New research published by the Western Sydney University (WSU) shows that there has been a decrease in lead times for solar projects in Australia but the time taken for the commissioning process has increased from three months to six months.

The study, published in Energy Economics, investigated the lead times for 170 onshore wind and solar projects completed in Australia between 2000 and 2023. The researchers focused on the pre-construction and approvals stage (including site selection, feasibility assessments, planning approvals, and environmental approvals), and then the construction and commissioning stages.

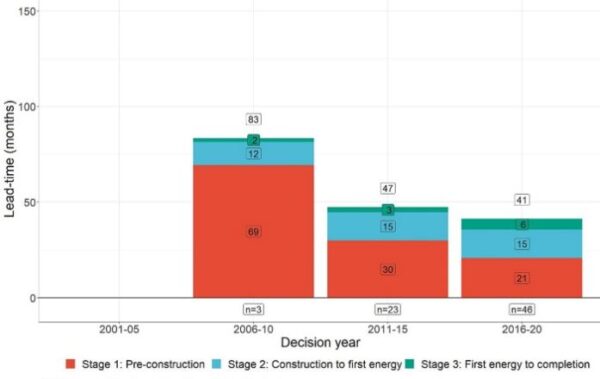

The study found that there has been a notable improvement in overall lead times with solar projects that commenced before 2010 requiring an average of 83 months from ideation to commissioning. This decreased to 41 months for those projects that commenced after 2016.

While the overall time required to deliver a project decreased – which implies that the approval process improved – the study found that there was an increase in building and commissioning lead times from 14 to 21 months, due mainly to longer commissioning periods.

“There is evidence of increased lead times for existing projects that are nearing completion, especially for solar projects where this step used to take about three months but has increased to six months or more,” Report co-author Thomas Longden said.

“A couple of recent solar projects have taken more than a year for this final step.”

Longden, a Senior Research Fellow at WSU’s Urban Transformations Research Centre, said one issue that has increased lead times in Australia was the 2017 change to how renewables projects are tested, introduced as a response to the South Australia statewide blackout of 2016.

On average, commissioning took up to seven months longer after the changes were implemented.

Image: Western Sydney University

With only 71 months until 2030, Longden warned that any delays in project development means Australia is at risk of missing its end-of-decade goals, notably an 82% use of renewable energy across the power system.

“These lead times indicate that the window for meeting our 2030 renewable energy targets is closing,” he said. “With 40-to-50-month lead times, most of the required projects would need to start being planned in the next couple of years.”

It is estimated that 10,000 kilometres of new transmission, 44 GW of new renewables and 15 GW of firming capacity needs to be delivered this decade to meet the target.

The report suggests that one way to expedite the delivery of renewables projects would be for all states to adopt a ‘one-stop shop’ approach for applications.

“This should include maximum response times for authorities to assess each step of the process,” Longden said. “Allowing suitable projects to be treated as expansions of existing sites could also improve administrative procedures.”

Some recent projects had lower lead times as they were built in multiple stages using the same or a similar set of approvals. This approach of modifying a previous approval has already been used when approving grid-scale batteries as a co-located asset.

A similar study of 48 countries was completed by Swiss scientists, which found average commissioning times have increased over the past two decades for all clean energy technologies, concluding although PV required the least time to commission, deployment of utility scale solar plants increased between 2015 to 2022.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.