German-based research company EUPD Research has released new findings from its annual survey of Australian solar installers inquiring into which brands of modules, inverters and storage are preferred and how companies are diversifying their offerings.

The 2021 survey saw EUPD Research speak to 200 companies here, with its research supported by Australian analyst SunWiz. The data supports claims from industry about its changing direction driven by growing saturation.

In the two years from 2019 to 2021, EUPD Research and SunWiz found Australia’s solar capacity expanded at a compound annual growth rate of 26.7%. The residential segment accounted for most of this growth, with the utility-scale sector a close second while commercial and industrial lagged.

EUPD Research

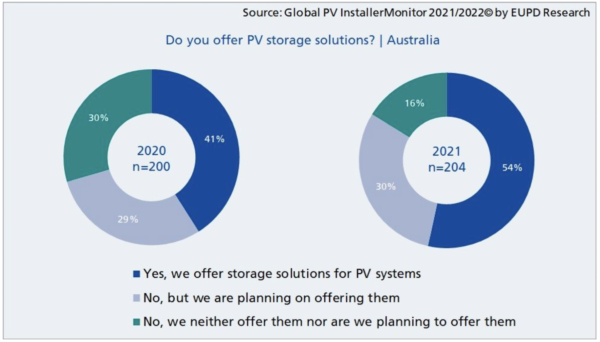

Storage market grows

Notably, the last year saw a significant jump in the number of companies offering storage solutions, growing from 41% in 2020 to 54% in 2021. Moreover, a further 30% of companies said they planned to include storage solutions in their portfolio by the end of 2022.

The remaining 16% of the sample group currently neither offer energy storage, nor are planning to do so in the foreseeable future. The primary reason given for that reluctance was economic, with companies saying storage prices remain too hight and, as a result, margins too low. A lack of expertise and the consequent high demand for training was also a leading factor.

These numbers confirm what Kosta Bourandanis, sales manager at wholesale distributor Supply Partners and co-founder of industry group Solar Cutters, recently told pv magazine about the saturation of the solar market in the country.

Diversification key as solar becomes increasingly saturated

For him, self-consumption is today the primary selling point for most solar systems, with feed-in tariffs no longer a drawcard.

