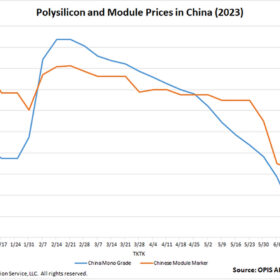

China solar module prices keep diving

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

‘Oversupply is a natural challenge to our industry,’ says Trina Solar official

Helena Li, president of Trina Solar’s global cell and module business, spoke to pv magazine at the recent SNEC trade show in Shanghai about the PV industry’s oversupply challenge. Li said the company is considering opening a factory in Europe and expressed optimism about future cost and price declines.

Weekend read: Solar’s known unknowns

Historic meteorological data is typically used to assess solar farm yield and secure project finance, but with climate change beginning to affect every aspect of society, past weather data may no longer be a reliable guide. Everoze Partner Nastasia Pacaut looks at how PV projects can be future-proofed in a changing climate.

Powerlink awards early works contract for CopperString project

A $20 million (USD 13.58 million) early works package for the CopperString transmission project that is forecast to unlock 6 GW of renewable energy resources and connect Queensland’s northwest to the national electricity grid has been awarded to CIMIC Group companies UGL and CPB Contractors.

‘It could be a difficult time going forward for solar module makers’

In the second interview of a series held at Intersolar 2023, pv magazine spoke with Karen Tang, Director – Editorial Lead Europe at Singapore-based market research company OPIS, about current price trends in the industry. She said solar panels may soon be bought at an average of USD 0.185/W but she also revealed that offers under USD 0.15/W are now becoming more frequent. Furthermore, Tang said prices may continue to drop in the future, with the bottom line being difficult to determine. Much will depend on the actual manufacturing capacity we will see coming online, which may not match the huge number of recent announcements released by module producers.

Top utility-scale inverter OEMs on what’s behind lead time blow outs

Lead times for utility-scale inverter power stations have recently ballooned from around six months on average to as long as 18 months today. Pv magazine Australia spoke to top manufacturers, including SMA, Ingeteam, and others on the compounding causes of the blowouts and what’s to be done.

Gentailer upheaval: EnergyAustralia reportedly in talks with Macquarie, Grok cuts AGL stake

The changing hands of Australia’s biggest ‘gentailers’ continues, with Mike Cannon-Brookes’ Grok Ventures reducing its stake in AGL, while Macquarie is reportedly in talks to acquire up to a 50% stake in EnergyAustralia.

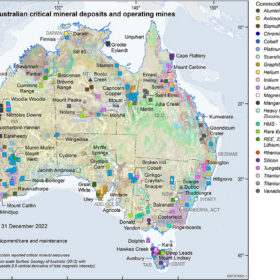

Australia’s critical minerals strategy released, includes no major policy schemes nor onshoring action plan

Australia’s federal government has released its anticipated Critical Minerals Strategy, and while the document decisively flags industry imperatives and challenges, the plan of action and policy solutions are far more hazy.

Neoen wins WA’s Collie big battery tender, moves into long-duration storage market

French renewables developer Neoen has won a 197 MW / 4-hour duration storage contract with AEMO. The contract pertains to the Collie big battery in WA’s south west, with Stage 1 to be operating commercially by October 2024.

AGL unveils three new big batteries as part of 12 GW decarbonisation strategy

Energy generating and retailing giant AGL has added three new grid-scale batteries and a 200 MW solar farm to its development pipeline as it looks to accelerate the transition of its energy portfolio from high-emission coal-fired power generation to backed-up renewables.