Some day, the 24th October may become known as Demand Response Day, or the day when it became possible to sell demand response directly into the electricity market, to help balance supply and demand at critical times.

It’s momentous: having a genuinely two-sided wholesale electricity market in Australia, in which energy users can benefit from being flexible in the times they choose to use or not use electricity in a way that serves the grid when demand is high, and also promotes efficiency in the amount of grid-balancing assets Australia needs to build to complement a burgeoning renewable energy supply.

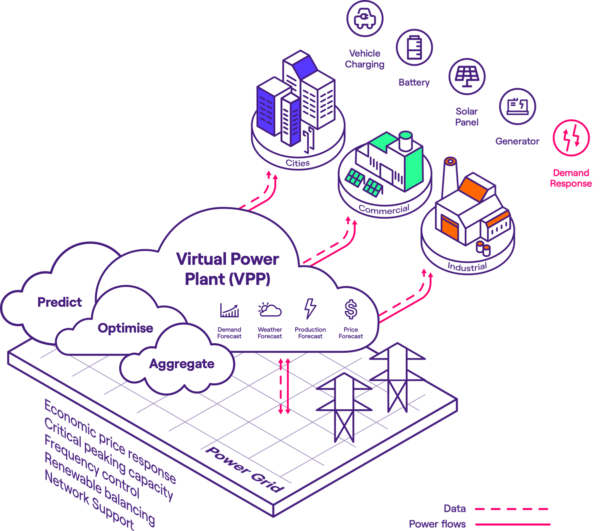

In an announcement this morning, Enel X declared itself the first registered demand response provider to the new market. As the operator of Australia’s largest virtual power plant (VPP), boasting more than 350 MW of available capacity (available at various times) from commercial and industrial (C&I) energy users, Enel X has already successfully offered C&I-based frequency control ancillary services (FCAS) to AEMO since 2017.

But Jeff Renaud, Head of Enel X Asia and Oceania, said, “Today marks a huge milestone for the wholesale market, and an opportunity for businesses to earn a significant new revenue stream while supporting Australia’s most affordable path to decarbonisation.”

Renaud told pv magazine Australia that businesses and sites such as commercial buildings, supermarkets, water utilities hospitals, agricultural sites, manufacturers and data centres can be paid in the range of around $10,000 to more than a million dollars a year — depending on the energy capacity they can be flexible with — to switch off their electricity loads at times when demand on the grid is greatest.

“The nice thing, and a critical element of the demand-response mechanism and other forms of two-sided market participation, like frequency control,” says Renaud, “is that businesses can do this outside of their retail power supply contract. They can use any retailer they like, and can then separately participate in the Demand Response Market (DRM) and get paid for doing it.”

Enel X

The setup

The Australian Energy Market Commission (AEMC) first received a rule change request on 31 August 2018 — from the Public Interest Advocacy Centre, the Total Environment Centre and The Australia Institute — to introduce a mechanism for wholesale demand response.

It was one of three separate rule change requests the AEMC received that year relating to the proposed new mechanism. After industry and public consultation processes, the Commission made a final determination in June 2020 that the wholesale demand response mechanism (WDRM) would come into force on 24 October, 2021, allowing a new category of registered participant, “a demand response service provider (DRSP) to bid demand response directly into the wholesale market as a substitute for generation”, says the AEMC website.

Although the determination officially came into force yesterday, the market actually started trading today.

The Australian Energy Market Operator estimates that by 2040 Australia will need up to 19 GW of new dispatchable resources to balance renewable power and replace retiring coal-fired power stations; the WDRM is designed to stimulate participation by large electricity users, and by investors in energy storage.

Enel X, the innovations spinoff of Italian energy utility Enel, asserts that “Each megawatt of demand response in the WDRM will lessen the need for investment into other more expensive resources.”

