There’s a lot at play, and at stake, in Australia’s energy system transformation. Both our electricity supply and demand are more weather dependent than ever, which is happening right at the point our weather systems are becoming more unpredictable than ever. Which makes modelling more vital than ever, at the exact moment our models are proving insufficient.

To top that off, we’re needing to deploy new, less battle-hardened technology, there’s a whole swath of new players entering the energy sector, and we’re stuck with price signalling systems which no longer cater to our needs.

To use the 2016 Oxford Dictionary word of the year, which now seems to be more prophecy than observation, it’s a clusterf*ck.

From Paul McArdle’s Global Roam in collaboration with the team at Greenview Strategic Consulting, the Generator Insights 2021, or GenInsights21, report published today is a deep dive into Australia’s energy system and it’s not particularly pretty.

In summary: our electricity generation is becoming more variable and uncertain, which is not necessarily bad but does add layers of complexity to a system already piling them on faster than a game of Uno. Each of these layers of complexity is shadowed by an additional layer of risk.

New risks mean new premiums. Which leads us to the question, who pays? Again, you get the picture. Clusterf*ck.

And, as the authors remind us more than once, success is not guaranteed. Excellent.

The report is detailed 600+ pages, so below are just a few takeaways:

Duh! DERs

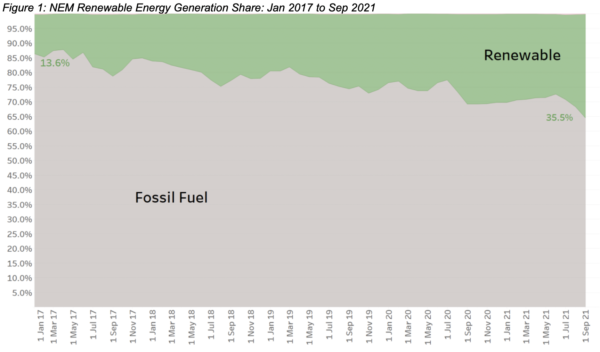

So the transition is rocketing along. At the beginning of 2017, renewables represented 13.6% of Australia’s total generation; as of September 2021, they accounted for 35.5%.

Rooftop solar, as we all know, is a hefty slab in that figure, but is largely invisible and uncontrolled. This, the authors note, means it will definitely have a limit in the National Electricity Market (NEM), we simply haven’t found it yet.

Rooftop solar is also having a significant impact on the commercial returns of the whole generation sector, but especially utility-scale solar farms. Building on the refrain that (specifically) rooftop solar is “eating everyone’s lunch!”, the authors note: “the rise of rooftop PV has been the largest single determinant of declining grid demand and also market demand – and yet the nature of rooftop PV is such that this decline has not led to a commensurate reduction in peak demand, or peak requirement for Aggregate Scheduled Target.”

Adding to that is the little fact that sun shines on utility panels and rooftops alike means the wholesale solar-correlation penalty is compounded, leading to increasing curtailment of wholesale solar.

Rooftop solar, the authors say, is also starting to encroach on minimum safe operating levels of ‘keeping the lights on services’ such as inertia. “These challenges reside not just in residential rooftop PV but extend further to increasingly sizeable and sophisticated portfolios of commercial solar farms that purposively sit just below the 5MW visibility threshold.”

Way to steal our sunshine.

It’s not just a technical problem either, but also a social one. The people who have rooftop solar are voters, so whatever policy is pursued will need to satisfy them, or it’s toast.

The issues, they say, also bleed into the world of commercial challenges. For instance, the significant price depression in the market during (typically) the midday and afternoon, “would likely result in significant economic curtailment well before getting to the 100% level.”

Which brings us to what the authors call Australian Energy Market Operator (AEMO) boss, Daniel Westerman’s, Big Hairy Audacious Goal: 100% instantaneous renewables by 2025. It’s a challenge, they say, “so much more complicated” than simply generating 100% of our energy from renewable sources. For all the hurdles the country faces between now and that Hairy Audacious Goal, you’ll have to read GenInsights.

Storage

The report also raises the issue of the way Australia is modelling our storage needs, saying ‘sunny skies’ scenarios seem to be the limit of what most are thinking about, and therefore modelling, at present. The report runs through a whole suite of scenarios which illustrate what can go wrong here, from looking across the world at Texas energy crisis in February, to how east coast droughts in 2007-2008 and 2016 impacted multiple layers of energy systems.

“We urgently need to develop a ‘real world’ perspective of how much storage will actually need to be retained, simply for insurance purposes… and then working backwards, to ensure we don’t put the system into a long term position from which it is difficult, if not impossible, to recover,” the report says.

“Energy storage is the key to power systems being able to withstand shocks, hits and issues – yet we understand very little of how these projects will operate in a market otherwise dominated by ‘anytime/anywhere energy’,” it concludes.

Price signals

Australia, unsurprisingly, has not priced carbon well in the market, “thereby distorting multiple levels of price signals, which is especially critical in a high Capex, low Opex electricity market such as the NEM,” the authors note.

“Countless times we see discussion and commentary on the number of MW installed, total percentage used at a particular point in time, yet without reference or understanding to price, price signal or financial outcome. Similarly, the electricity market (and its subsequent outcomes) should not simply be seen as another financial investment class, where the cheapest deployment of capital wins the day.”

Modelling

The authors also raise concern about the NEM’s evolution drastically outpacing that of the market models, impinging on their ability to compute genuinely valid answers. Again, the authors point to pricing.

Take, for example, the newly implemented Five Minute Settlement, which cost an estimated $500 million to $1 billion to implement. “It may be a shock to many readers to learn that much market modelling performed to support individual project business cases, and to produce high profile industry reports, are not done with a 5-minute timestep,” they say, nothing these are often still done half hourly, others hourly, and some even more coarsely than that.

These are just a few of the challenges our energy system stares down the barrel of. How they’ll be fixed remains to be seen.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Dispatchable power is what we are ideologically winding back in shutting down coal fired power stations. Unless this lost power is replaced we are stuffed in the long run. Hope is not a plan.