Sydney-based renewables outfit Energy Estate has revealed plans to launch a $500 million-plus capital raise to accelerate the roll-out of its development pipeline, which includes large-scale solar PV and wind, green hydrogen and pumped hydro projects.

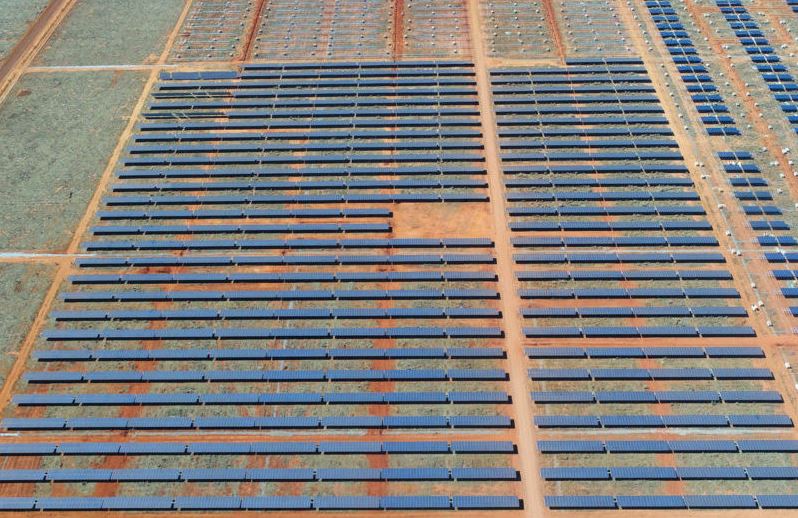

Since its formation in 2018, Energy Estate has announced plans to co-develop more than 30 GW of large-scale projects, including solar PV, long-duration energy storage, wind, and hydrogen production.

Among the projects being pursued by the company is the 2 GW Central Queensland Power Project being developed in conjunction with Renewable Energy Systems (RES) about 30 kilometres inland from Rockhampton.

Energy Estate said the first stage of the development would focus on the construction of the Moah Creek Renewable Energy Project which is to combine 200 MW of solar, 400 MW of wind, and a minimum 600 MWh of battery energy storage. The intent is to supply heavy industry in the region, including the Boyne aluminium smelter.

Energy Estate has also teamed with Mirus Wind to develop the Walcha Energy Project near the town of the same name, about 55km south of Armidale in New South Wales. The planned 4 GW project would include a 700 MW solar farm, a wind component, a 100 MW/150 MWh battery and a pumped hydro power station.

More recently, Energy Estate announced it would partner with Sunshine Hydro to develop a super-hybrid green hydrogen project near Gladstone in central Queensland. Valued at up to $5.5 billion, the Flavian super-hybrid project would incorporate 1.8 GW of wind generation and 600 MW of pumped hydro with 18 hours of storage. The project would also include 300 MW of hydrogen electrolysers, 50 MW of liquefaction, and a 50 MW hydrogen fuel cell.

While most of the projects remain in the early planning and feasibility stages, Energy Estate co-founder Vincent Dwyer said the funding round will be used to fund the construction of its platform of projects in Australia and New Zealand and to fast-track the company’s development activities.

“We have now embarked on the next step of our journey,” he said. “This will result in the large-scale, flexible renewable energy portfolio we are co-developing with our partners providing decarbonised energy, whether in the form of electrons, hydrogen, ammonia or other e-fuels, to local consumers including heavy industry and into export markets.

“Given the current turmoil in energy markets in Australia and the importance of decarbonisation across the broader industrial supply chain, including but beyond just low-cost power, leaning large-scale flexible renewable portfolios into industrial energy solutions is an important next step in the decarbonisation journey.”

Energy Estate has engaged Nomura Greentech as its financial advisor for the capital raising initiative.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.