China added 13 GW of solar to the end of June

The volume of new PV generation capacity added in the first half was higher than expected, given the rising input costs seen in recent months, but solar was nevertheless outpaced by new wind farms in the first six months of 2021.

China wants to test vanadium redox flow batteries

A 125 kW/500kWh storage unit will be tested by China’s National Photovoltaic and Energy Demonstration Experimental Center. The storage system will be provided by Canadian specialist VRB Energy.

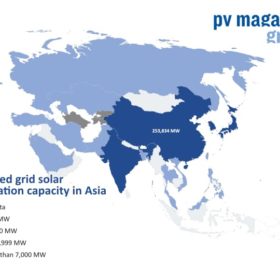

China to add 619 GW of solar this decade

Indonesia will catch the eye too over the next nine years, according to Wood Mackenzie analysts, as its market grows from 300 MW to 8.5 GW.

China’s solar PV demand could ‘effortlessly’ surpass 100 GW in 2022 as production overcapacity predicted

According to Asia Europe Clean Energy (Solar) Advisory Co. Ltd, demand for solar PV in China could “effortlessly” surpass 100 GW in 2022, following a year of “flat” demand in 2021. It adds that a “massive overcapacity” situation in the production sector is looming. Meanwhile, the distributed solar PV market is on track for huge growth, with potential for annual demand to reach upwards of 20 GW+ from next year.

China set to mandate solar on at least 20% of residential roofs in pilot counties

State body the NEA has given its provincial offices until July 15th to suggest counties where a solar mandate – which rises to at least half of all government roof space – can be rolled out. Selected companies will be awarded whole-county contracts.

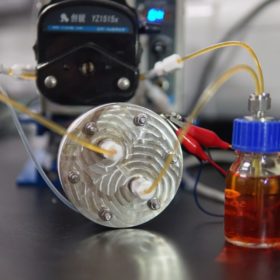

Sulphur-based redox flow battery with 15 consecutive hours of runtime

Researchers from Hong Kong have applied a novel charge-reinforced, ion-selective (CRIS) membrane to a polysulfide-iodide redox flow battery they had built in 2016. The redox flow battery showed a capacity decay rate of just 0.005% per day for 1,200 cycles, and a lifetime with over 2,000 hours’ cycling, which the academics said corresponds to approximately three months.

Biden’s US ban on solar imports from China’s Xinjiang province stirs strong reactions

The Biden Administration’s decision to ban solar imports from four Xinjiang-based polysilicon manufacturers, Hoshine Silicon, Daqo, East Hope, and GCL New Energy Material, has already raised concerns. One analyst warns of a “significant negative impact” across the U.S. solar industry.

PV-driven air conditioner coupled with ice thermal storage

Researchers in China have built a PV-powered air conditioner that can store power through ice thermal storage. The performance of the system was evaluated considering operating efficiency and stability and the scientists found that a device relying on a variable-speed compressor and an MPPT controller showed very good ice-making capability.

Jinko and JA Solar to invest $130m in 100,000 tonne polysilicon fab

The two solar manufacturers will get priority access to polysilicon produced at the planned fab in Inner Mongolia, which developer Xinte Energy has said will be fully operational by June 2023.

JinkoSolar, Longi, JA Solar claim 182mm modules offer lowest LCOE for utility scale solar

In a white paper, the three Chinese module manufacturers have reiterated the well-known refrain “bigger is not always better.” Experts from the three companies compared the BoS costs of 182mm-wafer-based modules and 210mm products, and found that the former have a slight advantage in racking, foundation, and land costs.