From pv magazine 06/2021

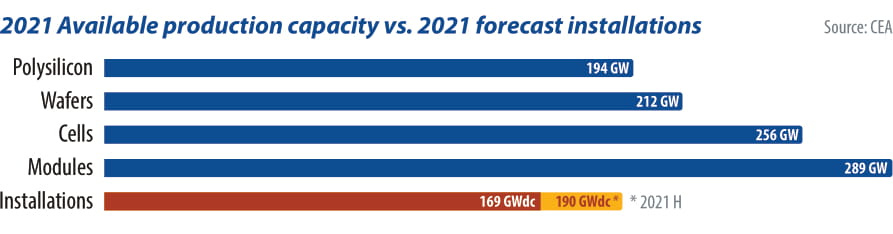

Module capacities vastly exceed the upstream stages of production and current annual demand, since module factories can be brought online faster, and with lower capex requirements, than cell, wafer, ingot, or polysilicon facilities. Major factories from Tier 1 players were completed and ramped to full production at the end of 2020, in anticipation of a 2021 recovery in solar demand. The chart below depicts CEA’s estimates for potential production which can take place in 2021 based on available and online manufacturing capacities at each stage of production, without considering input restrictions.

Module capacities exceed all other stages, and even if all polysilicon capacity is fully utilised, there is almost 90 GW, or 35% more, module production than polysilicon production once thin-film technologies are removed from module production outlooks. On the demand side there are similar conditions where module supply exceeds even optimistic estimates for 2021 installations by nearly 100 GW.

Due to the mismatch between module production capacity and both upstream limitations and downstream demand expectations, some module production must go unused, and module expansions continue to overshoot the rest of the industry. With lacking demand, some suppliers are likely to slow production, idle some lines, and delay some new expansions to keep fleets online until the rest of the industry can catch up to the module production segment.

Technological change

When the M6 (166 mm) wafer was first launched in late 2018, it was expected to reign as the market standard for some time. However, things quickly changed after Zhonghuan launched its G12 (210 mm) wafer in late 2019, which was followed by the launch of the M10 (182 mm) wafer. The M6 wafer now stands at risk of being phased out by as early as 2022 or 2023 and is very likely to only remain as a ‘transitionary’ wafer size. Manufacturers have been very quick in forming alliances based on their preferred choice of wafer size and launched the mass production of these larger wafer products. Most mainstream manufacturers have announced grand plans for 2021, with several of them even announcing 20+ GW of new module capacity for these larger wafer products.

CEA introduced a new “maturity score” metric in the company’s PV Supplier Market Intelligence Program, which can be used to compare suppliers based on the Manufacturing Readiness Level (R&D phase), Capacity Scale (ramping up phase) and Track Record (shipment scale) of different technologies, with scores ranging from one to 10 for each of these three stages, for each technology area. The rapid adoption of these new wafer sizes can be seen in the chart above right, which visualises the change in maturity scores of suppliers for these wafer sizes between late 2019 and 2020.

The rapid uptake of larger wafers and new module formats has had a significant impact on auxiliary component supply chains like those of glass, encapsulants, and backsheet. While polymer supply chains eventually managed to catch up, prices are still in a stabilisation period. Considering these, the alliances came up with a standardised set of module layouts for both the utility and residential markets. Additionally, manufacturers are adopting interconnection technologies like paving or shingling for higher module efficiencies and optimised material use.

All these module level changes were motivated by the desire to offer the lowest levelised cost of electricity (LCOE) for the end user. After mainly focusing on innovations at the module level, manufacturers are now expected to shift their focus back toward improvements in cell efficiencies and technologies, such as n-type.

