The price of solar panels in Australia started to fall around June, but solar and storage analyst Sunwiz says we are still yet to see the full ramifications of the global supply glut.

Adding to this global situation is the fact major manufacturer Tongwei Solar, which sells in Australia mostly under the brand TW Solar, has blazed into the Australian market this year, shifting former marketshare dynamics.

Tongwei shakes up Australian panel market

Although Tongwei is an established company, it formerly had no presence in the Australian market and was largely focussed on upstream solar manufacturing. It began seeking out Clean Energy Council approval for its own brand of panels in 2020, but has significantly ramped up its presence in 2023.

“Definitely the entrance of TW Solar in the market has shaken things up,” Sunwiz managing director Warwick Johnston told pv magazine Australia.

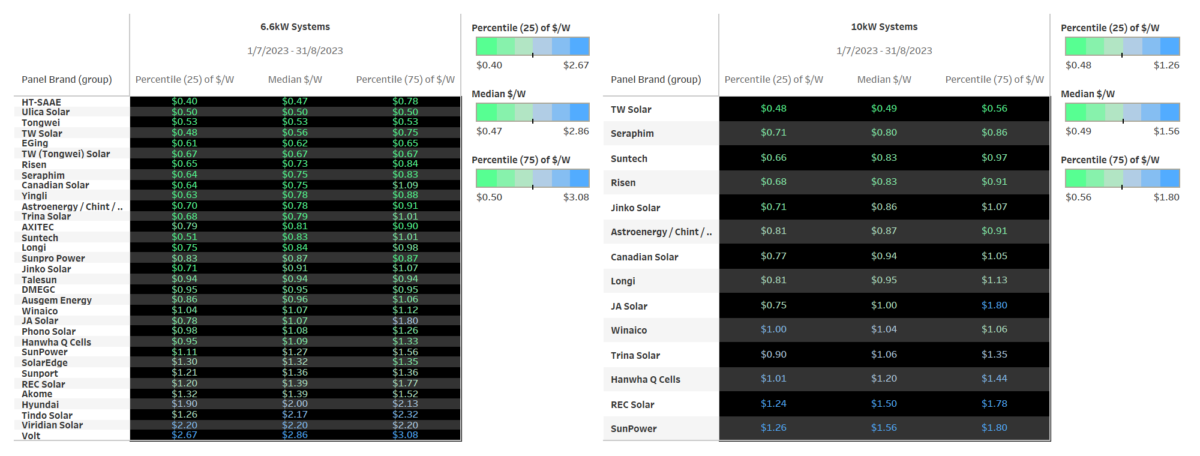

Image: Sunwiz

Despite being competitive in its pricing, it appears TW Solar has actually carved out most of its marketshare from the premium end of town, Johnston says. Premium panel marketshare was previously sitting at around 20% and is now down around 10%, he noted. “So it feels like Tongwei’s taken it from the premium end.”

Moreover, Tongwei are “not the only ones knocking on the doors of Australians,” Johnston says, noting a recent uptick in manufacturers expanding into the Australian market.

“So there’s super cheap panels that are coming through and everyone will have to adjust their prices accordingly,” he says.

Global price free fall yet to hit Australia

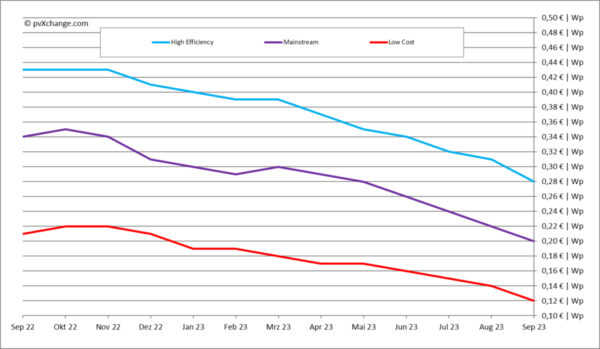

The entrance of new players coincides with the global free fall in solar panel pricing, of which pvXchange’s Martin Schachinger recently said: “Never before in the history of photovoltaics have panel prices plummeted so significantly in such a short space of time.”

On average, global prices in all module categories have been corrected downwards by around 10%. It is worth noting that module prices rose by more than 50% between October 2020 and October 2022, so until recently, solar prices were higher than they had been for a long time.

“Now things have completely changed… the speed and intensity of this change, however, surprise even experienced market participants,” Schachinger said, pointing out that increased manufacturing capacity, a module glut in Europe and regulations in the US have shifted the pricing landscape.

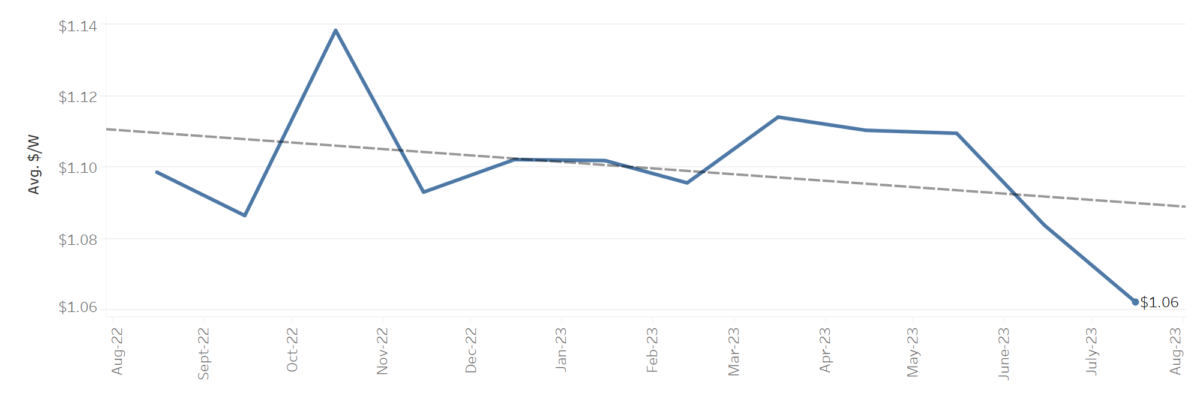

In Australia, the average panel price started shifting down in June, dropping from an average of $1.11/W to $1.06 in August (see top banner graph). While this is a significant drop already, Johnston says the bargain prices panels are selling for internationally haven’t even reached Australia yet.

“It takes a while for those things to flow through to Australia,” he says. “But it’s going to flow through.”

Obviously this benefits consumers, but it isn’t good news for Australian solar companies. As Sunwiz noted in a recent article, “the plunging price of solar panels is the biggest challenge emerging for Australian solar industry.”

“This plunge will have a wide-felt, mostly negative impact across panel manufacturers, distributors, retailers… and even inverter manufacturers,” it added.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.