From pv magazine USA

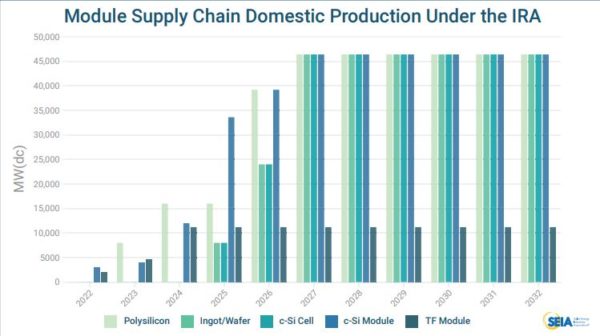

Following the passage of the Inflation Reduction Act (IRA), an energised solar industry is aiming high and envisioning a future where the U.S. has a robust domestic energy supply chain. The Solar Energy Industries Association (SEIA) released a roadmap to achieve this goal, with a target of 50 GW of annual solar manufacturing capacity by 2030.

The U.S. has been plagued by numerous pressures threatening the supply of solar modules imported from overseas. With decarbonisation and climate goals under threat due to this shortage, the U.S. is now turning to boosting domestic manufacturing to power the energy transition.

The Department of Energy (DOE) said, “Greatly expanding U.S. PV manufacturing could mitigate global supply chain challenges and lead to tremendous benefits for the climate as well as for U.S. workers, employers and the economy.”

The DOE concluded in a study that U.S. production could reach 10 GW in two years, 15 GW in three years and 25 GW in five years on its path to 50 GW annual production.

SEIA said domestic manufacturers should focus on building downstream production first, backfilling components with imports while upstream domestic production is built out. While scaling domestic module capacity will take 2-3 years, it will be 3-5 years before there is significant domestic manufacturing capacity for ingots, wafers and cells.

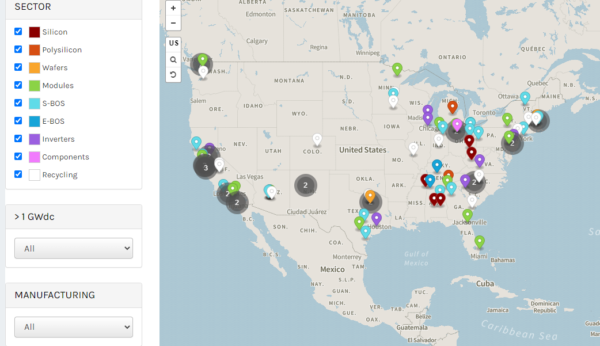

The DOE tracks the capacity of domestic manufacturing nationwide. Where does the U.S. stack up in relation to its goals? The figures below represent active capacity, which is set to expand dramatically following numerous investment announcements following the enactment of the Inflation Reduction Act of 2022.

The traditional solar module supply chain begins with silicon or polysilicon sourcing. DOE tracks eight polysilicon or silicon metal facilities active in the U.S. with a combined capacity of producing 244.4 kilotons of refined material each year. The largest silicon metal facility is a 73 kiloton fabrication in run by WVA Manufacturing in West Virginia. The largest active polysilicon site is the 32 kiloton-per-year Hemlock Semiconductor, operated by Siemens AG.

Next along the value chain comes refined polysilicon ingots. The DOE tracks no active polysilicon ingot manufacturing capacity in the U.S. thus far.

After ingots are formed, they are further refined into polysilicon wafers. DOE reports only one wafer facility inside the U.S., a 20 MW per year facility run by CubicPV in Massachusetts.

Wafers are then converted to cells. DOE does not report any cell manufacturing capacity in the U.S. This is set to change as Hanwha Qcells announced a USD 2.5 billion ($3.8 billion) investment in a vertical module value chain. The company plans to manufacture 3.3 GW of solar ingots, wafers, cells, and finished modules in Cartersville and Dalton, Georgia, creating 2,500 clean energy jobs.

(Read: “Next-generation factories promise a brighter future for solar manufacturing“)

Cells are then integrated as solar modules, often known by the public as solar panels. The two main types of solar modules manufactured in the U.S. are polysilicon and cadmium telluride (CdTe).

In total, DOE reports 16 polysilicon module manufacturers with a combined total of 5.6 GW of manufacturing capacity. The largest operational facility is the 1.7 GW Qcells module manufacturing site in Georgia.

Many manufacturers have announced investment into module manufacturing, including, but not limited to a USD 2.5 billion ($3.8 billion) 3.3 GW vertical value chain committed by Qcells; a 3 GW facility by Enel North America and 3Sun USA; a 1 GW expansion by Mission Solar; and a 1.2 GW planned facility by Philadelphia Solar.

CdTe capacity combines across two manufacturers, First Solar and Toledo Solar, for a total of 2.9 GW per year. First Solar has announced plans to expand its manufacturing capacity to over 10 GW by 2025, investing USD 1.2 billion ($1.8 billion) to achieve this growth.

Next time, pv magazine will track the manufacturing capacities of essential components like racking, trackers, inverters, and energy storage systems.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.