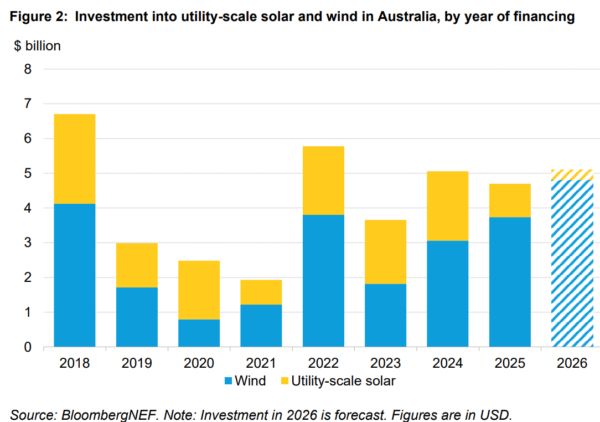

United Kingdom (UK)-headquartered energy analyst company Bloomberg New Energy Finance (BNEF) has forecast Australia is expected to see 2026 investment in utility scale solar and wind projects of $5.1 billion (USD 3.4 billion), though wind will account for 95% of the total.

The BNEFs ‘Australia: 10 Things to Watch in 2026’ paper says investment in utility-scale renewables will stay in line with 2025 levels, rather than achieving new investment records.

“Approximately $7 billion was invested in utility-scale solar and wind in 2025, with the second half of the year seeing a sixfold increase in investment compared to the first half,” the paper says.

“Utility-scale solar investment reached $961 million, down from $2 billion in the prior year. AMP’s 339 MW Bungama PV Plant in South Australia was the largest solar project financed, securing $404 million. The project also includes a co-located 250MW battery.”

Citing government policy as the biggest driver, the paper says to date the Capacity Investment Scheme (CIS) and New South Wales (NSW) Long-term Energy Service Agreements (LTESAs) have awarded support to 15.8 GW of solar and wind projects, but only 3.5 GW of capacity has secured financing to date.

Lengthy state and federal approvals, slow grid expansion, and social licensing issues are listed as primary causes for delay.

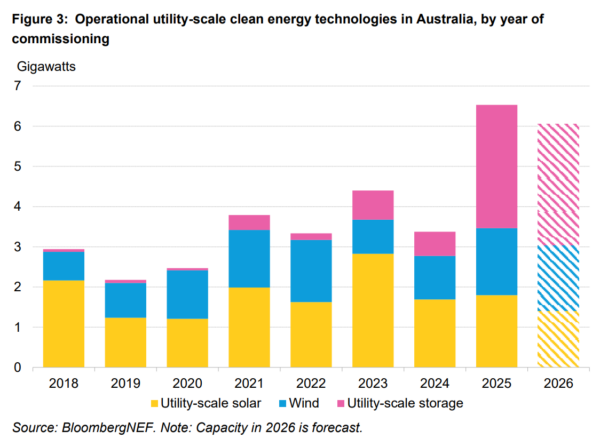

BNEF says utility-scale renewables and storage capacity installations will fail to reach last year’s high when more than 6.5 GW of capacity was commissioned and installations surged 94% year-on-year, driven partly by the increase in storage capacity.

“A record 3 GW / 7.7 GWh of batteries were commissioned in 2025 compared to 0.6 GW / 1.6 GWh in 2024, more than doubling the size of the overall operating fleet to 5.2 GW / 11.6 GWh,” the paper says.

Utility-solar is cannibalising its own value, BNEF says, as solar reaches increasingly higher levels of market saturation.

“Wholesale power prices were negative 18% of the time in 2025 in the National Electricity Market (NEM), particularly around midday when solar generation is at its peak. When power prices are negative, solar generators curtail their generation. Together, market saturation and negative pricing are undermining the merchant value of solar,” the paper says.

“Solar installations are set to fall 21% amid development hurdles and intensifying competition from rooftop solar. New South Wales is expected to lead solar additions with 798 MW, followed by Victoria at 317 MW.”

Other key areas BNEF lists to watch in 2026 include a plateauing of rooftop solar while small-scale batteries continue to boom, wholesale power price volatility will decline and electric vehicle sales will exceed 200,000.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.