CEFC backs developer’s vision for 100% renewables apartments

The Clean Energy Finance Corporation has awarded the Australian arm of Malaysia-headquartered property developer Mulpha an $80 million (USD 53.95 million) loan to help deliver the first stage of an energy-efficient apartment development in Sydney’s Hills district which is to be powered by 100% renewable energy.

New report calls Macquarie Group’s climate commitment into question

Macquarie Group’s commitment to the global transition to net zero emissions by 2050 has come under scrutiny with a new report uncovering billions of dollars in undisclosed exposure to oil and gas projects.

Australia and China strengthen hydrogen cooperation

China’s deputy head of the National Development and Reform Commission is reported to have recently met with Andrew Forrest, founder and executive chairman of Fortescue.

Novonix does $45 million deal with LG Energy Solution

Brisbane-based battery materials and technology company Novonix has sealed a $45 million (USD 30 million) deal with South Korean battery manufacturer LG Energy Solution that is complemented by an agreement between the two parties to jointly work toward developing high-performance, synthetic graphite anode material for lithium-ion batteries.

Global solar additions to hit 310 GW in 2024, says IEA

The International Energy Agency (IEA) said in a new report that solar will remain the main source of global renewable capacity expansion in 2023, accounting for 286 GW. In 2024, the figure is set to grow to almost 310 GW, driven by lower module prices, greater uptake of distributed PV systems, and a policy push for large-scale deployment.

Weekend read: Avoiding PV buyer’s remorse

New entrants to solar equipment procurement may be surprised to encounter constantly amended contract terms, index-linked price rises, and near-worthless defect warranties, but they reflect recent supply chain troubles. Clean Energy Associates’ Martin Deak offers a buyers guide.

Redflow to build 20 MWh redox-flow battery in California

Australian redox-flow battery manufacturer Redflow will build one of the world’s largest zinc-based battery energy storage systems in the United States after inking a multi-million-dollar deal with the California Energy Commission.

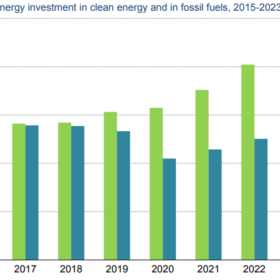

Global investment in clean energy nearly doubles that of fossil fuels

For every dollar invested in fossil fuels, 1.7 dollars are invested in clean technologies. Five years ago, it was a one-to-one ratio, said the International Energy Agency.

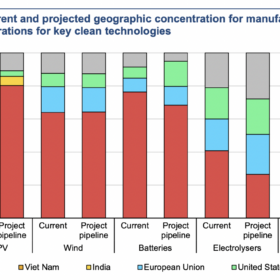

‘Huge subsidy fest’: Australia has the critical materials, but can it compete in the manufacturing race?

A global race is underway to capture the manufacturing market for clean energy technologies. While lady lucky has certainly shone on Australia, competition is fierce, experts say.

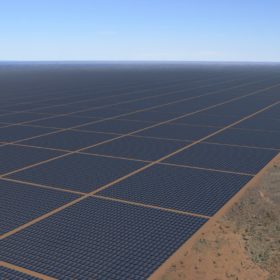

Cannon-Brookes, Quinbrook consortium secures Sun Cable

A consortium led by tech billionaire Mike Cannon-Brookes’ Grok Ventures and including green energy investment manager Quinbrook Infrastructure Partners has been successful in acquiring the giant $35 billion Sun Cable renewable energy project.