REZ wriggle on – Queensland and Victoria seek input

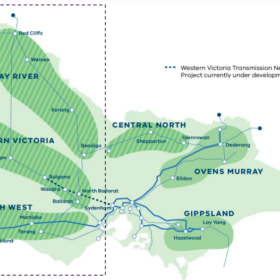

Both Victoria’s and Queensland’s state governments are moving on their renewable energy zones (REZs) with tight deadlines looming for hopeful projects in Victoria, while further north the government is eager to hear from local communities.

‘Good portion’ of NSW’s bus fleet to run on hydrogen as state launches collaboration platform

As Australia’s most populace state, New South Wales, prepares to put out its hydrogen strategy roadmap later this year, the state is planning to use hydrogen to power its public transport fleets and will soon launch a digital collaboration portal.

South Australia’s constrained renewables to be unleashed as four new syncons spin into action

South Australia is a global hero for its demonstration of a rapid transition to renewable generation. But as renewables supplied more than 60% of the state’s electricity, and pushed out coal and even gas-fired generation, cracks appeared in the system strength and inertia required to keep the grid reliably running. ElectraNet has deployed old, clean-running technology — synchronous condensers — to smooth the gaps.

Looking beyond 5-minute settlement to tariff models that show how flexible energy retailers can be

Processing nightmare, or product opportunity? Impending five-minute settlement comes at a difficult time for energy retailers. Software from across the ditch could help highlight the benefits and opportunities of more solar and a forecast uptick in battery energy storage.

Sunday read: the effects of defects

Mónica LiraCantú leads a research group investigating nanostructured materials for photovoltaic energy at the Catalan Institute of Nanoscience and Nanotechnology (ICN2). Recently, her group led a project that looked deep into the crystalline structure of a perovskite solar cell, revealing new information about the formation of defects in the material and how they could be engineered to improve both efficiency and stability. pv magazine caught up with the Barcelona-based scientist to discuss the state of the art in perovskite solar cells and remaining challenges on the road to commercialisation.

Saturday read: Going full circle with battery recycling

With manufacturing ramping up year by year and policies already looking to get ahead of the large volumes of end-of-life products, the landscape for lithium-ion battery recycling is rapidly changing. pv magazine recently spoke with Mari Lundström, associate professor of chemical and metallurgical engineering at Aalto University, to find out what is needed on the research side for the effective recycling of batteries.

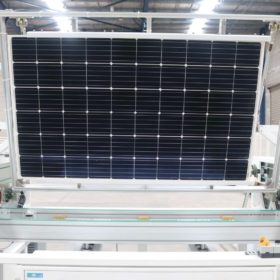

MSquare Energy becomes Australia’s second module manufacturer

Sydney-based MSquare Energy says it has ambitions of becoming Australia’s largest solar panel manufacturer. It is entering the market at a pivotal moment when Australia’s panel manufacturing industry is pushing to compete on equal footing with global leaders.

Powering Australian Renewables completes $2.7 billion Tilt Renewables takeover

Powering Australian Renewables Fund, a partnership between AGL Energy and QIC, has formally taken control of Tilt Renewables on the same day the consortium called on the Australian federal government to set a net zero 2050 target.

Meyer Burger plans to launch solar PV roof tiles in 2022

The Swiss group has acquired an integrated solar roof system solution from an unidentified German engineering service provider for this purpose. The aim is grow this sector from a niche market.

AEMO’s 2021 IASR sets new scenarios and ambitions for Australia’s solar industry

Solar PV is an important contributor to all energy scenarios presented in AEMO’s latest “Input, Assumptions and Scenarios Report,” but what’s the best possible outcome it can enable?