“Friendshoring” is emerging as an increasingly important term in renewable energy, touted by Nextracker CEO and founder Dan Shugar at the 2022 All Energy event in Melbourne. The term speaks to the need to ensure supply chains come from political allies – the focus of much of the US and Australian governments recent work together.

Since the pandemic hit, tracker company Nextracker has been moving its manufacturing back to its US base. It’s a strategy CEO Shugar told pv magazine Australia has proven extremely valuable for the company.

Given trackers are largely made from steel, the proposition is relatively simple. When it comes to critical minerals, including rare earths, which are crucial components for technologies like batteries, solar panels and wind turbines, the shift is decidedly more difficult.

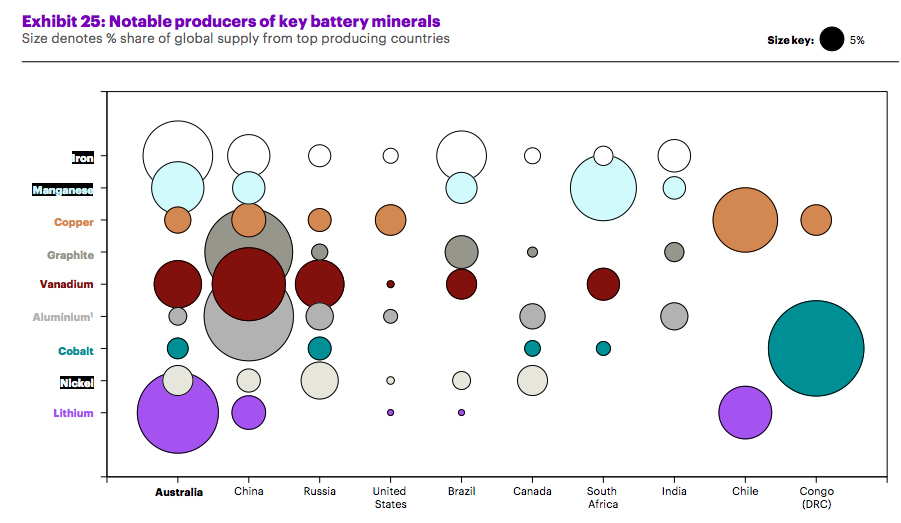

Image: Future Battery Industries Cooperative Research Centre

China currently controls around 90% of the global production of refined rare earths, and the majority of critical minerals. It’s a position China is seeking to defend, and Australia and the US are moving to undercut.

“Australia can play a role in diversifying supply by not only increasing production of rare earths, but also by increasing our involvement in downstream processing,” Australia’s Minister for Resources Madeleine King said at the Rare Earth Conference.

Analysts Tim Buckley and Matt Pollard have done interesting work on this topic in the last weeks, mapping out projects in development across Australia. Most of the potential lays in West Australia, where a number of refineries from companies like Lynas Rare Earths and Iluka Resources are being constructed.

Image: Lynas Rare Earths

In June, Lynas, an Australian company which is currently the only major player outside of China to produce and refine rare earths, won a $120 million contract from the US Defence Department to build a processing facility in the US.

Such moves will likely accelerate now with US President Biden’s Inflation Reduction Act, which will see billions invested to boost critical mineral supply chains for the US and allies like Australia.

Great to catch up with US Ambassador to Australia Caroline Kennedy today.

Good discussion around the importance of critical minerals to our longstanding alliance. @USEmbAustralia pic.twitter.com/FYH4A5qvy8

— Madeleine King MP (@MadeleineMHKing) November 2, 2022

The Australian government doesn’t seem to be taking such a direct approach to growing the industry though, with minister King highlighting her government is favouring loans and private sector co-investment.

“Last month the Prime Minister and I announced that the government will be refreshing Australia’s Critical Minerals Strategy,” she said yesterday. “The new strategy will be developed in consultation with industry and other stakeholders to best identify how we can help grow the sector.”

In the October budget, the Albanese government said it would allocate $50 million over three years to the Critical Minerals Development Program which King says will go toward “competitive grants to support early and mid-stage critical minerals projects. This funding builds on the $50 million recently committed to six key projects across Australia as part of Tranche 1 of the program, leveraging over $143 million in private sector co-investment.”

In the speech, minister King described herself as surprised to learn there is currently only one rare earths processing facility in the US.

“I suppose I should have known that before,” said King, “but, like many, I presumed there would have been more capacity to refine rare earths in the US. This serves to highlight the importance of Australia’s efforts to develop this processing facility to ensure our partners have diverse supply chains. But for me it was a light-bulb moment, where the magnitude of the opportunity available to Australia was made clear. The responsibility is equally enormous.”

Image: US Embassy Australia/Twitter

Minister King also drove home the message that the government’s plan is not only to produce critical minerals here in Australia – something the country has been doing for some time in various capacities – but also to begin processing onshore.

It would be somewhat surprising if this plan to begin critical mineral processing and rare earth refining in Australia doesn’t face serious backlash, given the processes tend to produce high amounts of toxic waste and have significant environmental and health risks.

Such issues were not addressed by the minister, who could hardly be described as an environmentalist nor renewable energy devotee. King has ardently supported Woodside’s Scarborough gas project and has refused to budge to demands from the newly elected “teal” independent members of parliament and the Greens party to end new fossil fuel projects.

Her speech on diverting at least some of the growing critical minerals market to Australia drew near immediate rebuke from Chinese officials. “No one should politicise, instrumentalise or weaponise the world economy,” Chinese foreign ministry spokesman Zhao Lijian said at a press briefing in Beijing.

Speaking to Bloomberg, Minister King acknowledged the play is far more of a long term vision than anything achievable in the coming years, saying it would be a “pipe dream” to think Western countries could end their reliance on China for rare earths and critical minerals in the near future.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The high temperature in the workshop, the large magnetic field, and the excessive dust are prone to occupational diseases.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.

Rare earths contain 17 chemical elements, including lutetium, scandium, and yttrium. For most people, these chemical elements are very unfamiliar, and long-term contact is relatively harmful to the skin.