bp Australia has concluded its $4.42 million “Renewable Hydrogen and Ammonia Feasibility Study” (the Study), supported by the Australian Renewable Energy Agency (ARENA), Lightsource bp and GHD Advisory, confirming that “production of green hydrogen and ammonia using renewable energy is technically feasible at scale in Australia”, and identified Western Australia (WA) as the ideal position for this production.

The technical feasibility of export-scale green hydrogen and ammonia production in Western Australia is due to WA’s “vast potential solar and wind resources, existing infrastructure and proximity to large, long-term markets.”

However, the Study, which evaluated the techno-economic potential of pilot and commercial-scale green production plants as part of Project GERI (Geraldton Export-Scale Renewable Investment) in Geraldton, WA, also found that significant infrastructural investment in ports, water and electricity networks and distribution would be necessary for the development of a green hydrogen export industry.

What is more, the markets of hydrogen and ammonia need development themselves, particularly general hydrogen fuel use as it still requires significant scale before it can be commercially viable. Ammonia, of course, is already traded globally at scale.

Lightsource bp completed modelling based on both the pilot scale (4,000 tonnes of hydrogen making up to 20,000 tonnes of ammonia), and commercial scale (200,000 tonnes of hydrogen making up to 1 million tonnes of ammonia), generated by a mix of solar and wind with “some battery support”.

For perspective, the pilot scale supposed a load requirement of 35.4 MW of renewable energy provided by a power purchase agreement (PPA). And the commercial scale plant supposed load requirements of 1370 MW through wind and solar capacity of 2000 MW each, “resulting in 77% electrolyser capacity utilisation. This would mean the plant would be ‘turned down’ reasonably regularly.”

Frédéric Baudry, president, bp Australia and SVP fuels & low carbon solutions, Asia Pacific, said in a statement that “this study confirms the potential for scaled-up green hydrogen in Western Australia. This looks particularly promising in the mid-west of WA, which has existing infrastructure, access to land and abundant renewable energy resources such as wind and solar.”

“Importantly,” continued Baudry, “our study also confirmed strong demand from potential customers in the hard-to-abate sectors, and for both local and export markets. This has the potential to position Australia as a regional powerhouse of the energy transition.”

bp has a role to play

Unlike Australia itself, bp has committed itself to becoming a net zero company by 2050 or sooner. And the company now views Project GERI as a key pathway to that goal with the help of its joint venture Lightsource bp, which would supply the requisite renewable energy. bp plans to develop around 50 GW of renewable energy in order to capture a 10% market share in the core hydrogen markets.

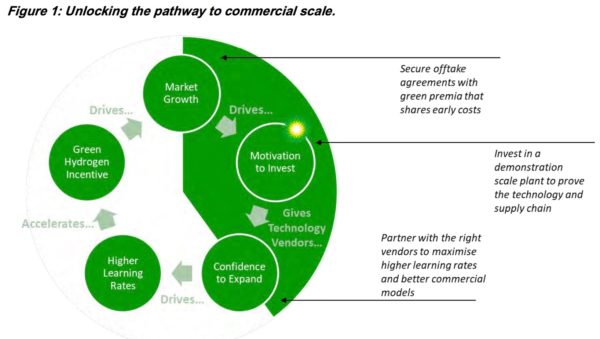

However, the Study stresses that “a thriving Australian hydrogen industry is not guaranteed.” Noting that “industry development depends on the level of government support, policy endorsement and infrastructure development.”

Of course, while the federal government’s energy agnosticism when it comes to developing the hydrogen industry is controversial, it should also be stated that bp is a company which has profited off the fossil fuels that cause global warming. bp should, therefore, be paying for the development of green hydrogen. The government’s role is to make development easy for bp, not to cover the costs of developing an industry that bp will also go on to profit from.

Nevertheless, it can’t be said bp is shying away from the costs of this transition. Indeed, the Study declares: “The absence of a carbon price or emissions cap is a key barrier to attracting investment in renewable technologies such as hydrogen.”

All about that money

ARENA CEO Darren Miller said bp’s analysis “of the economic opportunity presented by renewable hydrogen will help Australia determine how it can be scaled-up to satisfy future demand. The report represents a vital building block in our pathway to creating a fully integrated renewable hydrogen supply chain, allowing Australia to become leaders in a future export industry.”

Jason Fonti, origination and value chain leader at GDH Advisory, pointed out that “the magic figure is producing hydrogen below $2 per kilo and the pathway to get there is becoming clearer. The study has highlighted that, through innovation, talent, commitment and collaboration, Western Australia can become one of the major exporters of hydrogen in the global market.”

WA all the way

The study identified WA’s Mid-West Region as having the real global advantage in potential for green hydrogen production, but didn’t ignore the Pilbara, where the 26 GW Asian Renewable Energy Hub (AREH) is slated for construction (pending further environmental review), nor the Goldfields-Esperance region, where the AREH’s proponents recently proposed a 50 GW Western Green Energy Hub.

The Study concluded that “a finite window of opportunity is open to fully develop a hydrogen and ammonia industry in Australia…investment over the next three to five years and supportive government policy will be pivotal to achieve industry momentum…Progress will need strong corporate and government resolve and action, but the potential payoffs are momentous.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.