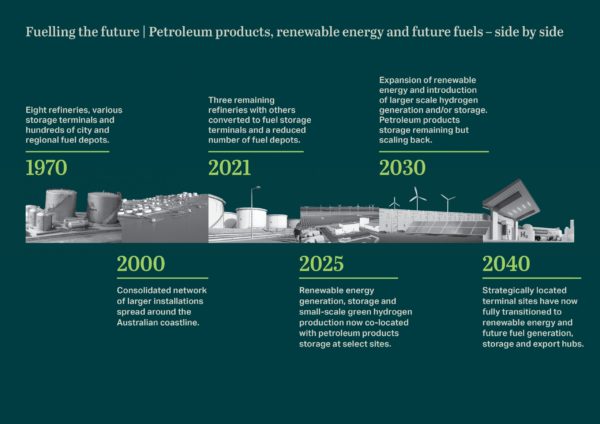

As reliance on petroleum-based products contracts, space previously used to produce and store the fossil fuel will inevitably free up. At least that’s the thinking which led infrastructure developer AECOM to run analysis on sites it believes are particularly promising for renewable development, especially given they already have community acceptance for industry and are often well connected to vital infrastructure.

The company looked at all 58 petroleum fuel refineries and storage & import terminals in Australia and New Zealand and found many with significant potential, including seven ‘unicorn sites’ which it says are uniquely flexible and therefore especially valuable.

“It’s about bringing to attention the broader set of assets that exist within the petroleum industry,” Craig Bearsley, Director of Energy at AECOM Australia and New Zealand, told pv magazine Australia.

“There’s been a lot of talk about repurposing of our refineries, but that’s only four of the 58 sites… so actually if you look at the fuel import & storage terminals, they have often similar properties to those larger refinery sites and have value.”

“It makes a lot of sense for these sites to be repurposed to entirely renewable fuels or other renewable based businesses,” he added.

Since AECOM has worked with many of these sites’ owners, it had access to much of the necessary data already, including information which formed the metrics of desirability like infrastructure connections and location. “This is something we’ve been doing on a site-by-site basis for clients for many years, but we’d never stepped back and said ‘let’s look at all the sites and just run it through our spreadsheets,’” Bearsley said.

AECOM considered at ten different strategic attributes for each of the 58 sites, including:

- Land availability – for instance, undeveloped land adjacent or near to the sites which could be used for solar generation or to house a future energy hub facility.

- Renewable resources – whether the sites have good solar irradiance or wind resources.

- Electricity transmission infrastructure – given the industrial nature of the facilities, AECOM found 72% of the sites were well connected.

- Gas infrastructure – such infrastructure proves helpful in initially integrating hydrogen through natural gas blending, though Bearsley noted AECOM’s focus was primarily on co-location of industries rather than the actual sharing of infrastructure.

- Water availability – which is especially useful for green hydrogen production which requires water inputs.

- Proximity to major population centres – sites located near populated areas were considered more attractive by AECOM as they offer a consumer market for products and are also where the benefits of energy storage are most effective.

- Proximity to industrial customers – industries already using or likely to need hydrogen in the future like fertiliser or steel making were a clear plus, though industry generally tends to have high demand for electricity, heat, and potentially hydrogen, again increasing site attractiveness.

- Sensitive receptors – in this instance, Bearsley said AECOM was primarily referring to residential properties. Nearby houses, he said, can be an issue for new high impact facilities like, for instance, a waste to energy plant, which would produce noise, emissions and have visual impacts. Sites with residential properties nearby may be better suited for low impact technologies like batteries.

- Legacy contamination – sites previously used for industry often have contamination issues, which makes them better suited for remaining as industry, saving money on rehabilitation.

- Proximity to renewable energy markets – AECOM deemed fuel storage terminals located at ports in North Queensland, the Northern Territory and Northern Western Australia especially attractive due to an abundance of renewable energy resources and proximity to the key hydrogen markets in Singapore, Korea, China and Japan.

While Bearsley said AECOM was considering all types of green energy industries, including big batteries and the creation of clean energy hubs, hydrogen is perhaps the most natural fit given it’s also liquid fuel and in that property shares some of the same requirements of petroleum.

“In the initial years, hydrogen is going to be a marginal business and every little advantage a site can get over another will be important,” he said. “By looking at all these different factors, you can start to determine the suitability of each site or its best end use. There were some sites that were really suited to a wide range of end uses and those were our so-called unicorn sites.”

AECOM found seven of these ‘unicorn sites’, but is keeping that list tightly under wraps. “Of course, we work with many of the clients who own those assets and are wanting to support them in transitioning those assets in the future or bringing in other investors or organisations that may be able to utilise those assets,” Bearsley said.

While just seven of the sites were considered ‘unicorns’, Bearsley noted many of the 58 sites were found to be highly useful and valuable even if they aren’t quite as flexible.

Despite that, Bearsley didn’t know of a single project being developed in any of the fuel import & storage terminals. “That’s why this is a thought leadership piece,” he said. “It’s really trying to get people looking further ahead to the next steps that we may need to take in transitioning the sector and the opportunities that exist.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.