From ISSUE 01 – 2022 JANUARY 12, 2022 PV MAGAZINE

When phones and computers became more widespread around the turn of the century, scientists and industry professionals began to worry about the supply of the 49th element on the periodic table: indium. Indium plays an important role in both LCD and OLED displays. By weight, it’s almost three-quarters of a layer of transparent conductive oxide, called tin-doped indium oxide (ITO), used to translate electrical signals into light.

Indium’s centrality contrasts its level of consumption. Markets consume infinitesimal amounts of the element each year amounting to roughly 800 tons. However, total recorded reserves only amount to roughly 15,000 tons, according to the U.S. Geological Survey, before it stopped counting reserves. Even if the rate of consumption was level, manufacturers worry that those known reserves could disappear in just 20 years. The fear of scarcity led to skyrocketing indium prices in the early part of this century.

Solar need

The solar industry currently comprises just 9% of demand for indium, but it’s vital for heterojunction (HJT) PV, which presents a promising route to surpassing the current crystalline silicon cell efficiency ceiling. Some thin-film PV materials also contain indium or make use of ITO layers. The World Bank predicted last year that trends in solar development would mean that by 2050, PV technology alone would account for more than double current indium demand.

As a result, the rapid expansion of solar manufacturing capacity is raising renewed worries that delicate supply chains will be strained by the push to transition from fossil fuels to zero-emission energy.

But the supply chain for indium is more nuanced than that, said Tim Werner, a research fellow at the University of Melbourne. “It’s not a question of scarcity. It’s a question of sustainability,” he told pv magazine. Until recently, there was little understanding about where indium came from, and what pressures its supply experienced. There is likely much more indium available than is recorded, he said.

Indium’s role

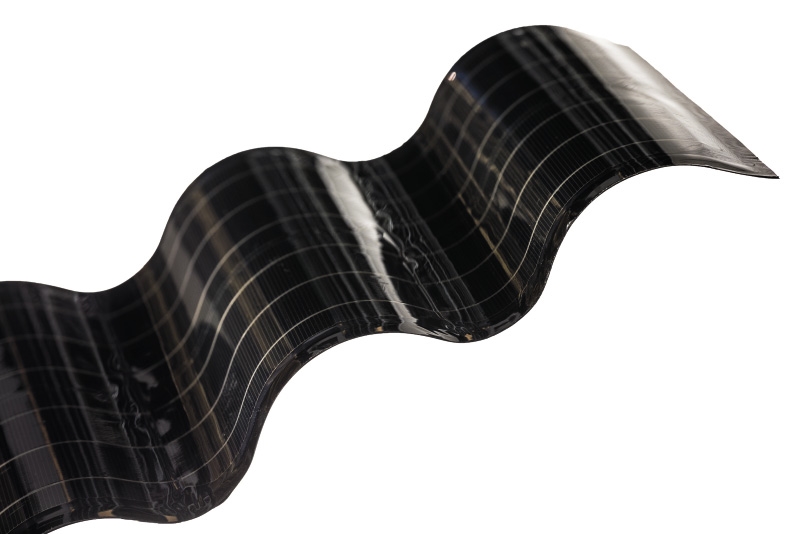

Major developments in solar technology depend on indium’s conductivity while remaining flexible and thin. For HJT cells and other PV technologies, projected demand is likely to make the costs of ITO weigh heavily on uptake. Recognising that solar uptake would likely put pressures on materials, scientists have long sought less material-intensive options for production.

In HJT cells, researchers are exploring various routes to working with thinner ITO layers while maintaining cell performance. In a recent paper in EPJ Photovoltaics, scientists at Germany’s Fraunhofer Institute for Solar Energy Systems found that reducing the ITO layer to 90 nanometers could reduce the solar industry’s demand for indium by almost 50%

Thin-film options also achieve lower material use, if they can overcome the economic barriers that have so far constrained them to a small fraction of the market. In copper-indium-gallium-diselenide, or CIGS, indium acts as the photon-absorbing layer that kicks off the electricity production. “Indium, as far as CIGS cells are concerned, is extremely important. You wouldn’t have the same material if you didn’t have indium. It wouldn’t perform as well,” said Lorelle Mansfield, a material scientist at the US National Renewable Energy Laboratory in Colorado.

Recognising the pressures on CIGS, scientists in the Swiss Federal Laboratories for Materials Science and Technology (Empa) have encouraged others to shrink the proportion of indium in cells to facilitate large-scale adoption. Currently, indium in CIGS comprises just 3.7 grams per square meter of the panel, according to Mansfield.

