Australian startup the National Renewable Network (NRN) says it has found a model to fit Australian households with no-cost rooftop solar and home battery systems. The systems in its program are not owned by the households, with full control handed over to the energy retailers.

The approach hinges on the value aggregated household fleets can provide to these retailers, which NRN says is substantial enough for retailers to then pass on discounted energy rates to the households, incentivising installation.

On average, NRN says its model saves households over $750 annually. For investors, NRN founder and Chief Executive Officer Alan Hunter tells pv magazine Australia there is a “double digit internal rate of return.”

NRN has today announced its formal partnership with Diamond Energy, which has been in the works for some time now.

“By working with NRN we’ve been able to help deliver a no upfront cost solar and battery solution. Our unique solution helps make the solar and battery even more affordable to our customers with the benefits delivered through our electricity bill,” Diamond Energy’s Mark Bertoncello said.

‘Customer is really the retailer’

As a company, NRN is positioning itself in the background, allowing retailers to design and name their own particular deals, as is the case with the Diamond partnership.

“We’re just the infrastructure behind it,” Hunter said. “The product is led from the energy retailer to the customer, they build their own plan… so either they will sell energy from the grid or behind the meter at the same cost, they may split the cost separately, they may do a subscription plan.”

The value NRN brings to energy retailers rests largely on hedging, the contracts they put in place to protect against the risks of price fluctuation in the day-to-day spot market. Having full control over an aggregated distributed energy resources (DER) fleet is valuable to retailers because it helps them balance their position.

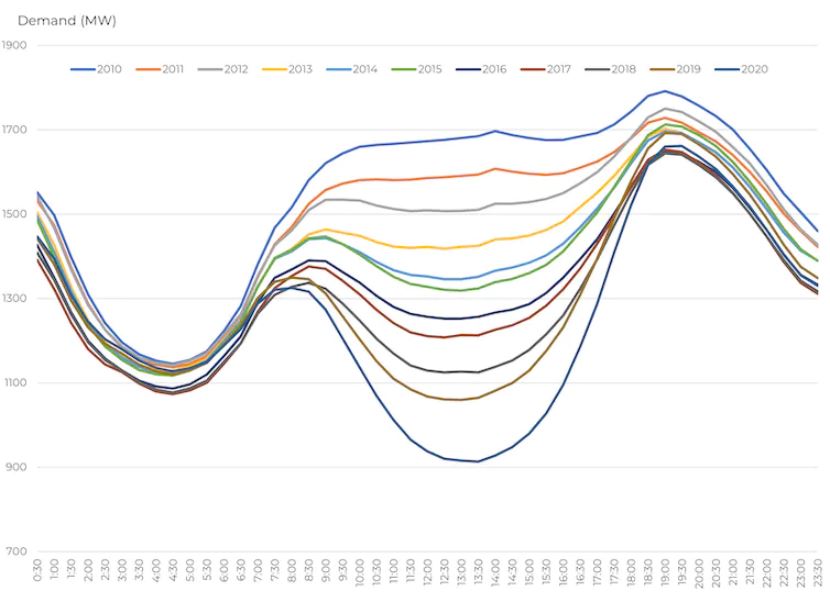

“We are removing the customer’s incentive for this (DER) system,” Hunter said. “So the retailer is able to use these assets to balance their hedging position and actually get energy contracts that could be significantly cheaper because they are flatlining the load profile of their portfolio.”

“We simulated that we can reduce a load-following hedge by $36 / MWh through flatlining and managing the VPP (Virtual Power Plant) accordingly,” he adds. “That value is so big for a retailer.”

Image: Supplied

“It’s just that curve. We are seeing more and more customers being incentivised to go out and buy a solar system which is just destroying the curves for the retailer,” Hunter said.

In terms of how NRN itself makes money, Hunter said it basically comes down to taking a clip from the four stakeholders who use its platform, including retailers, investors, installers and customers.

Issue of control

In NRN’s system, households won’t be promised energy independence, which is traditionally a strong selling point for home batteries, and one of the reasons VPP uptake remains so low.

This issue of control, however, matters significantly less since customers actually haven’t paid for the system. “There’s this whole balance of conflict between retailer and customer if the customer owns that system and tries to pass [to the retailer] the tools to operate it,” Hunter said.

“We’ve basically given all the whole tools to the retailer. There’s no customer interest here, the interest is that you’re going to decrease your cost, optimise the asset for that, and then you’re going to pass on cheaper rates to your customer.”

Balancing act

Solar veteran and Head of Business Development at Solar Analytics, Nigel Morris, is intrigued by NRN’s model, especially its emphasis on energy retailers, but notes solar balancing acts can be “complicated territory.”

