“This business has been focused on energy storage since the day it was conceived some six years ago,” said Simon Kidston, Executive Director of Genex Power at an investor webinar held this morning to deep dive the company’s Large-Scale Battery Strategy. The business case for energy storage has grown significantly over that time.

Genex recently diversified its development of energy storage, from the original slow-burn 250 MW/2000 MWh Kidston Pumped Hydro Project — under development as part of the Kidston Clean Energy Hub on the site of the disused Kidston Gold Mine in Far North Queensland — to include the Bouldercombe Battery Project (BBP)

A two-hour-duration (50 MW/100 MWh) installation of 40 Tesla Megapacks, BBP will be built on land leased from transmission provider Powerlink beside its Bouldercombe substation, 20 kilometres south of Rockhampton.

Kidston said today the deployment of capital ($55-60 million in total CapEx costs including financing costs, owner’s costs and contingency funding) into Bouldercombe diversifies the company portfolio by both geography and technology, and anticipates a growing need for energy storage to balance the intermittency of renewable solar and wind generation, and “make it firm and reliable for consumers as and when they require the energy”.

Capitalising on the rising revenue cream

Genex Chief Executive Officer, James Harding, and Chief Financial Officer, Craig Francis, elaborated on the business case for the company becoming Queensland’s first mover in the standalone big-battery energy-storage space, capitalising on all that the technology can provide in the current energy landscape and in response to emerging market opportunities.

Where Kidston Pumped Hydro negotiated a long-term, stable agreement under which Energy Australia will operate the asset for a period of 30 years, thus enabling it to secure favourable finance in large part from the Northern Australia Infrastructure Facility (NAIF); Bouldercombe will offer shareholders some of the “cream” now emerging in the market.

Arbitrage is one strong source of revenue: storing energy when demand and prices fall in the middle of the day — in Queensland they’re typically negative due to high rooftop and large-scale solar output — for sale in the evening when demand is at its peak and electricity is commanding higher prices.

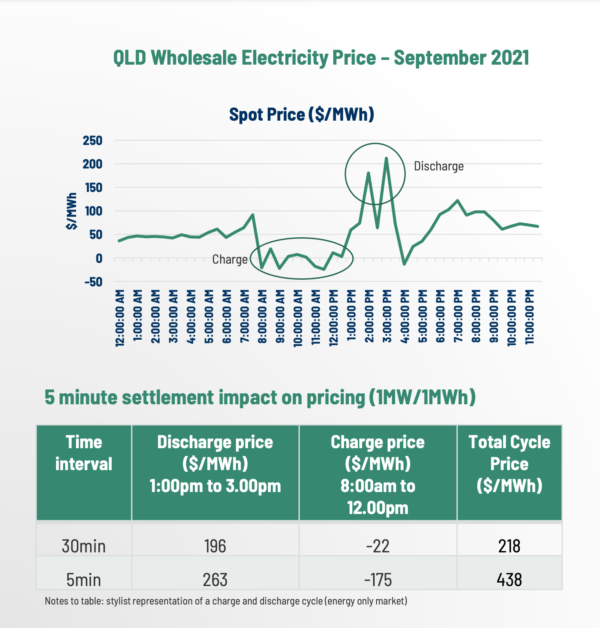

The five-minute-settlement factor

Just over a week since five-minute settlement (5MS) was introduced to Australia’s National Electricity Market (NEM), replacing the previous averaging of prices over 30 minutes, Harding says Genex has observed greater variation — spikes and troughs — in electricity pricing, which bodes well for battery-storage revenue

The 5MS market reform was intended to encourage fast-response technologies such as batteries by providing a greater price incentive for their services, and Bouldercombe is positioned to take advantage of the change.

Its Megapack battery system, enabled with Tesla’s Autobidder software, will be able to automatically dispatch within milliseconds of receiving and calculating the benefits of responding to a price signal.

As Harding pointed out, Kidston Pumped Hydro will also be able to ramp up to full generation within 30 seconds, whereas gas-fired technologies lag by minutes.

Image: Genex Power

Frequency control soothes grid hertz

Frequency Control Ancillary Services (FCAS), he says, are also increasingly in demand in a grid where around 25% of electricity is now typically supplied by renewables and that percentage must grow as more renewables replace retiring coal plants.

“As renewable penetration increases and as other events occur on the network, the balance of frequency which is set at 50 hertz is disturbed,” says Harding. Where demand suddenly exceeds supply, say, when a coal-fired powered generator trips; or when supply exceeds demand, in the case of a load suddenly going offline, a battery can very quickly inject energy or withdraw energy from the network in order to bring that frequency back into balance.

Coal-fired power plants have traditionally been the frequency stabiliser, but they will increasingly be the cause of imbalance, and in a grid supplied more and eventually only by renewables, more battery capacity will be required to provide a variety of services.

By 2040, Genex calculates 123 GWh of battery capacity will be needed to balance planned growth of renewables into the energy deficit left by retiring coal plants. AEMO figures indicate that 330 MWh of large-scale battery capacity, concentrated in Victoria and South Australia, are currently available to the system.

