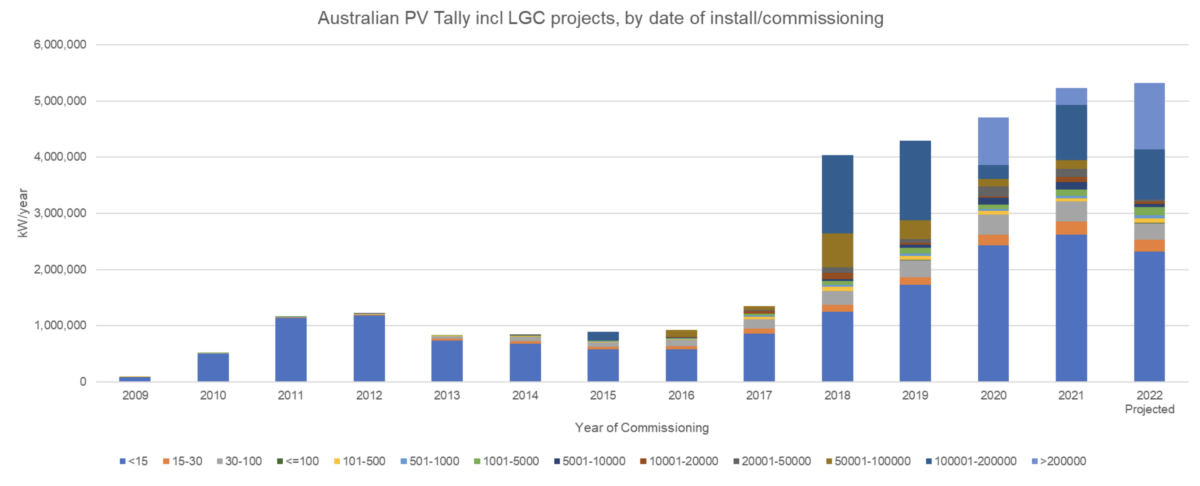

Solar’s cumulative installed capacity jumped by 20% last year alone, with installations in 2022 exceeding 5 GW, market analyst Sunwiz outlines in its 2023 Annual SunWiz Australian PV Report.

As rosy as this cherrypicked statistic looks, a closer inspection of the whole industry reveals a more complicated scene. This mammoth jump in the nation’s solar capacity, in fact, came down to three enormous solar farms entering operations. They make the claim solar had another “record year” in 2022 technically true, if a little misleading.

In reality, the year was far from a show stopper. The nation’s sweetheart, rooftop solar, kicked off the year with a seizable contraction, from which it was just able to claw back once energy became front page news worldwide. The commercial and industrial (C&I) segment behaved differently again, enjoying perhaps its greatest embrace to date. And while the utility segment rode on the coattails of a few huge projects, its momentum is far from full steam.

These disparate trends hold some important lessons for the industry, Sunwiz managing director Warwick Johnston tells pv magazine Australia.

Image: Sunwiz

Before we get there, the solar installed in 2022 brings Australia’s all-time tally to 31.4 GW, of which 21.7 GW is rooftop, mostly residential (19.9 GW comes from sub-100 kW systems).

