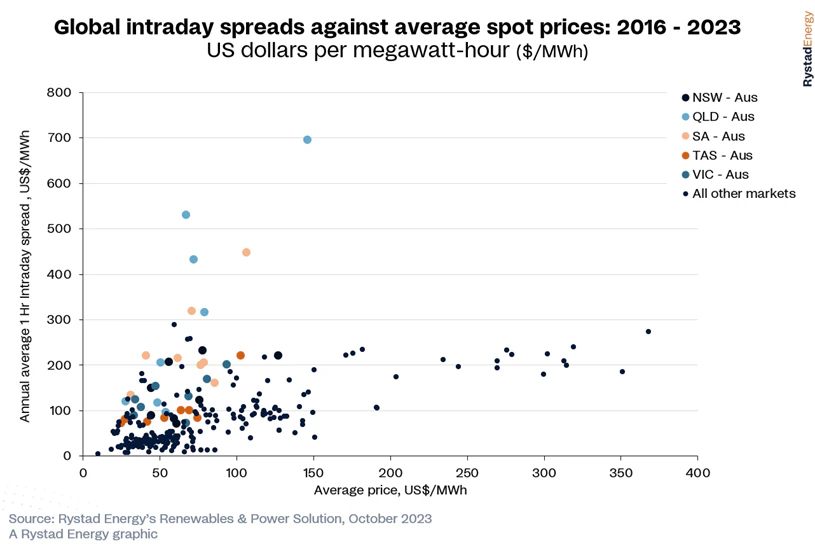

Queensland and South Australia have the widest spreads of all domestic markets, but Rystad’s label of ‘most volatile market’ relates to Australia’s National Electricity Market (NEM) as a whole, encompassing Queensland, New South Wales (NSW), Victoria, Tasmania and South Australia.

Rystad analysed public price data from 39 electricity markets globally and found that Australia’s NEM is experiencing the most fluctuations in daily prices of any system.

The key metric used to measure volatility was the average one-hour intraday spread for a year of data, i.e., the difference between the highest and lowest price during a given hour, it said.

This volatility is the result of losses of supply from unplanned coal generation outages and transmission line problems caused by natural disasters such as cyclonic winds or bushfires, which have become more frequent and devastating in recent years, Rystad said.

“Extreme price fluctuations are also down to high solar power penetration. While daytime generation is high, pushing prices down, elevated natural gas prices are causing soaring rates in the evenings and at night when solar generation falls and gas-fired generation is needed,” Rystad said.

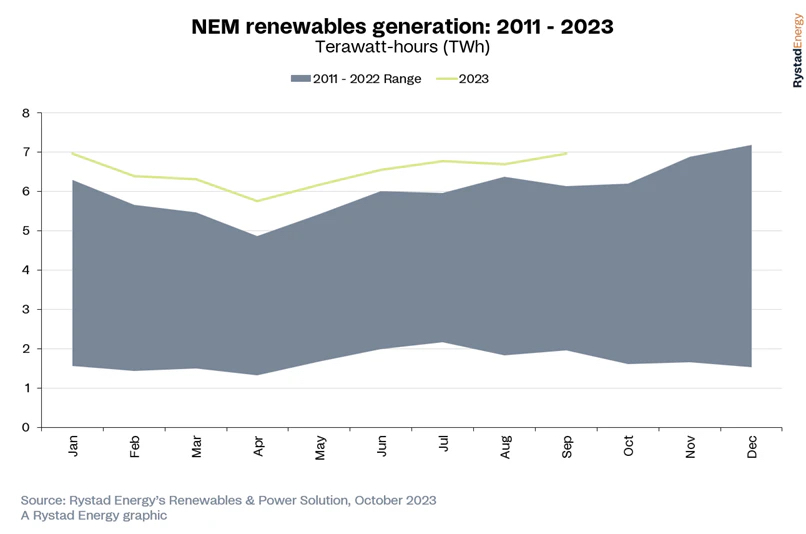

The company also noted that solar has driven significant renewable energy growth in Australia in the past year. Australia’s total renewable energy output reached 7 TWh, up 13% year-on-year. “Solar accounted for most of this increase, generating 1 TWh more than in September 2022,” Rystad said.

On the other hand, wind generation basically remained steady, increasing just 1% year-on-year, while hydro generation dipped slightly.

Rystad noted that storage is the solution to these volatility woes – something already well known. Australian governments have been pushing schemes to accelerate the rollout of storage, most notably with the federal government’s new Capacity Investment Scheme, auctions for which kicked off this year across the country.

Given energy arbitrage is one of the primary income streams for storage projects, high volatility should help propel more projects in Australia.

Rystad says a total of 46 GW and 640 GWh of pumped hydro and utility-scale battery storage capacity will be needed to balance the Australian market by 2050. It noted Australia currently has just 2.8 GW.

Other global electricity markets with high volatility included Japan and the Philippines, plus select regions of the US such as California and Texas.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.