New fabs

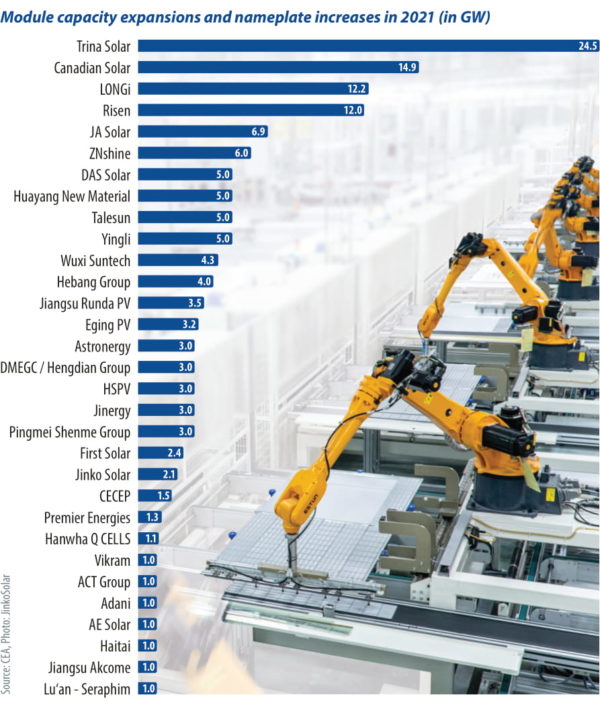

Five suppliers combined – Longi, JinkoSolar, Canadian Solar, Risen, and Talesun – added more than 28 GW of new module capacity between Q4 2020 and Q1 2021. In line with broader industry growth trends, many other suppliers also announced nameplate capacity increases in 2020 which are scheduled to come online this year. Currently, CEA is tracking just over 150 GW of nameplate capacity expansion announcements for module factories which are expected to be completed by the end of 2021. Of the 150 GW of new expansions, Trina Solar, Canadian Solar, Longi, Risen, and JA Solar constitute nearly half of new module production, with other major players like JinkoSolar spending 2021 ramping new cell facilities following rapid module expansions completed in 2020.

While large suppliers with sizeable expansions are foregoing updates to facility nameplate figures, we expect even more production capacity to be available once module equipment fully utilizes larger M10 or G12 cell inputs. Almost all new module factories are expected to be capable of producing up to a G12 format product, and any factory limited to a M10 product is likely to be easily upgradable if a clear wafer size preference develops in the market. Most factories finishing construction in 2020 were also designed with new format products in mind, and availability for large format products in most markets is anticipated to surpass all market demand by the end of the year.

Major suppliers maintain expansion plans, but with module capacity gluts developing, there are doubts that all supplier expansions plans will materialise on time and at a scale matching initial factory announcements. For the largest suppliers in the industry, significant over capacity and low utilisation can be maintained in the short term if financing costs are low and if profit margins in other segments of the suppliers’ fleets can support idle lines. For these suppliers, construction on new, multi-gigawatt facilities in China is currently underway and unlikely to deviate from initial plans. However, as high module costs are expected to persist throughout 2021, current conditions are certainly challenging for emerging suppliers that had hoped to run new factories at full capacity.

Quality concerns

Reliability concerns have been prevalent ever since the industry started moving away from mainstream technology such as modules with full cells from G1 (158.75 mm) wafers, five busbars, and cell interconnection with a 2 mm gap.