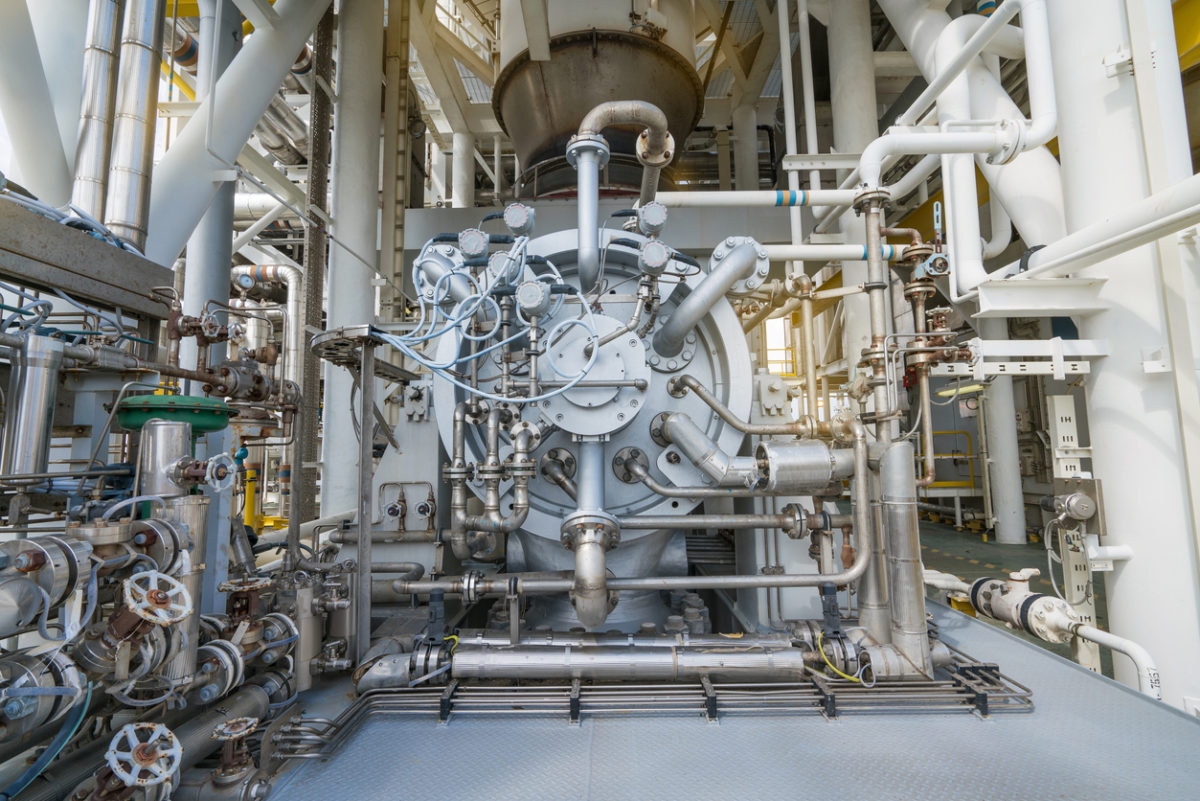

Enel X has been talking to C&I energy users since it entered the Australian market in 2011, forming its VPP from their existing assets — boilers, heat pumps, cooling systems, compressors, manufacturing lines and so on.

“We’re using lots of industrial equipment that already exists, for secondary purposes,” says Renaud. Linking such a distributed set of energy resources is not easy, he says, but the Enel X VPP platform has been constantly evolving over the past 10 years, and he’s proud of the sophisticated dual-asset use that it enables — ”It’s inherently very economically efficient.”

The difference in today’s demand response markets

From the participant’s point of view, the FCAS market and the demand response market differ in two main ways: reaction time and the duration of downtime required.

The Enel X VPP automates FCAS such that participating C&I assets can respond in less than one second to a frequency wobble in the grid, and may only remain offline for 10 to 15 minutes (which may suit cold-storage facilities that won’t lose their cool during that time, or data centres that can quickly switch to auxiliary systems, such as battery power, without mishap).

Participating in DRM allows more like a five-minute response time and up to a 15-minute response time. The Enel X VPP platform notifies those who have signed up and waits to get the go-ahead to take a nominated load offline for one to two hours when the grid risks being overloaded by demand and prices are high — typically in the evening hours of summer (the first and fourth quarters of the year).

“A customer that can respond in five minutes can earn more value than the customer that can respond in 10 or 15 minutes, but each can participate,” says Renaud. “We explain the economic spectrum of participation and then work with the customer to explore the options and approach that they’re comfortable with, that works with their IT systems and their operational policies.”

All-round benefits

AEMO recently noted that the market for FCAS related demand response has greatly encouraged the growth in available resources bidding into the market; Enel X itself registered some 150 MW of new resources over a period of 12 months, bringing its total participating fleet of customer assets to 250 MW.

AEMO’s Quarterly Energy Dynamics report for Q1 of 2021 referred to the positive impact this has had on market outcomes, including that it contributed to a reduction in the cost of electricity to consumers.

Enel X says it intends to work with its business customers to replicate its FCAS success in the WDRM.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.