Rooftop

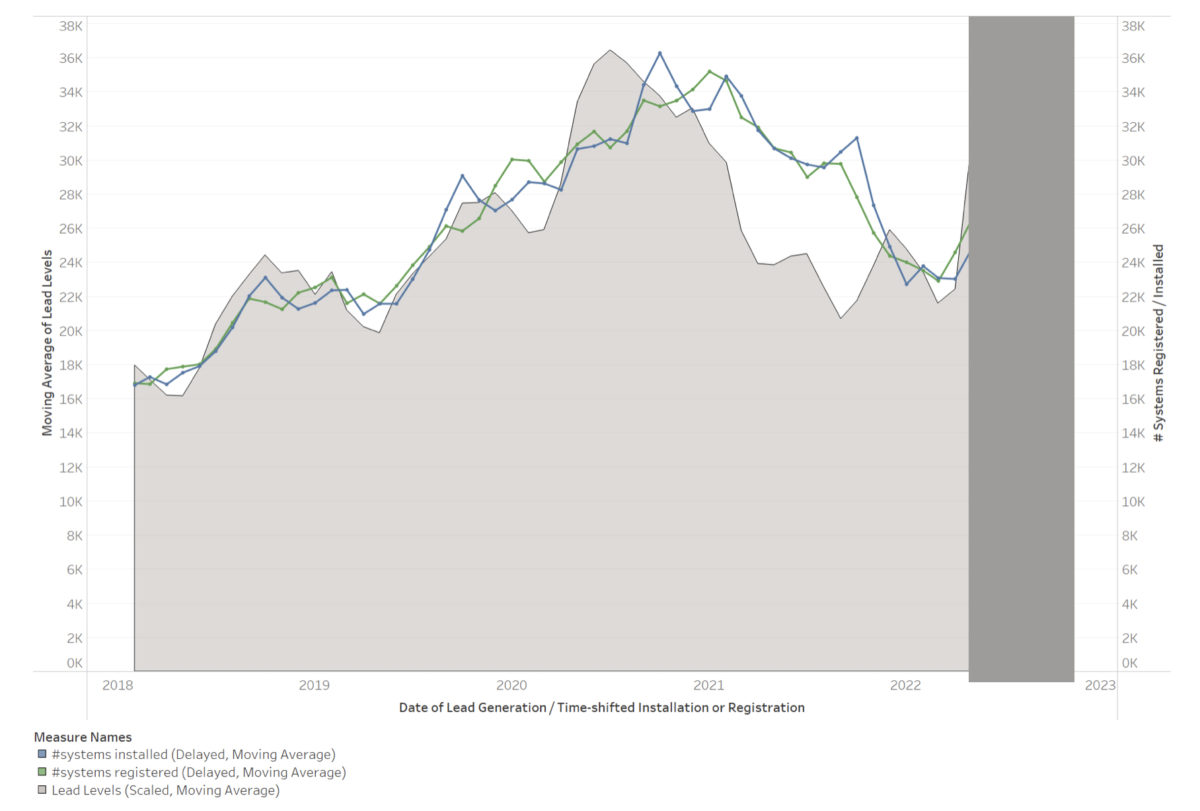

2022 kicked off with the single biggest monthly contraction in the volume of rooftop system registrations on record, virtually halving from one month to the next, Sunwiz outlines in its report.

This cliff-dive was actually forewarned by the data, Johnston says, but this was largely overlooked, leading suppliers into a painful position.

“All of 2021’s installations were effectively hangovers from 2020. And early 2021 was basically people had sold and were still fulfilling sales. Lead generation dropped off a cliff far earlier in 2021,” Johnston says.

Image: Sunwiz

The reason households stopped being interested in solar, he adds, boils down to the fact lockdowns were mostly over by the end of 2021, so restaurants and other outdoor activities stole the focus away from home improvements, a darling during the pandemic.

The issue here is the disparity between leads, sales and fulfilment – which had an unusual lag over the pandemic because demand was high but installers ability to actually install systems was spluttering with the final bouts of lockdown and high rainfall across the east coast.

“The key thing where wholesalers had a bit of a misstep was they didn’t read that leads had dried up and 2021’s installations had largely been buoyed by hungover interest,” Johnston says.

This misreading of the market – mistaking the high rate of installations in 2021 for a continuing boom in demand – meant solar suppliers radically overbought solar stock. This stock, Johnston says, was largely left sitting in warehouses as installs dried up, leaving suppliers playing a game of chicken in terms of pricing. “And in the meantime, they’re all hurting.”

(This approach of mapping demand through leads as opposed to installations has led Sunwiz to the conclusion 2023 will be a strong year for the rooftop segment, which pv magazine will report on in greater depth the coming week.)

Image: Victoria government

While rooftop’s contraction characterised the first part of the year, Russia’s invasion of Ukraine shook the globe’s still fossil fuel-dependent energy system and caused prices to skyrocket globally. Unsurprisingly, this led to a rush towards lovely, independent solar systems.

This panic-induced demand saw the rooftop segment recover some of its earlier losses, but while the year certainly ended strongly, Sunwiz found it wasn’t enough to entirely make up for the downturn. The segment ultimately posted a contraction overall, with few systems installed overall compared to 2021 and 2020.

It is also worth noting the federal election in May 2022 likely contributed to households hesitating or holding off their solar purchases.

Commercial & industrial

“Whereas STC systems both commercial and residential contracted, commercial had less of a contraction than residential,” Johnston says.

In fact, in December the C&I segment ended up having “pretty much a record month,” he added.

