Australia’s oldest coal-fired power plant Liddell retired completely in the last week of April 2023 after 52 years. This giant of AGL, which had a total registered capacity of 2,000 MW, operationally acted as a 1600 MW station and 1200 MW after the closure of its third unit. Australia’s transition to clean energy is in progress.

How did the National Electricity Market (NEM) cope in the aftermath of such a large unit going offline? Here we look closer at what compensated for the void of Liddell in New South Wales (NSW), the trends in imports and electricity prices of NSW, and the impact on neighbouring states.

Image: Cornwall Insight Australia

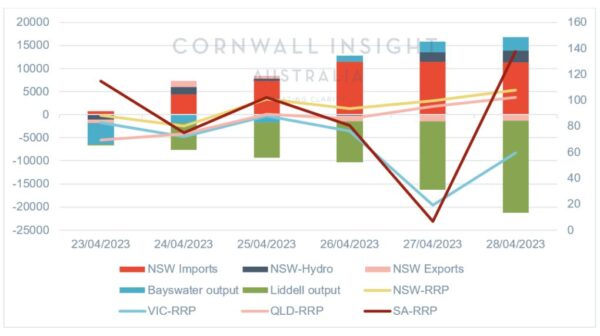

The green bar in the chart above indicates the gradual decrease in the energy from the Liddell power station from 23to 28 April 2023. The fourth unit of Liddell (LD04) was closed on 24 April, supplying 1972 MWh during its last day. The closure of LD02 took place on 26 April, and LD01 on 28 April.

When the Liddell power station was decommissioned, we saw an increase in the output of other local generators and NSW’s imports. The blue stack in the chart shows Bayswater’s generation (which is close to Liddell) over Liddell’s closure week. Hydro generation also increased.

NSW’s daily import level has also increased over the last week as Queensland and Victoria increased output from their local power stations due to the increased flow through their interconnectors to NSW. The power stations in Queensland (Gladstone and Kogan Creek) only produced 33048 MWh/day on 23 April, which rose to 35869 MWh/day on 28 April. This almost shows an 8.5% increase in the total generation. Similarly, the power stations in Victoria (Yallourn W, Loy Yang B and Loy Yang A) generated a total of 84,662 MWh/day on 23 April. This has raised to 92209 MWh/day on 28 April, which shows an increase of 8.9% of overall generation from brown coal. Hence, the wholesale prices have increased in these states as well.

In conclusion, the state has managed the closure of Liddell with hydro generation and imports. However, considering the future coal retirements and NSW’s dependency on this generation type, further development in renewable energy and batteries is important for the state. Otherwise, the impact on the state and the neighbouring states may deteriorate when the upcoming closure of Eraring occurs in August 2025.

Nevertheless, programs such as the recently announced tenders for allocating Long-Term Energy Service Agreements (LTESAs) to new renewable and battery projects to support the energy transition in NSW are a good initiative, providing additional capacity to replace the upcoming coal retirements in the state.

Author: Darshitha PP, energy market analyst intern, Cornwall Insight Australia

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.