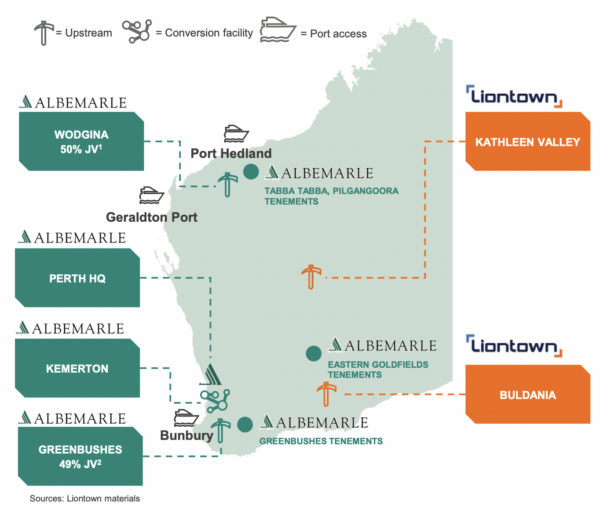

Formerly known as the Export Finance and Insurance Corporation, Export Finance Australia will now be providing finance to Liontown’s Kathleen Valley Lithium project in Western Australia after US giant Albemarle to withdrew its $6.6 billion bid for Liontown following a buyout from Gina Rinehart’s Hancock Prospecting.

The Australian government agency will provide $220 million to prop up the lithium mining project, which is one of the largest and highest-grade hard rock lithium deposits in the world. The Kathleen Valley mine is aiming to export 500,000 tonnes of lithium internationally, mostly to South Korea and the US.

Back in September, the board of Liontown Resources backed Albermarle’s refreshed bid for the company and its assets. Soon thereafter Rinehart set about upping her stake in the publicly listed Liontown, growing it from an original 4.9% stake to a 19.9%, spending $1.3 billion to do so, according to the Australian Financial Review.

The activity ultimately caused Albermarle to withdraw its $6.6 billion takeover bid, saying “growing complexities associated with the proposed transaction” meant that the takeover was “not in Albemarle’s best interests.”

Image: Albemarle

The corporate turbulence has no doubt cast doubts over how the major project will proceed, as Liontown had been targeting production from as early as next year, and already secured offtake agreements with Tesla and South Korean battery giant LG Energy Solution, and Ford.

Export Finance Australia will providing the funds through an export credit agency (ECA) facility, alongside a syndicate of commercial banks and funders, Australian Resources Minister Madeleine King said.

“The ECA Facility will also allow for the potential later participation of export credit agency counterparts, the Export-Import Bank of the United States (EXIM) and the Korea Trade Insurance Corporation (K-Sure) in the project, subject to EXIM and K-Sure eligibility criteria and credit and risk requirements being met,” her announcement noted.

Provision of EFA finance is subject to all financing conditions and regulatory approvals being met.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.