Fortescue Future Industries (FFI) Director Guy Debelle said the sheer scale of the United States’ $550 billion (USD 369 billion) Inflation Reduction Act (IRA) threatens to overwhelm Australia’s renewable energy advantages, drawing investment dollars out of the country and locking up potential export markets.

Debelle, formerly FFI’s chief financial officer and now serving as a director of mining giant Fortescue’s green energy branch, said Australia is well positioned to take advantage of the growing demand for the zero-emissions fuel but needs to act fast or risk being left behind in the race to grab a share of the global green hydrogen market.

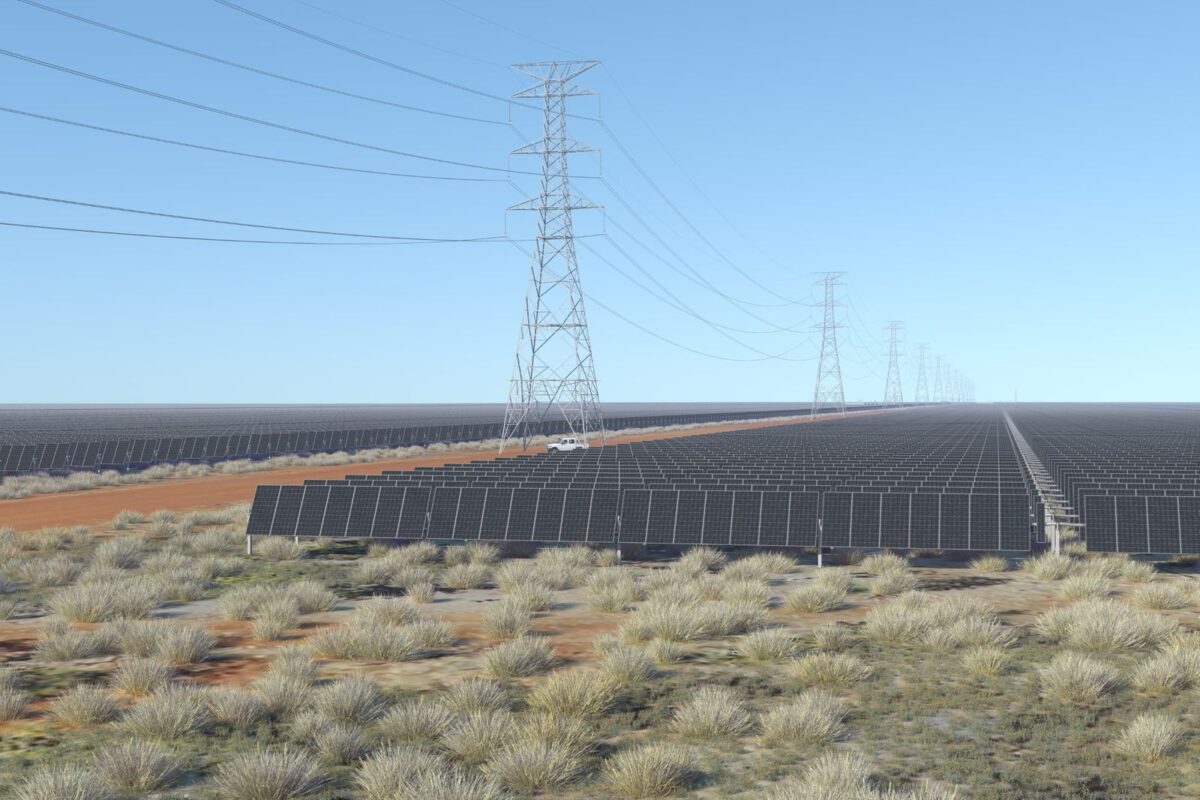

Speaking at the recent Australian Hydrogen Conference in Brisbane, Debelle said Australia’s renewable energy advantages make it an ideal location to generate green hydrogen. He also highlighted that Australia has a long history as a reliable energy exporter to nations such as Japan and South Korea but said the enormity of the IRA threatens to snap up those markets.

“I think it’s a material threat to us in terms of those export markets,” Debelle said. “There’s a real risk that with the U.S. getting their headstart on us through the Inflation Reduction Act they are going to lock up a fair chunk of the Japanese and Korean markets.”

“We have great potential here in Australia and we have great comparative advantage but … if you throw upwards of a trillion dollars at something, that tends to buy a comparative advantage.”

“I think it’s a really serious risk that by the time we get our act together, that market won’t be there for us.”

The Australian government has been overt in its ambitions to establish a green hydrogen sector with Energy Minister Chris Bowen describing it as “the heart” of the government’s vision for the country as a renewable energy superpower.

Bowen’s ideal is backed by the federal Department of Climate Change, Energy, the Environment and Water which in the latest annual State of Hydrogen report, says Australia has the foundations to become a global leader in green hydrogen.

Australia’s announced pipeline of major announced green hydrogen projects totals more than 100 projects worth an estimated $230-$300 billion of potential investment. This represents close to 40% of all global clean hydrogen project announcements.

The department does however caution that most of the announcements in this pipeline are yet to reach final investment decisions and Australia already lags other key global players in the number of large projects that have moved from planning to implementation.

Debelle said that bottleneck must be addressed quickly or Australia risks getting left further behind green hydrogen, to take full effect in the coming months.

“The Inflation Reduction Act got legislated last August, the details are going to be put in place this August,” he said. “Once that’s there, then you’re going to see projects hitting the ground in the U.S. pretty much straight away. Those projects are happening and they’re starting this year, not next year, this year. We need to start soon.”

Debelle said the federal government’s budget announcement of a $2 billion program to scale up development is “a good start” but said it must rolled out quickly and be accompanied by a clear strategy for it to have any chance of success.

“What we’ve got to realize here is that we were starting a long way behind,” he said. “We’ve got to be careful that we don’t sort of take too long to follow through on the announcements. The sooner we can see the details of the Headstart program and move forward with them the better.”

The Hydrogen Headstart program will provide revenue support for investment in renewable hydrogen production through competitive production contracts.

The federal government said the funding would “help bridge the commercial gap for early projects” and put the country on track to develop a gigawatt of electrolyser capacity by 2030 via two to three “flagship projects”. Those supported projects are expected to become operational by 2026-27.

“We can’t match the IRA across the board but I think a more targeted response to it … is achievable particularly if we think about it as an investment in the future,” Debelle said. “It’s not just money out the door, it’s investment.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.