‘First shipment of 500 W modules’ announced

Chinese manufacturer Risen Energy will supply Malaysia’s Tokai Engineering with 20 MW of its new panels, unveiled in December. Risen claims its products can help reduce balance-of-system project costs by 9.6% and the levelized cost of energy by 6%.

Eguana Technologies moves closer to Moixa GridShare AI integration

The Canadian battery manufacturer has announced an investment from Japanese Itochu Corporation and got closer to integrating Moixa GridShare AI with its Evolve batteries.

Analyst expects recovery for PV and storage supply chains

U.S.-owned analyst Wood Mackenzie expects solar demand to decline but predicts the market will recover, with the prospects for the energy transition remaining intact.

Australian Government stimulates solar PV in the face of Coronavirus threat

The Australian Government’s “Economic Response to the Coronavirus” incentivises commercial and industrial solar PV uptake.

Trina Solar doubles down on PV 5.0

Trina Solar’s two new bifacial solar modules are touted as a “game changer,” not only for utility-scale projects, but for commercial and industrial developments as well. PV innovation continues to reduce costs and improve performance, but Australia’s outdated infrastructure is doing its best to slow the transition down.

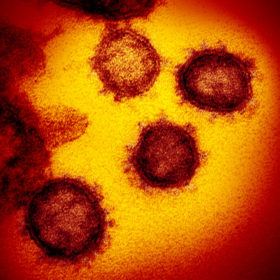

Short-term symptoms

The COVID-19 outbreak has disrupted the global PV supply chain. China, the largest manufacturing hub for solar products, has postponed factory openings in many regions, as it has been hit by logistical hiccups, staff shortages, and delivery delays. Manufacturers in some Chinese provinces are running under capacity, while those overseas are facing the same situation.

BNEF lowers 2020 global PV outlook due to coronavirus concerns

Many solar factories in China are starting to resume production, suggesting that concerns about supplies of PV components could soon begin to ease. Nevertheless, the temporary standstill will have an impact on the global solar market, as the implementation of some projects will probably be postponed until next year.

Coal developers risk half a trillion dollars down nonrenewable drain

A new report from financial think-tank Carbon Tracker has found that coal developers risk wasting more than $600 billion due to stubborn resistance to the already cheaper electricity resources provided by renewable energies worldwide. The report finds, in short, that a new coal plant is about as prudent an investment today as a Clydesdale and cart.

Solar-powered trees for cool spots in urban hot spots

A Japanese consortium has started producing solar-powered ‘urban furniture’. The result is a solar-plus-battery bench with cooling elements and vaporizers.

Evaluating battery chemistries for grid-level storage

Researchers in China have ranked some of the most commonly used battery chemistries according to parameters deemed important for grid-level storage. The team gave a score in each category and determined a winner – and it wasn’t lithium-ion.