Solar market analyst SunWiz has published its 2021 Australian Solar Year in Review report, revealing, among other things, the year’s most popular brands of both solar panel and inverters.

The full report is behind a paywall, though pv magazine Australia has been given permission to publish the top 14 panel brands in the rooftop segment in alphabetical order:

- Canadian Solar

- JA Solar

- Jinko

- LG

- Longi

- Hanwha Q Cells

- Hyundai

- Phono Solar

- REC Solar

- Risen

- Seraphim

- SunPower

- Suntech

- Trina

For inverters, the top 10 brands with the largest market shares in the rooftop segment are as follows (again, in alphabetical order):

- Enphase Energy

- Fronius

- Ginlong/Solis

- GoodWe

- Growatt

- Huawei

- Sofar Solar

- SolarEdge

- SMA

- Sungrow

Quarterly trends

The final quarter of 2021 saw a shakeup of the panel brand leader board. Jinko dropped its market share significantly in that fourth quarter, while Longi’s most radical descent happened across the second quarter.

On the other end of the scale, Canadian Solar markedly increased its market share from the second quarter and Hanwha Q Cells rocketed up in the fourth quarter. JA Solar also enjoyed a surge in popularity from the second quarter.

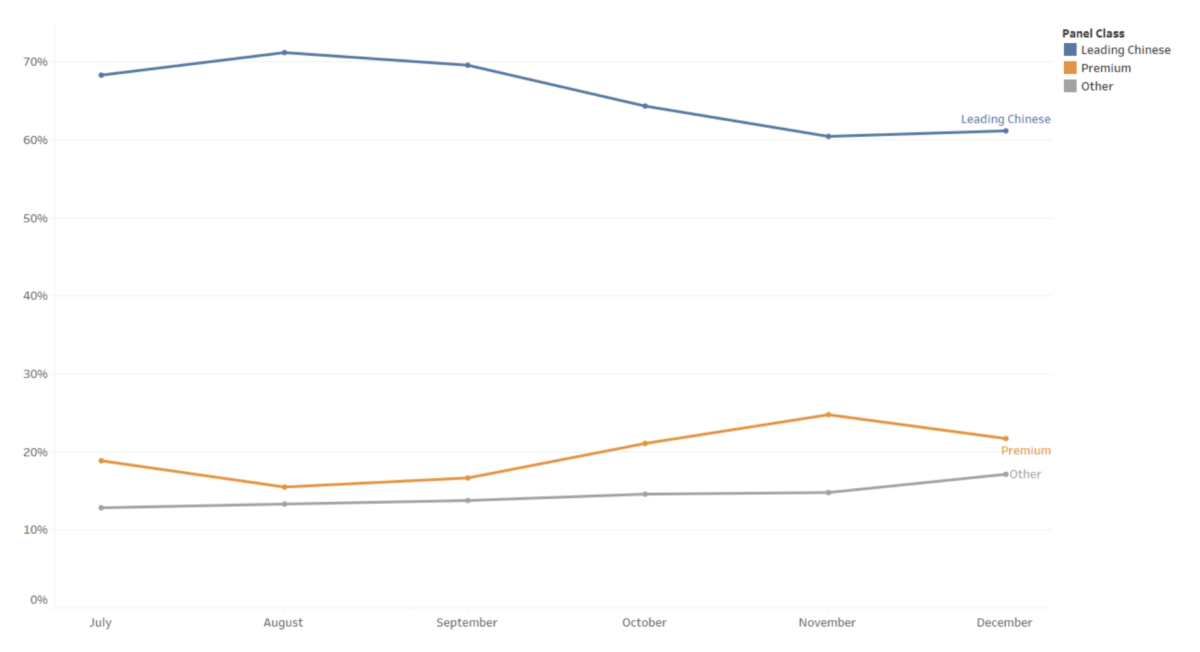

In terms of brand origin, leading Chinese brand continued to account for the greatest portion of the Australian market by a long shot. Their popularity peaked in August, before dropping steadily through to November, with a slight increase in December.

Premium brands, on the other hand, followed a reverse trend with their popularity at low point in August before steadily growing through to November. Premium panel brand’s popularity dropped slightly in December.

Brands which fell into neither of these baskets remained steady from July to November, but grew their market share in December.

Sunwiz

2021 in summary

Last year saw record volumes of solar installed, with growth primarily driven by rooftop solar which compensated for the slowing in the utility-scale segment.

In total, 5.2 GW of solar was installed in 2021, putting Australia’s cumulative tally at 26.9 GW. By November, Australia reached a landmark with over three million solar systems installed on rooftops, solidifying the country’s global lead in terms of solar per capita.

While the popularity of rooftop solar has created economies of scale pushing down the average price for residential solar systems, chaos in the solar supply chain and diminished product output from China led prices to increase in the second half of the year. Prices are likely to remain high in the first half of 2022, and when paired with low electricity prices and feed-in tariffs, this mixture has worsened the economics of solar, SunWiz noted.

Be that as it may, the analysis noted solar remained an “excellent investment”.

You can find the SunWiz 2021 analysis here.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.