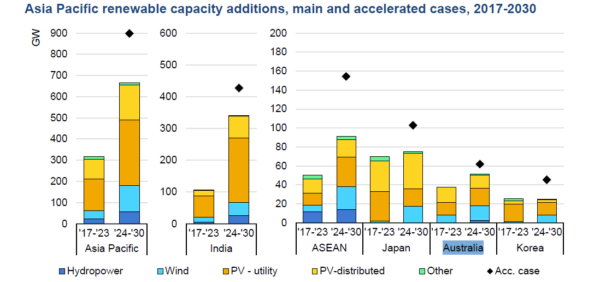

Paris-based International Energy Agency (IEA)’s Renewables 2024 report has forecast Australia will add 53 GW of renewable capacity between 2024-2030, with a nearly 65% share of solar, split between utility scale (55%) distributed applications (40%) and systems dedicated to hydrogen production (5%).

Forecasting the global share of solar and wind electricity generation will rise from 13% in 2023 to 30% by 2030, Australia is already in the IEA’s Phase 3 of a possible six variable renewable energy (VRE) generation phases, where the VRE determines the operation of the power system and like Italy and Chile, the net load in Australia resembles the ‘duck’ curve, requiring additional flexibility.

Australia’s solar growth will contribute to the overall renewable additions across the Asia Pacific where 70% will be solar generated across India, Japan, Vietnam, Indonesia, the Philippines, Thailand and Korea too, all providing two-thirds of that growth.

International Energy Agency

Independent think tank Climate Energy Finance Director Tim Buckley said the IEA now models a continued increase in global renewables deployments to 940 GW annually by 2030, a 70% increase in the record of 2023.

“This shows a global ‘bending of the curve’, very overdue in light of the climate science, but a deployment rate considered impossible only a few years ago,” Buckley said.

The IEA’s report says expanding Australian state- and federal-level auctions, rising corporate demand and the high competitiveness of solar systems drive dynamic renewables growth.

“The variable renewable energy generation share is expected to achieve the highest value in the region, and also the highest for a large energy consumer with no cross-border interconnections, stressing the need for significant system flexibility investments,” it says.

Australia has quadrupled its VRE share in 2016-2023 and is expected to double it by 2030, making it one of the global pioneers in managing high VRE energy systems.

The report finds the dominant procurement method in Australia is competitive auctions, while the most market-driven growth in the Asia Pacific region comes from corporate power purchase agreements (PPAs) for solar and wind projects, including in Australia.

“The massive deflation of prices for renewables technologies and the drive for energy security and independence both increasingly favour accelerating investment into renewables as the world looks to mitigate the escalating crisis of climate change, but we need to collectively go faster,” Buckley said.

Energy storage

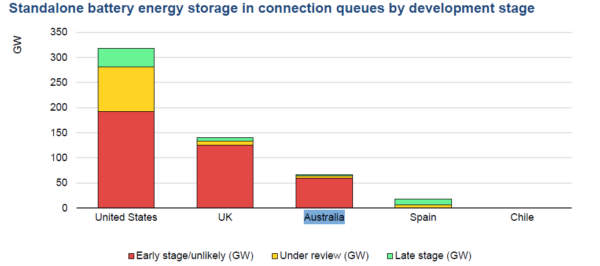

The report estimates 540 GW of standalone battery storage projects are currently in grid connection queues in the United States, the United Kingdom, Spain, Chile and Australia and of this capacity, over 55 GW is in late stage development.

The United States has the highest amount (64%), Spain (19%), the United Kingdom (12%), Australia (5%) and Chile, less than 1%.

International Energy Agency

Renewable hydrogen

Global installed electrolyser capacity is forecast to increase by 47 GW over 2024-2030, reaching almost 50 GW by the end of the decade with China and Europe accounting for over half (59%), and 40% shared across the Middle East and North Africa, India, the United States and Australia.

In Australia, the electrolyser base is expected to grow by 2.9 GW from export-oriented projects and some targeted transport applications both domestic and international.

Government grants for hydrogen hubs and production premiums from competitive auctions under the Hydrogen Head Start auction program can help buoy production, and 3.6 GW of projects in the first round were shortlisted for 1 GW of funding.

Further development hinges on access to low-cost electricity and sufficient capacity to connect additional load to the grid, and does not appear to factor recent withdrawals from the hydrogen market by Origin Energy or Fortescue.

The report does forecast uncertainty for electrolyser deployment in Australia concerning import demand in Europe and Japan with no committed offtake agreements identified in either market.

“Though Australia and Germany’s joint H2Global tender, and Japan’s decision to allow imported hydrogen to receive the subsidy in their new contracts for difference (CfD) could help bring planned projects to financial close,” the report says.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.