India targets domestic production with 40% PV import duty, boost to manufacturing-linked incentive

India’s Union Budget, presented this week by Finance Minister Nirmala Sitharaman, allocates an extra INR 19,500 crore ($3.6 billion) to the production-linked incentive scheme for solar from April.

Ampol makes move into energy retail market

Australia’s largest petroleum company Ampol has revealed its ambition to expand into the nation’s energy market by submitting an application to the industry regulator for licences to retail electricity and gas in Australia.

Philippines launches 2 GW renewables auction

The Philippines’ Department of Energy hopes to allocate 1,260 MW of solar through the procurement exercise.

Shell completes Powershop takeover despite widespread outrage

Shell has completed its acquisition of green power company Powershop Australia. The takeover sparked heated outcry when it was first announced in November 2021, reportedly causing Powershop to bleed customers who felt angered and betrayed by the apparent ‘greenwashing’.

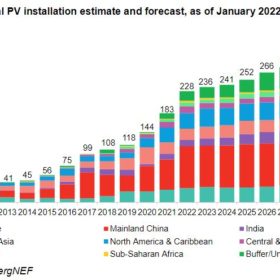

BloombergNEF says global solar will cross 200 GW mark for first time this year, expects lower panel prices

The analyst also forecasts strong growth for the storage business and a significant increase in PPAs for photovoltaic projects in Europe. It also said the newly installed PV capacity for 2021 reached 183 GW.

Australian zinc-bromide batteries chosen for Acciona’s Spanish testing field

Gelion’s zinc-bromide Endure batteries will undergo commercial tests at the 1.2 MW Montes del Cierzo testing field Spanish renewable energy company Acciona Energía operates in Navarra, in the north of Spain.

Natural hydrogen exploration ‘boom’ snaps up one third of South Australia

South Australia has found itself at the heart of a 21st century gold rush, though this time for naturally occurring hydrogen. Since February 2021, 18 exploration licenses have been granted or applied for in the state by six different companies searching for natural hydrogen.

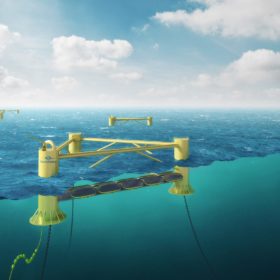

Perth ocean energy company gets funding boost from Japanese shipping giant

Western Australian ocean energy company Bombora Wave Power has received an investment of $6.74 million to deliver its pilot projects and commercialise its technology from one of the world’s largest shipping companies, Japan’s Mitsui O.S.K. Lines.

Hydrogen vehicle maker Hyzon links with RACV to establish Melbourne headquarters & deliver tow trucks

U.S.-based hydrogen vehicle maker Hyzon has announced Melbourne will soon be home to its Australian headquarters as part of a newly formed partnership with RACV, which will see the pair develop a purpose-built facility for Hyzon out of RACV’s Noble Park operation in the city’s south east.

Australian firm targets Mongolia for green hydrogen project

Australian oil and gas exploration and development company Elixir Energy has signed a memorandum of understanding with the Mongolia Green Finance Corporate to support financing for the first phase of a proposed green hydrogen project planned for the South Gobi region of the East Asia nation.