Indian state of Madhya Pradesh to host 1.4 GW solar park

A new solar power plant will be developed on 2,800 hectares of land near a temple in the Indian state of Madhya Pradesh. It is expected to be operational within a year.

Trina launches grid-scale storage solution

Trina Storage’s new 2.1 MWh DC All-New Elementa solution is a modular LFP battery cabinet with a plug-in concept to connect multiple units. The company is ramping up battery manufacturing capacity to strengthen vertical integration, given supply chain risks throughout the world.

Lightsource bp to build 150 MW fishery solar farm in Taiwan

UK solar specialist Lightsource is developing a 150 MW solar park at a fishery in Budai, in Taiwan’s Chiayi county. Construction is expected to commence in June 2023.

Tata Power secures 300 MW solar project from Indian government

Tata Power Solar has secured an engineering, procurement and construction contract for a 300 MW solar project under India’s Central Public Sector Undertaking scheme. The project, awarded by state-owned hydropower producer NHPC, will be located in the Indian state of Rajasthan.

Hanwha Q Cells to build US solar module factory, expand cell capacity in South Korea

Hanwha Q Cells plans to build a 1.4 GW solar panel factory at an undisclosed location in the United States. It has also announced plans to expand its cell capacity to 5.4 GW in South Korea. CEO Justin Lee spoke to reporters at the Smarter E event about the company’s plans and current supply chain issues.

Jetion presents heterojunction solar module series based on n-type G12 wafers

The largest product of the series is a solar module with an efficiency of up to 22.5% and a power output of up to 700 W. For all the panels of the series, the temperature coefficient is -0.26% per degree Celsius and the manufacturer offers a 12-year product guarantee and a 30-year power output guarantee.

Solis unveils off-grid PV inverter

The S5-EO1P(4-5)K-48 series off-grid PV inverter has an efficiency of 96.7% and supports parallel operation of up to 10 units, which allows for a system capacity of up to 50 kW. According to the manufacturer, the device is compatible with all top-tier brands of lithium-ion and lead-acid batteries.

Longi’s ambitious global green hydrogen plans

In recent years, Longi has turned its attention to green hydrogen. Li Zhenguo, company founder and CEO, recently spoke to pv magazine about its strategic shift and how he believes that coupling this technology with solar PV will be the key to achieving carbon neutrality.

Renac Power unveils high-voltage residential battery

Renac Power’s new plug-and-play battery has a storage capacity of 3.74 kWh, but it can be enhanced in series with up to five batteries to 18.7 kWh. It has a nominal voltage of 96 V and a voltage range of 81 V to 108 V.

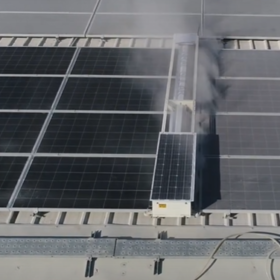

Self-powered, dry-cleaning robot for solar panels

Enray Solutions has developed an autonomous, water-free cleaning robot for ground-mount solar installations that draws its power from an on-board PV panel and battery. The robot is designed to withstand the harsh environmental conditions of all kinds of terrain.