The US Department of Energy has funded several CIGS research projects, but companies that aimed to sell CIGS have largely succumbed to silicon-based rivals that were able to benefit from achieving superior scale. Mansfield believes CIGS will still have a niche especially in flexible, transparent, and lower-price markets. “We’re going to need all of these technologies to meet the goal that we want to meet with reducing emissions,” Mansfield said.

There have also been attempts to replace indium in the module entirely. Recent research has proposed swapping some of the ITO layers with silicon-based materials. Aluminum-doped zinc oxide has been used in the lab, although it’s more susceptible to corrosion.

Murky supply

Indium appears on the list of critical minerals of the United States, Canada, the European Union, and Australia – for which it ranks third-most critical. However, there are no “indium mines” in operation.

Instead, indium supply comes as a byproduct mainly from zinc sphalerite mines, where it appears in almost invisible concentrations of 0.01% or less. Often zinc mines and refineries may not pay attention to the indium in the concentrates they sell. Zinc products tend to be sold, sometimes across borders, without factoring indium into the price. And zinc mines don’t report the concentrations of indium in their deposits, unless it can play a large enough role in their businesses.

Australia, for instance, sends much of its zinc concentrate to be refined in China, which also dominates the industries in display screens and solar PV. While Australia has no listed indium production, its zinc products likely contain indium. China produces roughly 50% of the world’s indium, but its materials are largely imported in the form of other concentrates. In its critical minerals report, the Australian government lists five exploration projects that may produce indium. Some of these companies don’t list indium in shareholder reports.

That makes tracking down the sources of indium difficult. Estimating the sources of the mines that send indium to the world’s technology manufacturers requires making inferences about the trajectory of zinc purchases.

“We do know where the world’s zinc is being mined and where concentrates are going, and refined indium is coming from those countries that buy the zinc,” Werner said. With that approach, he estimated that indium reserves are closer to 300,000 tons, 20 times higher than previous estimates.

“So, then the question is not really ‘are we going to run out of indium?’” Werner said. “It’s ‘where is it going to come from?’ and ‘what are going to be the impacts or risks associated with different indium supply chains?’”

Adaptability and expansion

Researchers in Germany and China estimated that indium experienced the highest supply pressure, second only to tellurium, in the forecasted expansion of solar technologies to 2050. Projected demand will outstrip China’s projected supply, they wrote, unless significant changes in reuse and processing were made.

Other metals crucial to solar panels are also produced as byproducts. Gallium, for example, is derived from mining bauxite, a mineral used to extract alumina. The demand for some of these minor metals may drive companies to oversupply other primary metals. “You’re more inflexible to changes in demand, because you always need there to be zinc in order to get the indium,” Werner said.

Indium refineries regularly only recover a fraction of the available indium. Technological improvements in processing may also be able to increase production without having to mine more land. Researchers from Germany and Portugal recently outlined a methodology in the journal Mineralium Deposita to extract roughly a fifth of the world’s supply from a copper-zinc deposit in Portugal, where scientists have long noted the high concentrations of indium.

Companies continually mine indium ore, but it often goes to refineries that cannot extract the indium. Instead, it’s sent elsewhere to be separated. Given that zinc refiners already have access to indium ore, adding an additional processing circuit could extract indium without necessitating large capital expenditures. Otherwise, the indium ends up in waste.

At one project in Tasmania, Australia, a decades-old waste pile left by a lead-zinc mine contains indium and may be recoverable. “If there can be some innovation in recovering mine waste, we would open up an enormous reservoir,” said Werner.

Indium recycling

Considering indium’s scarcity, recovery and reuse of ITO layers and other solar components could boost the viability of the solar panels. ITOs are regularly recycled, and Japan and South Korea dominate the recovery of these metals. Places with fewer zinc mines, such as the European Union, have devoted research funding to investigating whether their recycling industry can help fill forecast demand.

The small amount of indium in a solar panel or display screen makes it difficult to build a business case for recycling. Recovering all the indium in use by Australia’s citizens, Werner said, would only produce as much indium as is contained in one deposit of mine waste. “So purely from a mass perspective, recycling does not seem that viable to me. From a strategic perspective, some countries might think it’s more important,” Werner said.

Material recovery can also target materials that are typically lost before the products reach consumers. Researchers in China recently wrote in the journal Sustainability that scrap and waste from the country’s bustling manufacturing sector could be important feedstock for recycling industries. They estimate that between 2000 and 2019, companies lost 19,000 tons of indium to production losses and scrap.

Werner hopes that the understanding of indium’s supply chain will lead to greater scrutiny about a critical material whose demand is likely to jump significantly. “Particularly with a lot of these climate change discussions right now, people who research mining are trying to highlight that, yes, we are going to need a lot more mining to meet demand for critical metals, to build the renewable energy capacity to meet these climate targets, but it matters where that mining takes place.”

Ian Morse

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.