Despite the caveats to investors imposed by Australia’s ever-changing electricity market regulation and the difficulties of connecting new renewable energy projects to the grid, the latest research by market analyst and advisory firm PwC, finds bigger players — state governments, oil and gas majors and sophisticated large investors — have become involved in the energy transition, and are shifting the rules of engagement.

“Australia’s renewable energy supply is set to expand exponentially, and the ripples of change in today’s energy market will soon turn into waves,” says PwC Australia’s Danny Touma, one of the authors of the report, Renewable energy market gives developers and investors pause for thought, released on Friday.

The report’s title may make both sectors brace for the worst, but its salient points indicate an unstoppable king tide of change — and suggest how experienced developers can surf it.

It shows that while investment in renewables by oil and gas companies was just 2% of new projects over the calendar years 2017-18 calendar years; 2019-20 saw their engagement rise to 15%.

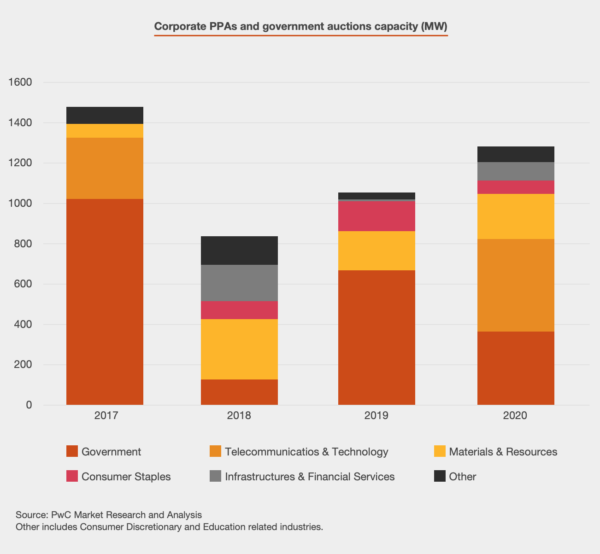

In addition, PwC research finds that large energy users, such as corporates and utilities are being driven by the need to ramp up their Environmental, Social and Governance (ESG) credentials, to accelerate their move to renewable energy via power purchase agreements.

These two factors alone signal to investors that there’s a healthy appetite for green energy, as technological developments also drive down the cost of renewable energy generation, and energy storage is proving its value for time-shifting variable renewable generation.

The report cites the Clean Energy Council’s (CEC) recent tally that more than 100 large-scale solar and wind projects are either planned for construction or already have infrastructure sprouting from the fields. If all are carried through to fruition, they will add 10GW of renewable capacity to the National Electricity Market.

A match made under the sun

“The sector is ripe for partnerships between local developers who often find it challenging to access capital and negotiate regulatory hurdles to get projects off the ground, and corporates who are seeking to build their net-zero carbon credentials,” says Touma,PwC’s Integrated Infrastructure partner, who specialises in environmental transactions.

Among the emerging partnership trends, PwC identifies a move to earlier engagement on projects by developers seeking to secure access to capital.

“The good news,” says Touma, “is that investors are out there.” They’re also, unsurprisingly given recent well-publicised difficulties in bringing projects to successful commissioning and then uncurtailed operation, seeking greater influence over project development.

“Utilities, oil and gas companies, or infrastructure funds,” are determined to “avoid ‘cost of capital’ auctions at the ready-to-build stage, avoid expensive individual sale processes,” and are instead focused on “their need to decarbonise and manage a larger portfolio of renewables,” summarises a statement accompanying the report.

Power coupling

With strategic investors and independent power producers stepping into the fray, PwC finds that the number of projects by smaller boutique developers has decreased from 30% in 2017 to 22% last year. The big end of town, it seems, has the leverage and resources needed to manage changing risk factors.

For example, given greater state government involvement in energy policy and markets, PwC says there’s a growing need for investors to bring expertise in government relationships and lobbying to ensure positive outcomes.

The spectrum of stakeholders, from local communities and landholders to off-takers and networks, is also exerting greater influence and demanding to know more about project owners.

And grid congestion remains a preoccupying challenge: PwC quotes the CEC’s 2021 Clean Energy Outlook Confidence Index survey conclusions which include: “Investors have consistently rated the grid connection process as the top business challenge since July 2019.”

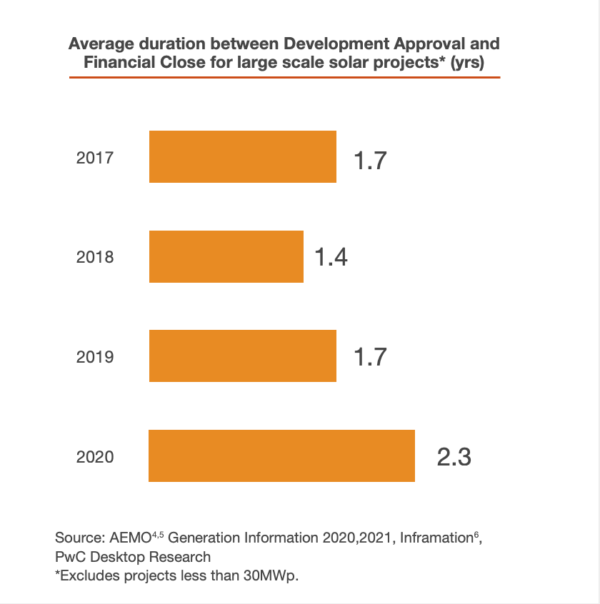

PwC also notes that, “One of the consequences of grid congestion has been the change to technical modelling requirements for generators to achieve an offer to connect. These changes have led to an increase in costs, and delay for developers to achieve financial close on their projects.”

Time to financial close has increased, says the ‘pause for thought’ report, from the shortest recorded average period of 1.4 years in 2018, to 2.3 years in 2020.

The pre-nup

As a result, still keen investors frequently seek to engineer one of two partnership structures, in which they either purchase parts or all of a development company; or they purchase a specific pipeline of projects.

Despite the greater degree of control such structures offer investors, it’s still incumbent on the capital provider to respect the developer’s expertise, skills and methodology (otherwise why would you be investing in that company?); “be up front about how and when they expect to be involved in decision making”; be sure to validate the developer’s proposals; and understand the risk profile of the transaction. That is, any such deal “will likely include a range of projects, only some of which will reach financial close”, says PwC in its report.

For the developer’s part, the rules of engagement recommended by PwC include being prepared to articulate their core strengths and capabilities; identify where the input and expertise of a large investor can positively impact outcomes; and present realistic timescales and expectations for each project’s connection to the grid.

The upshot is that shareholders and a climate-concerned market are increasing the pressure on big players to demonstrate their commitment to the energy transition, and they’re bringing their clout, capital and expertise to bear on project development.

In the ever evolving renewable-electricity landscape, this is unlikely to represent a final state — but perhaps a welcome learning bridge over troubled waters.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.