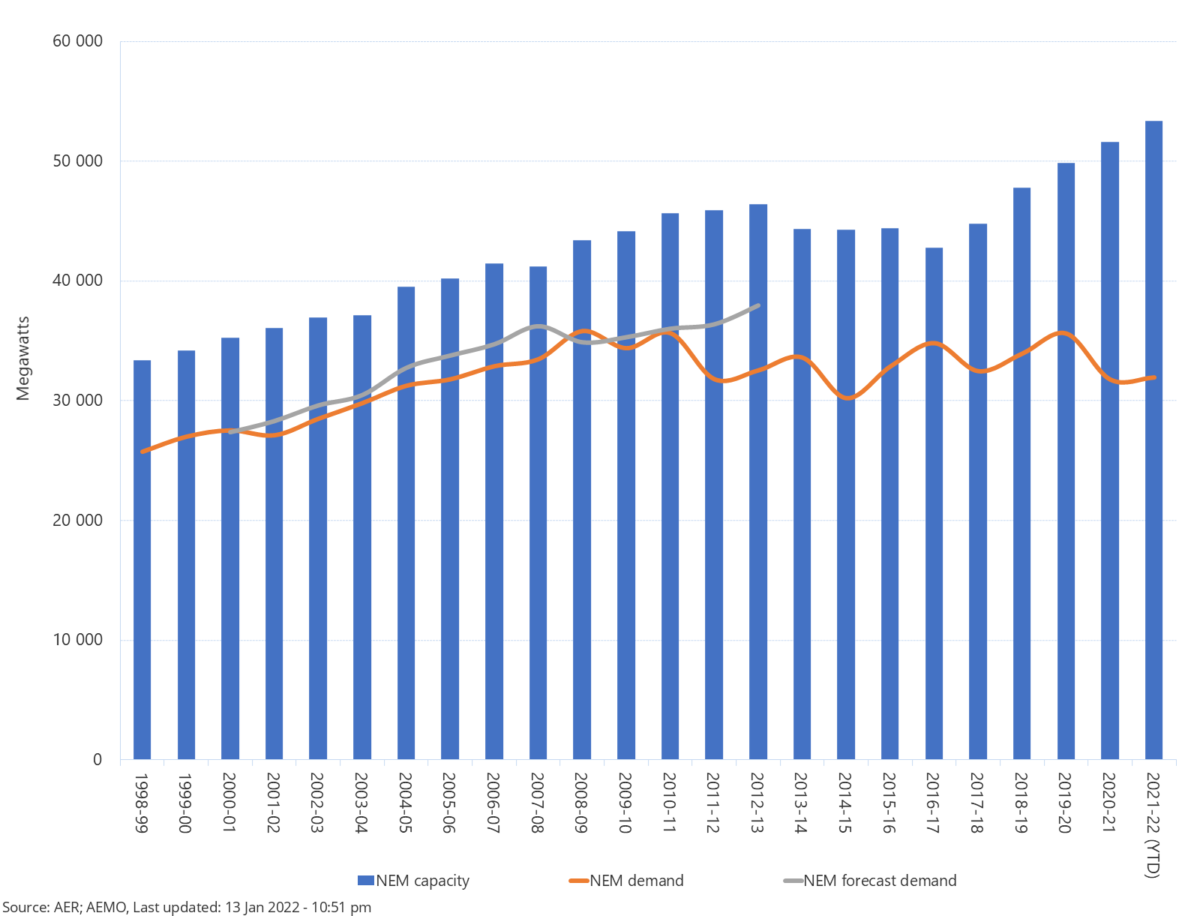

This is hardly surprising given SunWiz estimated Australia’s cumulative installed solar PV capacity at the end of 2021 was 26.9 GW. For reference, the National Electricity Market’s demand since 2020 has sat at just over 30 GW, leaving very little room for other generation types during daylight hours.

Australian Energy Regulator (AER)

Bourandanis said he is increasingly hearing of solar companies diversifying into electric vehicles (EVs) and batteries as a means of ensuring customers can get the most out of their solar, since exporting back to the grid holds little promise.

While EUPD Research’s ‘Market Briefing Australia’ presentation did not speak at length on EVs, presenter Saif Islam noted 12% of Australian companies are already offering “electric mobility solutions” with a further 33% planning to add this technology to their portfolio of offerings in 2022.

Few companies accounting for most work

In Australia, one third (35%) of installation companies accounted for 89% of all of Australia’s installed PV capacity in 2021.

The remaining 65% of ‘low volume’ solar companies accounted for just 11% of installations.

For Platinum Solar Designs’ general manager Scott Mason, this signals at a larger issue in the industry. Mason told pv magazine Australia monopolisation is a growing problem and is exacerbated by the current governance structure.

He believes the current rules around installer accreditation have created a landscape where a handful of big companies aggressively market low priced system, poaching accredited installers from smaller companies by contracting them as sole traders. This, he says, limits the number of installs smaller boutique companies can make and lowers the overall quality of installs.

Procurement – where and what companies are buying

The vast majority of solar companies, 88%, procure their equipment from wholesalers, with just 7% purchasing directly from manufacturers. This, Islam noted, made Australia a “very interesting” space for wholesalers.

Australia’s most popular wholesaler among those surveyed in 2021 was MM Electrical, which took almost a quarter of the market at 24.7%. It is worth noting that all the subsidiary trading companies including Haymans Electrical, TLE Electrical, AWM Electrical and D&W Electrical were included under the umbrella of MM Electrical.

Tradezone and One Stop Warehouse came in second and third, taking a 20.4% and 19.9% stake in the market each.

EUPD Research also looked at brand awareness in among installs for solar modules, inverters and storage systems, asking installers which manufacturers they could name directly off the top of their heads.

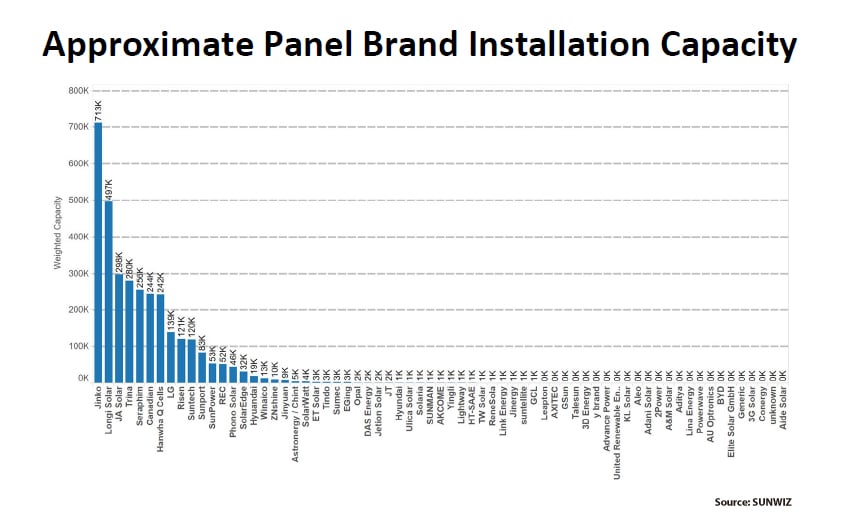

Image: SunWiz

Solar module brand awareness

For solar modules, the resounding winner for brand awareness was Jinko Solar. The Chinese manufacturer was named by 64% of respondents.

In second place was Trina Solar with 47% of respondents listing the brand unaided.