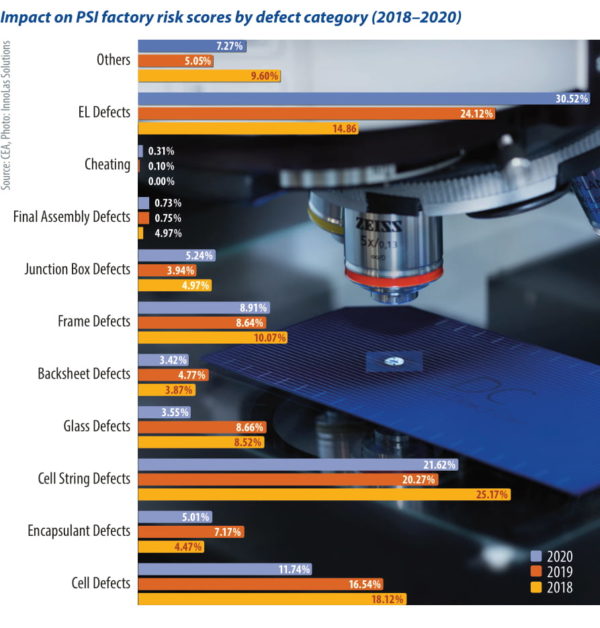

Pre-shipment inspection quality metrics from CEA’s Supplier Benchmarking Program, shows a clear rise in quality issues and associated risk scores for inspected modules from 2018 to 2020. As seen in the chart below left, the impact of the EL defect category (primarily micro cracks and poor soldering) on the factory risk scores has almost doubled between 2018 and 2020. During the same period, the industry went through a transition towards larger wafers, half-cut cells, multi busbar technology and reduced inter-cell spacing. These advancements largely led to, among other issues, tabber-stringer malfunctions and subsequently much higher EL defect rates, exacerbated by the mass ramping up of gigawatts of new production lines, which typically take months to stabilise.

The new wafer sizes and larger module dimensions can make the module more susceptible to mechanical stresses, especially in high wind or snow regions. Among the dense interconnection technologies that are used in the latest modules, tiling has already had several long-term reliability concerns in the form of excessive stresses and microcracks which discouraged many manufacturers from adopting this technology. Paving, on the other hand, can also have reliability concerns unless damage free laser cell cutting and thicker encapsulants are used.

The rapid introduction and adoption of new technologies along with aggressive ramping of capacity, as in the case of the larger format modules can certainly cause several reliability concerns along the way. This concern is even more severe in the case of suppliers with less of a track record, since they might have to go through steep learning experiences accompanied with process instabilities, high defect rates and low production yields.

Due diligence

Of course, all these new PV module products must be certified according to IEC standards before being produced. However, it is generally accepted that IEC testing standards are following a “minimum bar” approach and are not considered adequate to evaluate the performance and reliability of PV modules for 25 years or more in the field.

Extended Reliability Testing (ERT), which goes beyond the IEC requirements, is generally accepted to be a suitable approach to a more rigorous evaluation. There are several ERT protocols that are being used globally to test modules, such as PVEL PQP, RETC PQP, TÜV Sud Thresher, and CSA C450, etc., and the newly published IEC TS 63209-1 standard is attempting to unify these.

ERT takes six to eight months to complete, and it must cover all bill of material (BOM) variants that a supplier uses. So, by design, this requires careful planning and investment from suppliers. The current challenge is that the proliferation of product variants, and the need to use alternative BOMs because of raw material bottlenecks, creates situations where procurement decisions need to be made before ERT is completed for all candidate products and BOMs.

Additionally, production lines must overcome lengthy ramp up periods, where process instabilities, for example at the tabber stringer station or during lamination, can result in excessive quantities of inferior product being produced and shipped to buyers, unless a robust quality assurance program is applied both before and during production, and before products are shipped.

Buyers are therefore advised to be more proactive in performing due diligence when it comes to new product procurement decisions. Although all these new technologies are great for reducing LCOE, such claims for LCOE improvement are only valid when products are reliable and last for their designated lifetimes, producing the expected energy yields.

George Touloupas, Joseph C. Johnson and Aditya Vardhan

George Touloupas is the director of technology and quality for solar and storage at Clean Energy Associates. He leads projects centreed on developing CEA’s internal quality standards, researching new production technologies, and developing new services. He has an extensive background in PV manufacturing, as well as downstream experience. Prior to joining CEA, he worked as the chief operating and technical officer at Philadelphia Solar in Jordan and technical and operations director at Recom.

Joseph Johnson is a lead analyst for solar and storage at Clean Energy Associates, a company that focuses on solar PV quality assurance, supply chain management, and engineering services. At CEA, he explores market trends, supplier quality, and trade policy as part of CEA’s technology and quality department.

Aditya Vardhan has been working as a junior PV engineer at Clean Energy Associates LLC for more than 12 months. While based in India, he works with colleagues in China, Europe and the United States to provide technical expertise and market intelligence. His primary focus areas is identifying and analyzing technological trends across the PV value chain, along with maintaining client-facing market intelligence products.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.