“I think it’s really cool when people find new ways to extract value out of the larger energy market and it’s a real interesting sign of maturity in the solar sector that we can do that,” Morris told pv magazine Australia.

There have been a number of different iterations of what Morris describes as a ‘full wrap’ strategy, from residential Power Purchase Agreements (PPAs), VPPs, to centralised and wrapped product suites like that being forwarded by 1Komma5, and more recently subscription-based models like the newly launched proposition from Lavo.

“It all seems great, but there’s a lot of real world stuff that gets in the way of it all working,” Morris said.

Some of these real world issues come down to technical complexity butting up against limited returns, as in the case of VPPs, as well as more nebulous problems, like consumer skepticism and installer tendencies.

There are few customers who trust companies and energy retailers to have their best interests at heart, Morris said, noting “Australians are inherently skeptical,” especially about offers which seem ‘too good to be good true.’

Such things have been on Hunter’s mind too, who acknowledges that “debunking that whole ‘sounds too good to be true’” will be a hurdle for the company. He is adamant, however, that NRN has the “numbers and transactions that show every stakeholder is winning.”

“Building out the platform has been hard. But we have the right legal structure now, we have the right stakeholders involved,” he said.

To Morris’ eyes, NRN’s key point of difference is the company’s focus on value to the retailer. “I like the innovation… I do not understand the risk though and I do not understand how hard they are leveraged,” he said of the company’s more intimate inner-workings. “The fundamental issue is you still have a finance cost, you’ve got investors, you’ve got fees, admin, you’ve got a lot of things to juggle.”

NRN’s plan

NRN is planning to inject $100 million into fitting renewable systems on 15,000 homes over the next three years. In the more near term, Hunter said the company already has about 500 homes committed to systems in deals with four different energy retailers to deploy over the coming six to nine months.

To date, it has deployed more than 1 MW of solar and batteries systems into the Queensland, New South Wales, Victorian and South Australian markets, mostly through its partnership with Diamond Energy.

In terms of funding this expansion, the company has just completed a $13.5 million seed raise, which includes both equity and debt.

Getting installers onside

Morris thinks another key challenge NRN will face is getting enough installers on board. Installers, he said, have traditionally been hesitant about new models that stray too far from the traditional sell/install approach.

Each NRN-programmed rooftop and battery household will carry a 10-year maintenance contract for solar installers worth $5,000. Something which Morris says is “an attractive story for an installer who is willing to think outside the box.”

The role of VPPs

After much excitement, VPP programs in Australia are still struggling to find their feet. Subdued uptake among consumers is often credited to this issue of control and energy independence flagged above. The other component is that VPP’s financial returns are often fairly “marginal,” Morris said.

“We know a VPP is really worth a couple of hundred bucks to an end user. That’s about the most value you can get out of a VPP and there’s volatility around that,” he said. “It’s part of the reason VPPs haven’t taken off.”

“There’s an awful lot of variables and to build the software architecture for that is very, very complex and you’re dealing with lots of different manufacturers of different equipment who have their own issues around comms and reliability and connectivity. So getting architecture right is a very significant challenge.”

Given the distributed home solar and battery systems within the NRN platform are centrally owned, rather than purchased at the whim of individual consumers, the company is hoping it can smooth some of these kinks.

Expanding access to renewables

NRN is also selling a promise of giving more Australian households access to renewable technologies. Renters and low-income earners have traditionally been locked out of the solar market, which in turn means they suffer more from growing costs as networks and retailers try to claw back some of the pie rooftop solar has undercut.

Hunter said NRN’s contractual structure enables renters to access its program, but notes it is still a sticky issue.

“We are over the years going to make that a lot smoother,” he said. “We want to see how we can work with local governments or councils to incentivise the landlords,” he says. If NRN’s platform could offer landlords a cash incentive, say $1,000, to install a system, then Hunter thinks they would be far more likely to bother with the process.

He believes NRN’s system is simple enough for landlords to navigate, the issue is “just that commercial driver.”

That’s a wrap

“These holistic wraps, whether it’s through a model like this [NRN] or whether its 1Komma5 or whoever… whoever can successfully wrap intelligent software, better service and more value together for customers and convince them and the network and installers to actually deploy it, that is the next realm for us,” Morris said.

“We’re now able to help energy retailers with these aggregated fleets, so it’s a really, really interesting thing. If it’s going to be a success or not, time will tell.”

“These companies seem to be finding new ways to extract value out of the energy market. If they can find more ways to extract more value from DNSPs, retailers, or whoever it is, then everyone benefits because then there’s more money in the pot. Of course, the real world is a bitch.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.