As coal exits the system…

Major outages are set to become more “unpredictable” says Genex CFO Craig Francis.

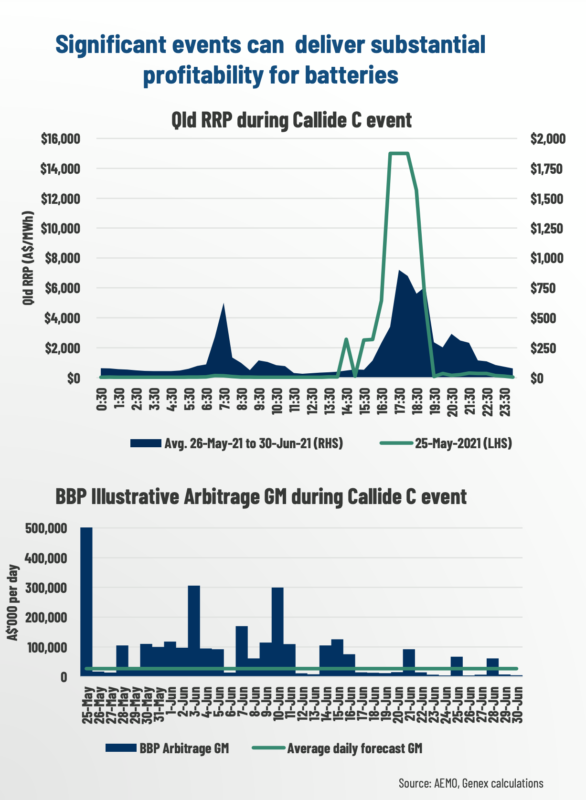

Beyond the day-to-day business case for Bouldercombe, Genex has calculated the services it could have offered to the grid during the recent outages and extended unreliability of the grid caused by this year’s fire at Queensland’s Callide C coal-fired power plant.

The cascading effects on the Queensland network of the May 25 fire were that it tripped Callide’s other two units, and disrupted transmission not only in the region, but to the north and south, thereby also interrupting the generation capacity of surrounding power stations. A resulting 3 GW shortfall in power supply caused blackouts all over the state.

For a period of two hours, the spot price of electricity rose to $15,000/ MWh. Had Bouldercombe been operating that day, says Francis, “it would have made $700,000 or 7% of our projected revenue, in a 24-hour period”.

The rest of the month continued to see volatile prices as the market adjusted to the loss of Callide’s generation, with peak evening prices averaging around $6,000/MWh.

“We’ve done an illustrative analysis of what Bouldercombe would have delivered over that period, had it been operating just on the arbitrage side of things — ignoring FCAS,” says Francis.

Genex calculates BBP would have earned $3.2 million in net revenues: $700,000 on the 25th of May and a further $2.5 million for the following month.

“If we’re talking about a $10 million average [annual income] forecast, [that’s] some 255% of what we’re forecasting,” said Francis, who emphasises that such events are not included in the base business case for the battery.

“This is outside system normal — just cream, really” he says. It’s “the upside that we see in this project and what we really want to capture in the commercial model”.

Image: Genex Power

Batteries are flexible: fast to build and a blank canvas for software smarts

Tesla Senior Manager of Project Sales and Business for the APAC region, Maria Cahir also spoke to the Genex audience, about the flexibility of battery technology to be adapted with firmware/software updates that take advantage of emerging market opportunities, such as mimicking inertia.

She said, that as the big spinning turbines of coal and gas generation exit the market, the need for other sources of inertia in the grid is currently reviving the fortunes of old tech such as synchronous condensers, but “Tesla has developed a platform called Virtual Machine mode… a firmware layer that enables batteries to mimic the physics of rotating synchronous machines” and step in with sub-second response to correct frequency or voltage imbalances in the grid.

The firmware is currently being tested for effectiveness using a fraction of the Hornsdale Power Reserve capacity, and Cahir says, “AEMO has been very happy with the data that we’ve generated to date.”

Calculations indicate that “Hornsdale, at 150 megawatts, could provide about 50% of the inertia that’s needed for the entire state of South Australia”.

Bouldercombe will take advantage of such “over-the-air” Tesla software updates as the need arises.

Image: Genex Power

Genex sees more batteries in its future

Genex announced at the meeting today that one or two further large-scale batteries for Queensland and New South Wales are part of the company’s Large-Scale Battery Strategy to achieve 2,500 MWh of storage by 2025.

It says it wants to maximise its learnings and relationships with the Queensland Government, federal agencies such as ARENA, Powerlink and Tesla, to further Australia’s decarbonisation, while delivering returns for its shareholders.

Positioned on the backbone of the Queensland grid, in a state that has the potential to be islanded by occasional failures of NSW-Queensland interconnectors, and which has high solar penetration causing “spiky” electricity prices on any day, Bouldercombe has a strong business case.

In fact, says Francis, it is “the first commercially delivered, large-scale battery project in NEM; all the others have long-term government contract support or are receiving subsidies from ARENA.

“I think that’s a really, really big step for the development of battery technology in the NEM itself as we move to support this transition to greater renewable energy.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.