LG was the third most listed brand, an indication of why the industry was so dumbstruck at the news in February that the Korean brand would be exiting the solar module market.

Canadian Solar grew its brand awareness considerably in 2021, taking out fourth position.

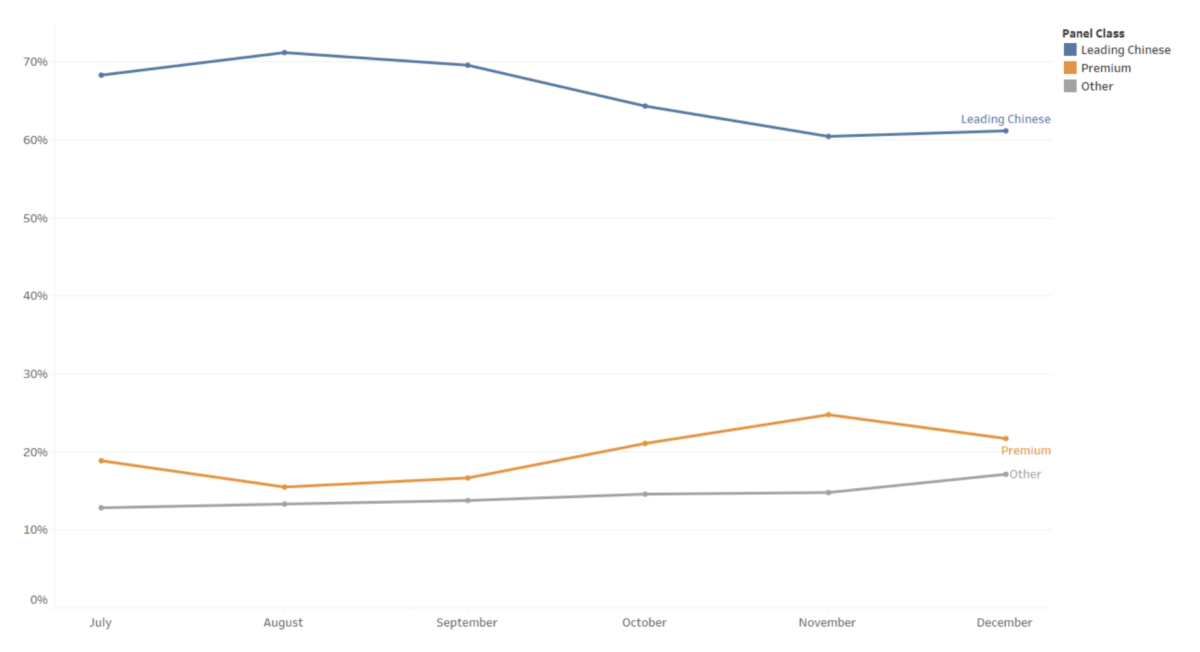

Most stocked module brands

Unsurprisingly, there was much crossover between the most recognisable and most widely stocked brands in solar, with Jinko converting its visibility to a leading position in many installers product portfolios.

Jinko modules featured in 35% of surveyed installer portfolios, with 23% of those companies offering Jinko products exclusively.

Trina was a close second, offered by 32% of installers while Canadian Solar featured in 21.6% of portfolios.

Sunwiz

Inverters

Fronius continued its dominance in the inverter space and was “by far” the most listed brand name, with 84% of respondents referring to the Austrian company. Its inverters were stocked by 57% of surveyed installers.

In terms of brand awareness, SMA, Sungrow and SolarEdge were all mentioned by around 45% of installers.

SolarEdge was stocked by 34.8%, Sungrow by 24.5%, Enphase by 20.6% and SMA by 20%.

Storage

In terms of brand awareness, LG (including LG Chem and LG Energy Solution) was actually the most frequently named manufacturer, with 56% of installers pointing to the manufacturer while slightly less, 54%, referred to Tesla by name.

BYD was a distant third in brand awareness, named by 26% of respondents.

Coming to distribution, LG solutions were offered by 43.1% of the installers who have expanded into the storage market. 40.4% offered Tesla, while 18.3% offered BYD solutions and 17.4% offered Alpha-ESS.

Installation types

The vast majority of installs (76%) were new systems, 18% retrofits while 6% of installers did not answer.

In terms of installed capacity, 83% were below 15 KWh and just 12% were more than 15 KWh. The final 5% was unknown.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

With LG getting out of the PV solar panel business, what is happening with their batteries? Will they also dump their PV battery division?

Last year I bought LG panels because they were second highest efficiency, and well-known brand. I don’t want to get stung twice by LG. I may go with Tesla anyway, as now don’t trust LG to stay in the market.

Hi Warren, I haven’t heard any rumblings that LG is planning to close its battery division nor of any companies moving away from them in regards to storage. I believe LG has said it will honour all panel warranties, but I do understand – the news of them exiting the panel market was a shock to everyone!