As the decarbonisation deadline draws ever closer, there was a resounding damnation of yesteryear’s “piecemeal approach” among the attendees of 2022’s All Energy event. This holds as true for the big picture national energy strategy as it does for the residential segment, where brands like QCells, Maxeon SunPower, even SMA sought to demonstrate their new energy ‘ecosystems.’

The problem this strategy seeks to solve comes down to fatigue. Shopping for solar is exhausting, and every additional technology from the inverter to the home battery adds another layer of complexity. The assumption is then that by making one sleek, integrated product family, the customer can have a single point of contact under a single brand with a single bill and single warranty set, allowing them to take a singular sigh of relief.

“There’s a real need for simplicity and one of the ways to deliver simplicity is by stacking things together from one provider,” Mick Fell, General Manager at Qcells Australia, tells pv magazine Australia.

The premise is hardly novel – as Fell points out, it is how the majority of Australians today came to have their smartphones. That is, a telco company aggregates hardware, software, and services into one offering so tight “we just don’t think about it anymore,” Fell says.

Like these mobile plans, energy propositions are increasingly including a finance component, which enables customers to pay month to month, rather than outlay one great expense at the get-go.

“I think the thing that makes a massive difference for integrated solution providers is, instead of saying ‘here’s a solution, give me $20,000,’ is saying ‘here’s a solution, it will deliver a service which is equivalent to the service you used to get from your old electricity provider at a cheaper price and you’ll get one bill,” Fell says.

But in a country like Australia, where the majority of low hanging solar homes likely already have the technology, the question becomes: is the remaining market big enough to warrant all these branded home energy stacks?

Integrated solutions boom in maturing markets

In regions where the rooftop segment is still nascent, integrated solutions are proving an important selling point, Managing Director for BayWa r.e Solar Distribution in South East Asia, Junrhey Castro, tells pv magazine Australia.

In countries like Thailand and the Philippines, fully integrated systems with battery storage and electric vehicle (EV) charging are, Castro says, in fact inspiring investment in the residential sector. This is especially true in wealthy circles, where technologies like solar and EVs add to social status.

Likewise, integration has been decisive in Europe. In countries like Germany, where Maxeon Solar Technologies’ Executive Vice President Ralf Elias heralds from, the vast majority of rooftop solar systems today are installed as a component of a larger, integrated home energy suite.

For Elias, the value of this integration became obvious when he installed his own solar system a few years ago. The interfaces between products quickly emerged as a “pain point” for him and an issue ripe for solving with better interindustry cooperation.

Building a full stack

Maxeon, which sells in most parts of the world under the SunPower brand, is building its SunPower One suite by working with what Elias calls “category leaders.” As Elias points out, it doesn’t make sense for Maxeon to try to compete with technology experts in different fields, but rather build tight working relationships so their product lines fit seamlessly together.

Image: Origin

Earlier this month, Maxeon announced its partnership with Star Charge, folding its EV charging products into the SunPower One suite. The company has also been working with Enphase, integrating its microinverter solutions, with plans to bring heat pumps, virtual power plants (VPP) and energy automation software into the fold within the next year. For some of these technologies, Maxeon plans to work with several partners to build scope and flexibility.

Which brings us to a clear issue in the full stack strategy – how to provide enough variation to cater to the different needs of households all within the one neat, easily deployable umbrella.

Currently, Maxeon’s SunPower One battery storage hardware and hybrid inverter technology comes from Alpha ESS, with the company offering a 10 KWh battery and 5 kW hybrid inverter.

It will offer more battery sizing options in future, but for the time being this is the standard. To capture the booming interest in renewable systems amid soaring energy prices though, providing appropriate variations for different sized households seems like something that requires addressing urgently.

Image: Energizer

South Korea’s QCells is slightly further along in its vertical stack offering, having already integrated with VPPs and currently offering a modular battery design which can scale to 20.5 kWh. Likewise, Energizer’s Homepower ‘eco suite’ affords customers the ability to scale their batteries to a maximum of 24.4 kWh.

