As the world moves towards a decarbonised future, analysts at Rystad Energy have pointed to a flurry of investment activity in Australian lithium projects as evidence of the country’s rapidly developing role in the global battery materials supply chain.

Rystad Energy senior analyst Susan Zou said the combination of soaring demand and considerable local deposits of the metal has led to significant movement in the Australian lithium market with a sting of multimillion dollar investments announced in recent weeks.

This includes IGO-Tianqi’s Australian joint venture’s acquisition of Perth-based lithium exploration company Essential Metals, and SQM’s plan to invest in Western Australian (WA) minerals company Azure Minerals.

Chile’s lithium major SQM has committed to investing up to $20 million (USD 13.85) to acquire a 19.99% interest in Azure Minerals which holds a major stake in the Andover lithium project in WA’s Pilbara region.

Tianqi Lithium Energy Australia (TLEA), a joint venture (JV) between Australian mining and processing company IGO and China’s Tianqi Lithium, has agreed to acquire Essential Metals through a $136 million (USD 94 million) scheme of arrangement. Essential owns the Pioneer Dome lithium project in WA’s Goldfields region.

Zou said the transactions demonstrate that Australia will have an increasingly important role to play in supplying lithium to the global market in coming years.

“These extensive investments will further support Australia in rapidly developing its lithium supply chain and will reinforce the crucial role the country plays in the battery supply chain,” she said.

“These investments will also add further strength to both Tianqi Lithium and SQM, which have already established a solid presence in Australia.”

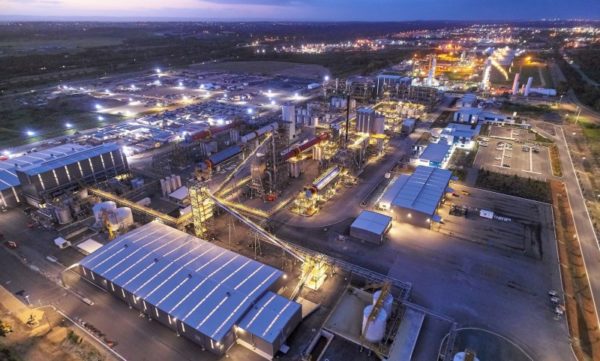

Image: TLEA

Lithium is a vital element in rechargeable battery technology and demand for the material has increased significantly in recent years.

Australia is already the world’s largest lithium producer, responsible for more than 50% of global production in 2021, followed by China and Chile. Australian lithium mine output is estimated to hit 526,000 tonnes of lithium carbonate equivalent in 2023, up more than 40% from 372,000 tonnes last year. It is expected to reach 1.5 million tonnes of lithium carbonate equivalent by 2025 and exceed three million tonnes by 2030.

Zou highlighted the United States as key terrain for Australian companies after the Joe Biden administration last year unveiled its Inflation Reduction Act which will see billions invested to secure supplies of metals such as lithium, cobalt, nickel and graphite that are crucial to clean energy industries.

The Inflation Reduction Act includes tax credits for electric vehicles (EVs) but Zou said the full credits only go to cars that source components and raw materials from the U.S. or free trade partner countries.

“Last year’s Inflation Reduction Act in the U.S. requires that the proportion of value for battery minerals that are mined and processed in the country or in countries that have free-trade agreement need to reach 40% for an EV in 2023 in order to receive EV credits and this threshold will increase in the upcoming years and hit 80% in 2027 and onwards,” she said.

Zou said while it is likely the U.S. will identify additional free trade agreements for the purposes of the battery critical mineral requirements going forward, Australia, as one of the countries with an exisiting free trade agreement with the U.S., has a “critical” role to play.

Image: Ioneer

While Australian mining and refining projects have attracted global attention, Australia companies working offshore are also set to play a role as nations move to boost domestic supply of battery metals.

Sydney-headquartered mining company Ioneer earlier this week announced it had received a conditional commitment for a loan of up to USD 700 million ($998.6 million) from the U.S. Department of Energy (DOE) to help fund construction efforts at its Rhyolite Ridge lithium mine and processing plant in Nevada.

Ioneer Managing Director Bernard Rowe said the loan is the result of ongoing discussions between all parties.

“The conditional commitment is the culmination of 23 months of discussions with and due diligence by the Loan Programs Office and it represents a significant milestone for Rhyolite Ridge,” he said.

Rowe said the loan could fast-track development of the site. Ioneer plans to start production from the mine in 2026 and has contracts to supply Ford and Toyota with output.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.