On Monday, mineral sands miner Iluka Resources announced it had reached a final investment decision to proceed with the construction of what will be the first rare earth oxide refinery in the country following financial backing from the federal government plus a risk sharing agreement.

The refinery is to be built at the company’s Eneabba operation north of Perth and will produce separated high value rare earth oxides including neodymium, praseodymium, dysprosium and terbium, critical inputs for the electric vehicles, renewable energy technologies like wind turbines and advanced electronics.

Australia as a serious China alternative

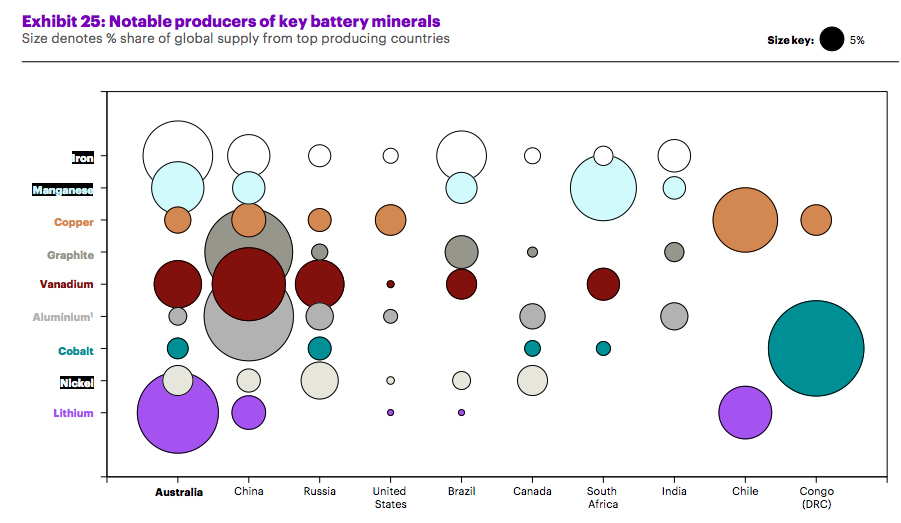

The Eneabba Rare Earths Refinery, which Iluka’s managing director Tom O’Leary said should be “meaningful globally” during press conference yesterday, is seeking to answer worldwide calls for diversified supplies of critical minerals. While Australia is already a major exporter of rare earth and critical minerals, China completely dominates the refined or ‘processed’ market.

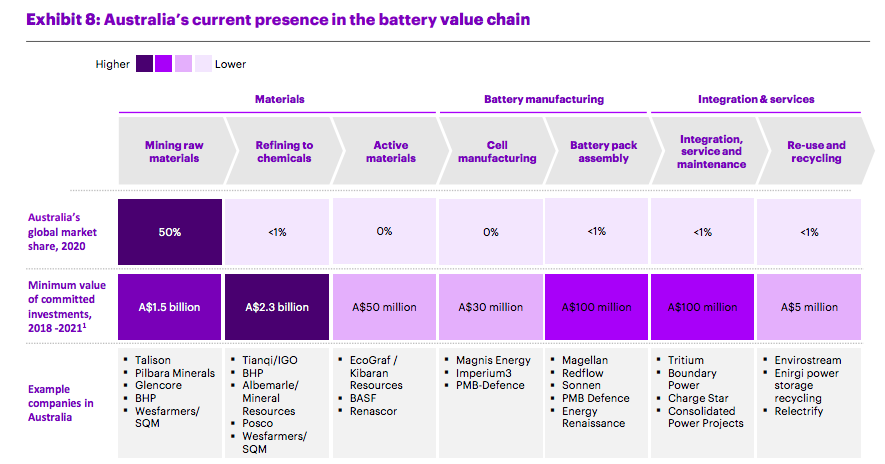

The global risk of this is becoming increasingly glaring with many Western countries scrambling to find alternatives – an opportunity which Australia has potential to seize. Processed materials are worth far more than the raw ones, with research from the Future Battery Industries Cooperative Research Centre finding that if Australia can start “value adding” through processing as well as building onshore manufacturing capacity the economic opportunity could be worth billions.

The Eneabba Rare Earths Refinery

Construction on the refinery is due to begin later this year with first production due in 2025. It will first use inputs from Iluka’s own stockpiles of rare earth bearing minerals, but is designed to process feedstocks from external suppliers.

The refinery’s total rare earth oxide capacity will be 17,500 tonnes per annum.

The project has been enabled by a $1.25 billion loan from the federal government’s Critical Minerals Facility. The Commonwealth government has also entered into a risk sharing arrangement with Iluka, which the company pointed to as a key component of its investment decision. Iluka will put $200 million from its own equity into realising the project.

Both the prime minister Scott Morrison and treasurer Josh Frydenberg praised the project, saying it would capture more value on-shore from the country’s critical minerals as well as strengthen Australia’s position as a trusted global supplier of critical minerals. “Building a modern manufacturing sector and securing our sovereign capability is a key part of our plans for a stronger economy and a stronger future for Australia,” Frydenberg said.

Iluka says it has already received the key state and federal government environmental approvals for the project, and is now working towards securing further approvals and regulatory requirements. The Eneabba Rare Earths Refinery will be owned and operated by Iluka’s wholly-owned entity named RefineryCo.

Since 2019, the company has accelerated its shift away from mineral sands mining to begin diversifying into rare earths. This has been driven, company MD Tom O’Leary said, by the “electrification of the global economy and the increasing policy priority assigned to critical minerals and their supply chains.”

Lithium refinery

It’s worth noting that another refinery is close to take off further south in the state. The Kwinana lithium refinery, a joint venture between Australian miner IGO and China’s Tianqi, is currently working on becoming the first battery-ready lithium hydroxide producer in Australia.

China is currently the world’s biggest refiner of lithium, controlling about 80% of the market, according to a 2020 study from BloombergNEF.

Iluka Resources

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.