Even German inverter brand SMA is focusing on integration, investing significantly to build its software and grow its energy management platform, alongside its EV charger and home battery offerings, Boris Wolff, SMA’s Executive Vice President of Global Sales, told pv magazine Australia.

Funding the full stack

Coming back to QCells though, in October the company announced a finance partnership with loan-provider Plenti. The partnership speaks to the clear need to address cost, since a stacked system is a considerable investment.

This money question also leads back to one about the market’s actual size – especially in Australia. Here, suburbs in a number of states are already reaching up into 50% rooftop penetration – basically all of which has been installed in yesteryear’s dreaded piecemeal approach. With very few of these systems nearing their end of life, a big chunk of the ‘integrated’ market would then appear to be lost.

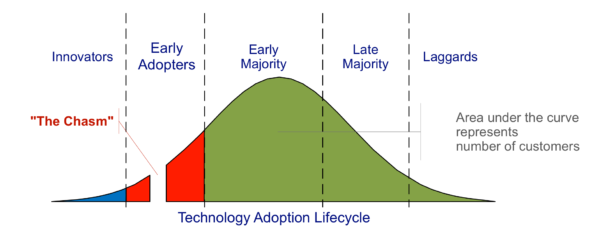

The focus then becomes new customers – households likely falling into the ‘late majority’ segment in the technology uptake curve.

It is a market QCell’s MD Mick Fell acknowledges is relatively small, with roughly 7 million households in Australia “left” without solar, most of which have glaring barriers to entry – be they rented or apartments.

Subsidisation as key

Despite this – he’s optimistic the market will grow, largely at the hands of more comprehensive government subsidies for things like batteries, energy management, EVs and heat pump technologies.

“One way to think about it is ‘let’s grid it all out postcode by postcode, who’s left, who has blockers.’ It’s all very cold and unemotional. The other way to think about it is just to go ‘on the basis of equity, everyone should have access to this,’” Fell says.

“So whether you’re living in a fancy apartment or whether you’re living in a house you own in a country town and can’t afford to put on solar, how do we make it so those people have not just solar but the potential to access things like batteries and EVs and they’re able to electrify and get away from things like gas. I think once you frame the question like that, the answer becomes different.”

Image: Twitter

For Fell, the clearest “answer” is for governments to offer the “quick and dirty” solution of handing money to, say, landlords to install systems on properties they lease.

Complex solutions like neighbourhood batteries – which were given attention in last week’s federal budget – have a greater tendency to stall in Fell’s eyes. While the community approach might grapple with the question of equity in a far more nuanced way, he says the industry just isn’t ready to deliver those solutions in the same way it is ready to deliver rooftop solar and individual batteries.

“Civil and project development of any community asset is hard, even if it’s a playground. Whereas hanging assets on the side of someone’s wall or sticking them in someone’s garage is somewhat easy. Around 10,000 people here are trained to do that right now,” Fell says.

Ausgrid

“The industry is set up to deliver solar on roof, battery in garage and increasingly providing services [like VPPs] to customers who are interested and signing up to them. Certainly the electricity retailer industry has been around for years as a competitive industry and it’s very good at what it does when it goes out there to acquire customers and so all these things are things that people know how to do.”

Certainly, integrated product suites do hold clear promise for easy and rapid installation, and a faster rollout overall.

But realising this will also require retailers and installers to adjust their business approach, moving from bundling their own favoured technologies to selling under single brands.

To this end, Maxeon’s Vice President for APAC Sales, Chris O’Brien, says the company has focused on providing a single tool for their retail partners to use to design customer’s product suites. Again, O’Brien told pv magazine Australia, the goal is on ease which, in turn, will hopefully lead to efficiency.

Whether governments will indeed open the subsidy flood gates that would enable a significant market for these fully stacked suites in Australia, only time will tell.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.