Image: Bunnings

While skyrocketing electricity prices surely would have vindicated companies on the solar journey, Johnston says businesses would have probably started planning their systems well before that particular pandemonium broke out.

More likely, he says, is that big customers would have been doing solar trials these last years and by 2022 were finally ready to get on with a complete rollout. He noted both Woolworths and Bunnings, two of Australia’s biggest chains, had big solar pushes in 2022. Likewise, Johnston says while nursing homes used to be among the biggest C&I customers, that has now shifted to industrial precincts.

Looking at commercial systems aerially via Nearmap, Johnston says there is an “amazing” number of new builds going up immediately with solar systems installed.

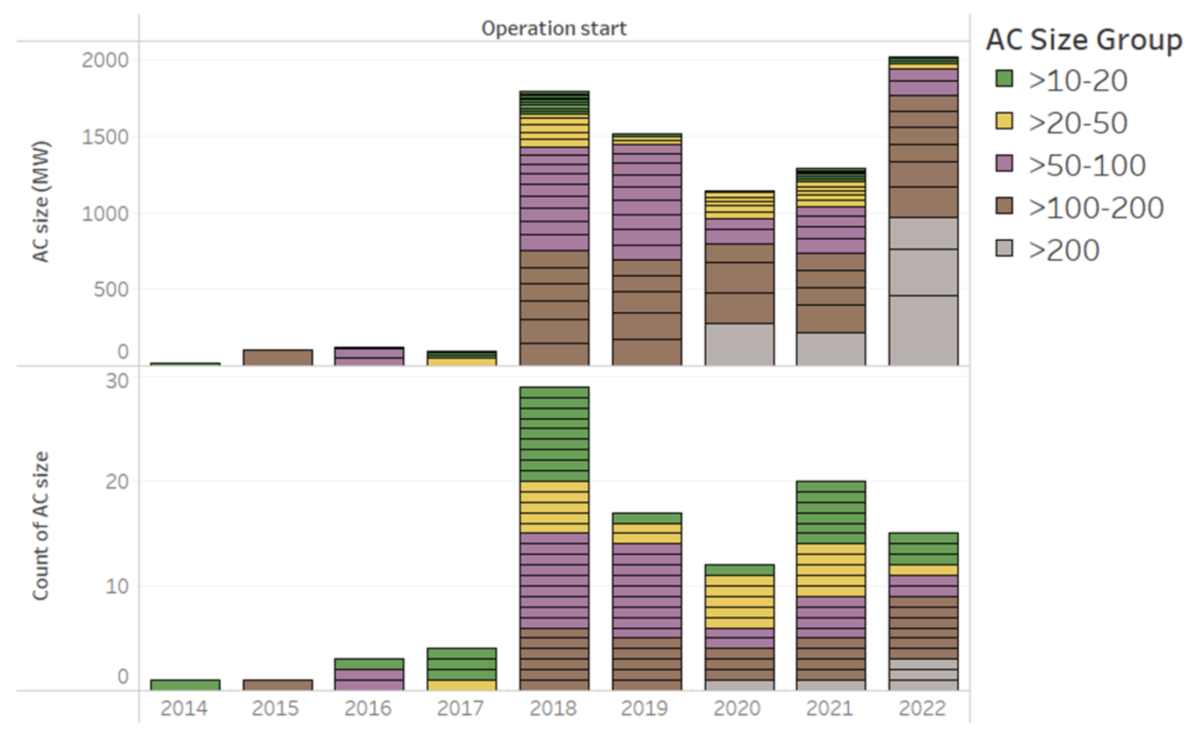

Utility

Much of 2022’s solar growth came from the utility segment. Specifically, the energisation of three massive solar farms, each exceeding 200 MW in scale.

Image: Sunwiz

Those were the Neoen’s Western Downs Green Power Hub in Queensland, Iberdrola’s Port Augusta Renewable Energy Park in South Australia, and Lightsource bp’s Woolooga Solar Farm also in Queensland.

These three projects led to a record year for solar farms being connected to the grid, Sunwiz found.

But while rooftop leads led Sunwiz to an optimistic conclusion for rooftop solar in 2023, this approach has led to a starkly different vision for the utility sector.

For more in-depth data on the solar and storage market in 2022, see the 2023 Annual SunWiz Australian PV Report.

Image: Vestas

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.