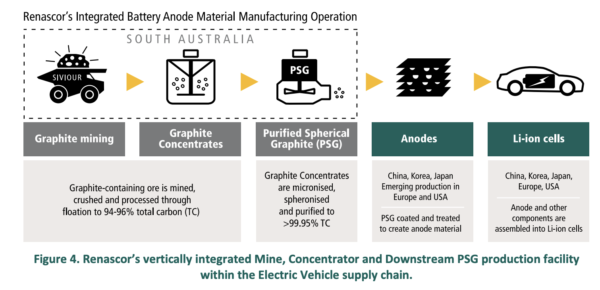

Australian project developer and minerals explorer Renascor Resources Limited (Renascor) has received approval from the South Australian Department of Energy and Mining for its Program for Environmental Protection and Rehabilitation (PEPR) at its proposed Siviour Graphite Mine and Concentrator – the upstream component of Renascor’s Siviour Battery Anode Material Project (BAM Project).

Purified spherical graphite (PSG) is a key component of lithium-ion batteries, which is why a handful of companies across the globe are racing to become the first producers outside of China to stake the prime spot as the global wave of demand begins to take off.

According to a company statement the PEPR approval allows it to process up to 1.65 million tonnes of graphite, a crucial component of lithium-ion battery production. At that rate, Renascor says it can produce up to 150,000 tonnes of graphite concentrates each year. Renascor intends to use the graphite concentrates to produce PSG for use in lithium-ion battery anodes.

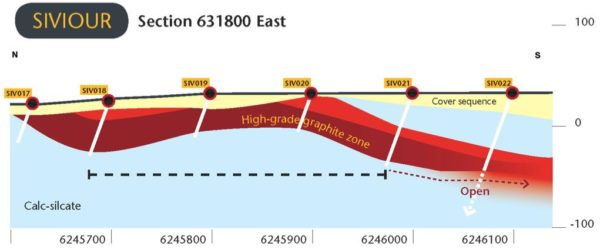

The Siviour Graphite Deposit is located in South Australia’s Eyre Peninsula and is among the world’s largest reported graphite deposits.

Image: Renascor Resources

Renascor Managing Director David Christensen said the news brings Renascor a step closer to becoming a producer of 100% Australian-made purified spherical graphite. For Christensen this dream cannot be realised soon enough for “there is growing potential for substantial upstream bottlenecks in the graphite-anode-battery supply chain due in large part to the lengthier approval process associated with new graphite mining operations relative to rapidly growing anode capacity.”

Through Export Finance Australia, the Australian government approved a $185 million (USD 124 million) loan facility funding to the BAM Project, provided it received PEPR approval. The company says it is already in discussions with “leading anode, battery and electric vehicle manufacturers in northeast Asia, Europe and the United States concerning potential PSG offtake.”

The Saviour Graphite Mine and Concentrator will consist of a conventional open-pit mine and crush, grind, float processing circuit. The deposit’s near-surface, flat-lying orientation is particularly favourable, and Renascor predicts a 40-year mine life.

There are a handful of other companies banking on market appetite for diversifying PSG supply chains outside of China. Norway, Sweden and Germany are all in the game, and closer to home Western Australian startup International Graphite is well on its way.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.