Rystad Energy is forecasting pumped hydro energy storage technology will play a key role in Southeast Asia’s future energy market, projecting a nearly eightfold increase in capacity in less than a decade and an estimated total investment of up to $106 billion (USD 70 billion).

Fossil fuels currently supply 64% of the region’s power generation but with the shift to clean energy technologies gathering pace, reliable and renewable energy storage solutions are crucial to enhance electricity system flexibility and bolster grid reliability.

Rystad Renewables and Power Analyst Nevi Cahya Winofa said pumped hydro’s ability to provide long-duration storage, while delivering many of the grid regulating functions traditionally provided by coal-fired power stations, makes it a critical part of the future energy system.

“Pumped hydro shines as a promising solution to meet growing energy storage demands, essential for maintaining grid reliability as Southeast Asia incorporates more variable renewable sources such as solar and wind,” Winofa said.

“Nevertheless, policymakers and developers must implement effective risk management to address the various challenges and uncertainties inherent in the operation of pumped hydro ensuring their seamless integration into the region’s energy landscape.”

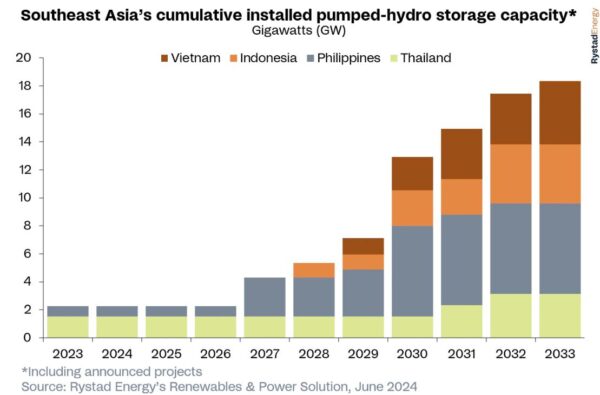

Data supplied by Rystad shows there is currently 2.7 GW of pumped hydro storage under construction in Southeast Asia, with 13.3 GW in various stages of development, predominantly in the Philippines and Thailand.

Thailand has the most existing capacity but the Philippines is expected to soon surpass it with about 5.7 GW of capacity in the pipeline and government policies favouring pumped hydro installations continuing to support the technology.

The country’s upcoming Green Energy Auction Program, anticipated in the second half of 2024, is expected to offer 3.1 GW of pumped hydro capacity.

Similarly, Indonesia, Vietnam and Thailand are progressing with pumped hydro through policy frameworks. Thailand has 1.6 GW slated for development while Vietnam and Indonesia have about 4.5 GW and 4.2 GW of pending capacity, respectively.

Rystad said state-owned utility companies dominate pumped hydro projects in most of Indonesia, the Philippines, Vietnam and Thailand.

“The high upfront costs and the long time it takes to see a return on investment make pumped hydro projects less attractive to private companies,” the consultancy said. “Additionally, the licensing process can be unpredictable, dragging out project timelines and adding risk for potential developers.”

Indonesian state-owned utility company PLN is currently the biggest developer of pumped hydro in Southeast Asia, with 3.7 GW of projects in the pipeline.

The roll out of pumped hydro projects is also gathering pace in Australia, where the energy market operator has calculated 74 GW of firming capacity will be needed by 2050 to support the energy transition.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.