Australian firm developing 700 MW floating solar, 1.5 GWh battery, in Sri Lanka supported by government PPA

Victorian company United Solar Group, which is developing a floating 700 MW solar and 1.5 GWh battery project at the Poonakary Lake in Kilinochchi, Sri Lanka, has had a Power Purchase Agreement approved by the Sri Lankan cabinet.

$4 billion expected from sale of Naturgy’s 1.3 GW portfolio-holder GPG Australia

Major Australian renewable energy portfolio holder Global Power Generation Australia, jointly owned by Spain’s Naturgy and an arm of the Kuwait Investment Authority, is reportedly going up for auction early next year.

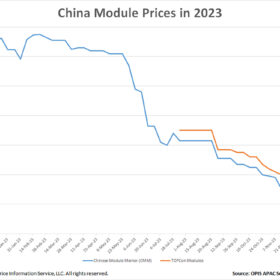

China module prices slide to new lows, manufacturers cut production

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

Nuclear who?

Authors of the “World Nuclear Industry Status Report 2023” define the future role of nuclear energy in the global energy mix as “irrelevant” and “marginal.” The authors add that there were 407 operational reactors producing 365 GW in the middle of the year, which is less than installed capacity predictions for solar by the end of the year.

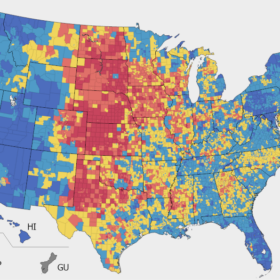

Hail damage accounts for about half of all solar facility loss claims, says GCube

GCube Insurance says that hail damage accounts for less than 2% of filed claims but constitutes more than 50% of total costs for solar facility loss claims.

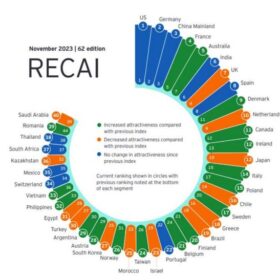

Australia ranked fifth most attractive market for renewables investors

Australia ranks as the fifth most attractive destination for green investment and development opportunities according to multinational consultancy EY’s latest renewable energy country attractiveness index.

Empirical approach shows PV is getting cheaper than all the forecasters expect

With the consistently unambitious forecasts for solar trotted out by entities such as the International Energy Agency (IEA) now a matter of record, a German risk management company has tried to predict more realistic figures for 2030 and beyond.

Rooftop solar is crushing* the returns for large-scale VRE

* rooftop PV is a dominant factor, though there are others… such as the ongoing need for ‘Keeping the Lights on Services’ (which large-scale VRE largely does not supply).

Australian lithium, critical minerals, with Chinese ties unlikely to cash in on US IRA subsidies

A number of Australian critical minerals, including lithium, miners and refiners will likely be ineligible for IRA subsidies after the US government published its draft rules forbidding access to enterprises with over a 25% stake held by Chinese companies or “cumulatively” by Chinese investors.

Origin deal collapse ends Australia’s corporate climate-takeover era

Origin shareholders have voted down the Brookfield-led takeover bid, likely ending what would have been one of Australia’s largest corporate buyouts. The failure of the deal concludes 18-months of bids by private capital to accelerate the sluggish transition of Australia’s two biggest ‘gentailers.’